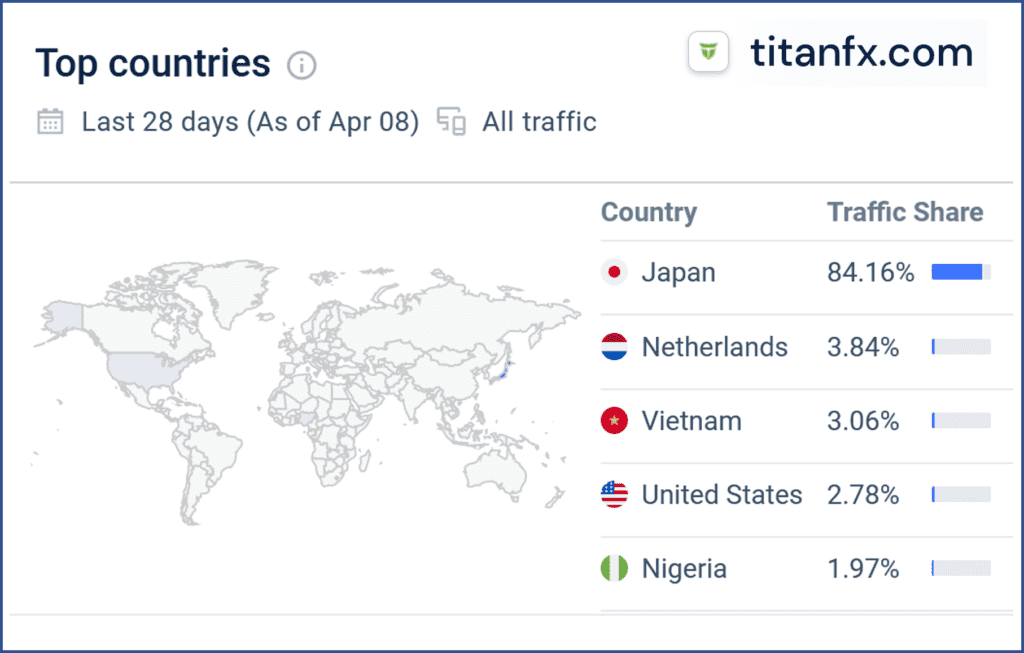

TitanFX is an offshore multi-asset broker licensed by the VFSC in Vanuatu and the FSC Mauritius. It offers its services to retail and corporate clients. TitanFX‘s website is mainly visited by Japanese clients, but people in the Netherlands and the United States are also among the website users, Similarweb analysis shows. We believe that TitanFX is affiliated with the FCA-regulated Pelican Trading and TradeNext or shares some resources with it We have given TitanFX an Orange compliance.

Key Data

| Trading name | TitanFX |

| Activity | CFD, forex, crypto broker |

| Domains | https://titanfx.com |

| Social media | |

| Legal entities | Titan FX Limited Titan Markets |

| Related individuals | Martin St-Hilaire (LinkedIn) James Hudson (LinkedIn) Audrius Bernotas (LinkedIn) Peter Houghton (LinkedIn) Giethu Kavanal (LinkedIn) |

| Jurisdictions | Vanuatu Mauritius |

| Regulators | VFSA (Vanuatu) for Titan FX Limited FSC Mauritius for Titan Markets |

| Leverage | up to 1:500 |

| Payment options | Bank wire, credit/debit card, e-wallet, crypto |

| Payment processors | SticPay, bitwallet, banks |

| Trustpilot | 4.3 stars with an Excellent trust level |

| Compliance rating | Orange |

Short Narrative

In 2020, Vanuatu-based TitanFX became the very first official member of our non-profit organization, a self-regulating body for Financial Dealer License (FDL) holders who operate digital platforms for trading financial instruments and securities online. Early this year, the Vanuatu Financial Services Commission (VFSC) appointed Martin St-Hilaire, the Managing Director of Titan FX, as a member. TitanFX and its management are well-established in Vanuatu.

Some officers of TitanFX, such as Martin St-Hilaire or Peter Houghton, are also officers at Explore Global Ltd d/b/a TradeNext, also regulated by the VFSC. In this respect, these two broker schemes are likely to be interconnected.

Compliance Check

TitanFX is operated through regulated offshore entities. However, the broker has no license to offer its financial products in Japan, Europe, or North America. To our knowledge, TitanFX does not have a permit from the Japan Financial Services Agency (JFSA), even though most of its clients are from Japan.

Despite the lack of regulatory permission, it is no problem to register as a retail client with TitanFX, for example. Pre-KYC deposits are not possible, which is positive.

Besides the lack of regulatory permission, TitanFX also offers retail clients a maximum leverage of 1:500. Such high leverage is prohibited in most Western regulatory regimes.

Therefore, we see an Orange Compliance rating for TitanFX as justified.

Share Information

If you have any information about TitanFX, its operators, or its facilitators, please share it with us through our whistleblower system, Whistle42.