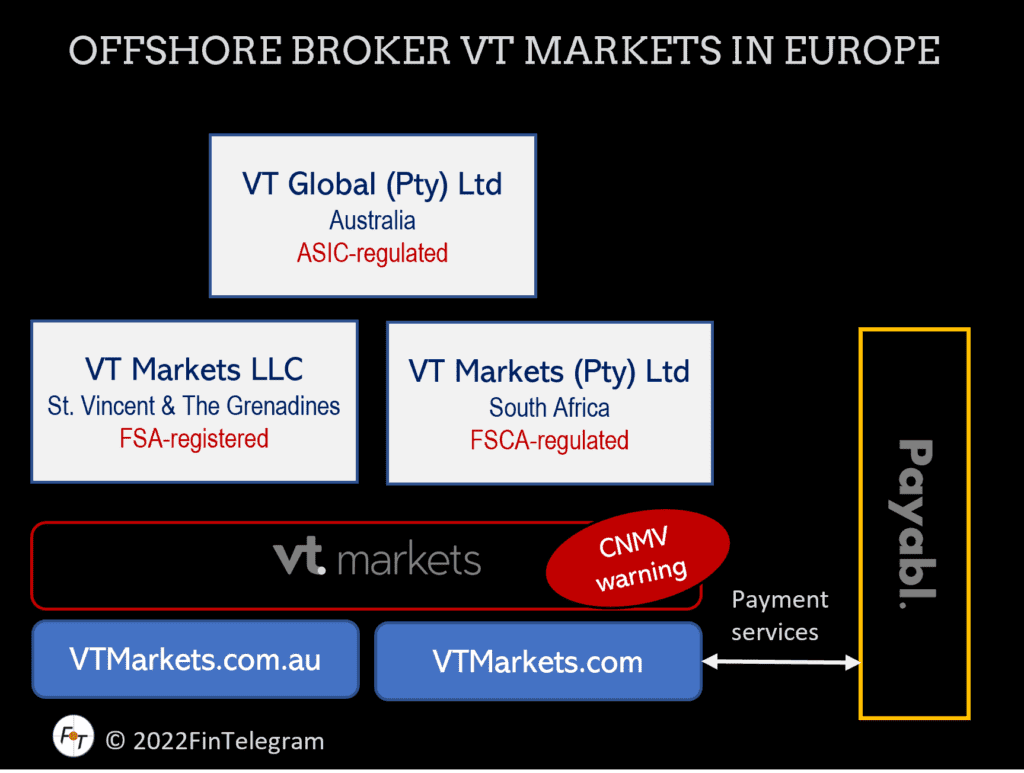

VT Markets is an Australian broker scheme that also allows the onboarding of retail clients in EEA jurisdictions via offshore entities. VT Markets offers maximum leverage of 1:500. Until mid-2022, VT Markets was part of the Vantage Group and still operates with the same solution. In fact, VT Markets is a 1:1 implementation of VantageMarkets with different branding. Payabl and BridgerPay are the main payment facilitator of the scheme, which has already received regulatory warnings.

VT Markets Update

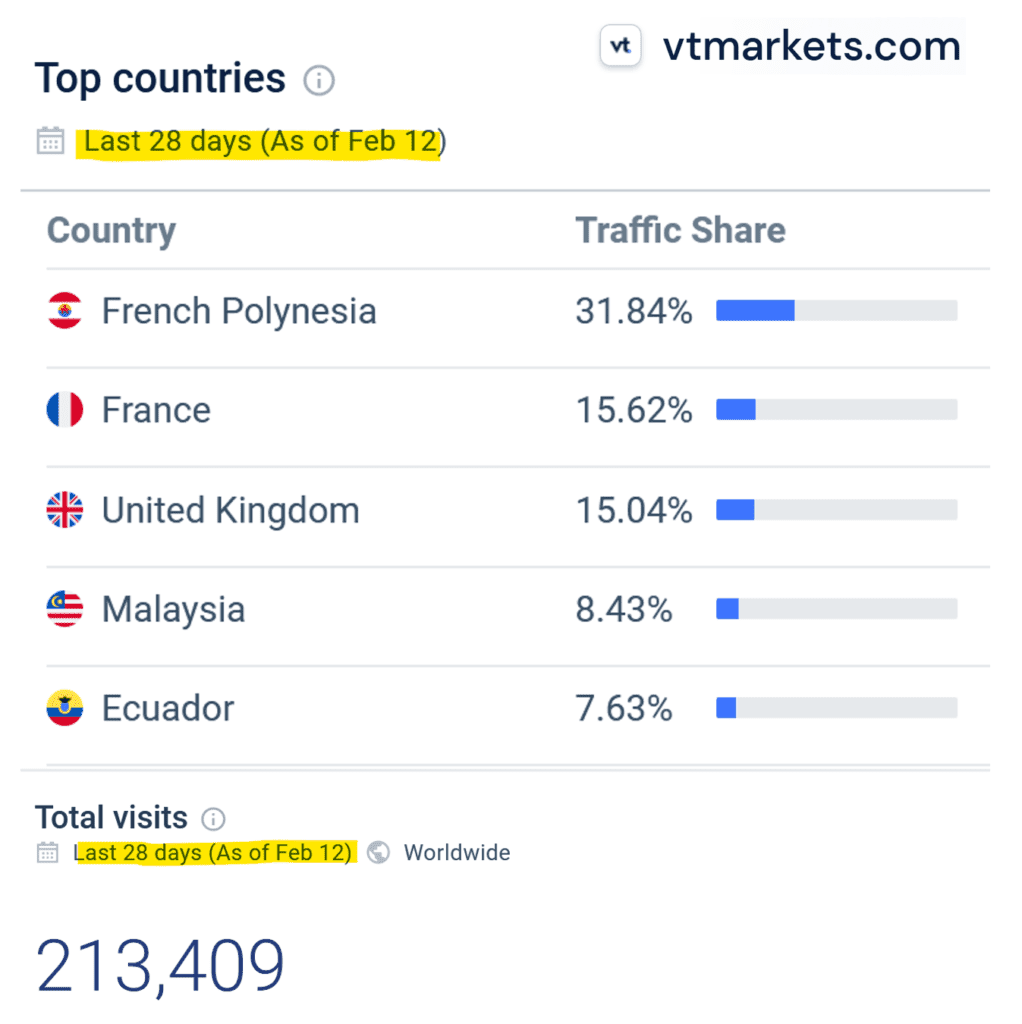

According to Similarweb statistics, in the last 28 days before Feb 12, 2023, nearly 40% of VT Markets‘ approximately 213,000 website visitors came from EEA regions (screenshot right). Moreover, more than half of the visitors to the VTMarkets.co website come from the United States.

On Trustpilot, VT Markets has a 3.1-star rating with a corresponding “Average” rating out of around 300 reviews.

Payment Facilitators

The main payment facilitators for the offshore broker are Payabl, a payment institution founded by former Wirecard executives Ruediger Trautmann and Dietmar Knoechelmann, and BridgerPay. Until at least 2022, Vigglobal Holding Cy Ltd was used as a payment agent. All these payment facilitators are based in Cyprus.

Deposits can only be made after the KYC process has been completed, which is compliant with the regulatory requirements. Payment options include bank transfers, credit and debit cards, fasapay, Neteller, Perfect Money, and direct crypto deposits.

We could also have made unlimited pre-KYC deposits using crypto deposits via TrustWorthy Pay.

VT Markets‘ payment solution is identical to that of VantageMarkets. In this respect, we assume that the two schemes are still connected and/or controlled by the same people.

Regulatory Violations

VT Markets was part of the Australian Vantage Group until Q2 2022 when it was carved out (report here). The multi-asset and CFD broker VT Markets offers leverage of up to 1:500 in violation of regulatory requirements in EEA jurisdictions. Although VT Markets has no authorization in the EEA regions, it is no problem to register as an EEA resident.

We could have theoretically made unlimited pre-KYC deposits via VT Markets (VTmarkets.co) even before KYC Check, i.e., before confirmation of ID and address, by bank transfer via Token (Token.io) or SWIFT to the bank accounts of VT Markets.

VT Markets Key Data

| Brands | VT Markets |

| Domain | www.vtmarkets.com www.vtmarkets.co www.vtmarkets.com.au www.vtmindo.com |

| Legal entities | VT Global Pty Ltd, Australia VT Markets Pty Ltd, Australia VT Global South Africa (Pty) Ltd, South Africa VT Markets LLC, St. Vincent & The Grenadines Vigglobal Holding Cy Ltd, Cyprus |

| Jurisdictions | UK, Australia, Vanuatu, Caymen Islands, St. Vincent & The Grenadines |

| Authorizations | ASIC for VT Global Pty Ltd (Australia) FSCA for VT Global South Africa (Pty) Ltd (South Africa) |

| Platform | |

| Leverate | up to 1:500 |

| Payment options: | Bank wire, credit/debit card, crypto, wallets |

| Payment processors | National Australia Bank, Token BridgerPay, Payabl fasapay, Neteller, Perfect Money, TrustWorthy Pay |

| Related individuals | Pedzai Mvere (LinkedIn) |

| Warnings | CNMV |

Share Information

If you have any information about VT Markets or Payabl, please let us know through our whistleblower system, Whistle42.