The notoriously well-known Deutsche Handelsbank has been in the FinTelegram focus over the last three years. Like ING’s Dutch subsidiary Payvision and, until its collapse, Wirecard, the bank was a prime address for scammers and cybercrime organizations. Uwe Lenhoff, who died in prison in 2020, was one of the clients of Deutsche Handelsbank and used the bank to launder the illicit proceeds of his huge lotto scam LottoPalace. Now the German financial institution seems to be about to close its dirty payment division. This is according to a report in the German newspaper Handelsblatt.

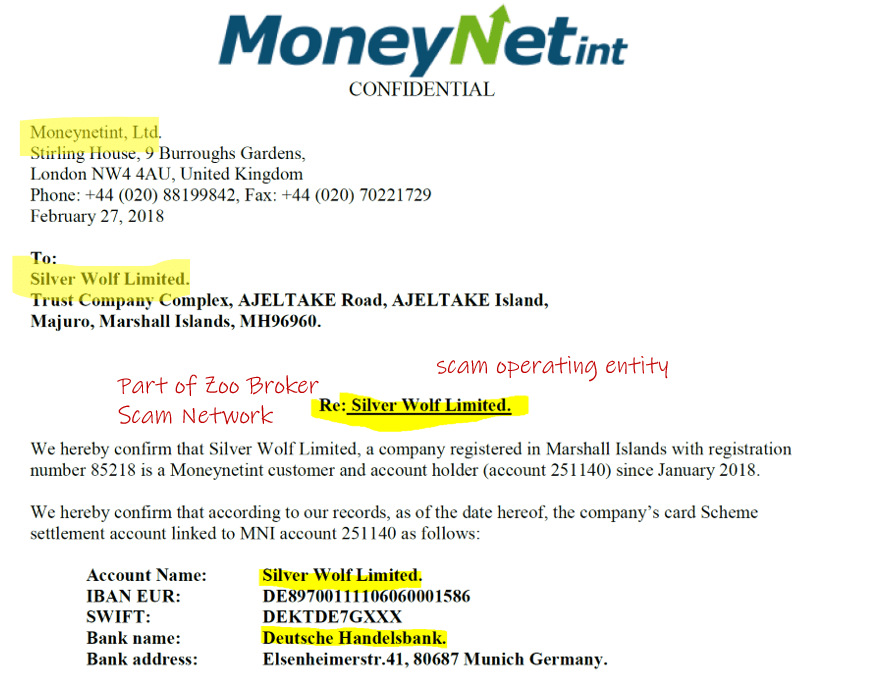

The comprehensive documents available to FinTelegram prove that Deutsche Handelsbank laundered funds for huge scams such as the Zoo Broker Scam Broker Network or Gal Barak and his E&G Bulgaria. The German bank also worked closely with the FCA-regulated MoneyNetInt Group (see screenshot on the left).

For two years, Deutsche Handelsbank has reportedly been systematically dismantling its high-risk payment division. Allegedly the institute in 2019 had around 210 payment service providers as customers. Of these, only 20 would currently be left, reports Felix Holterman in German Handelsblatt. Clients of the porno segment and offshore customers have allegedly been terminated. Customers, running scams such as LottoPalace would no longer be possible today. Thus, closing the payment business would only be a consequent final step to end the dirty legacy business. This is probably also against the background of the ongoing investigations by the public prosecutor’s office and BaFin.

In April 2021, the Munich I public prosecutor’s office searched the bank on suspicion of money laundering. The German regulator BaFin is also interested in the bank. In fall 2019, BaFin urged the long-time CEO of Deutsche Handelsbank to resign. Moreover, in November 2020, the regulator ordered the bank to take appropriate internal safeguards and comply with general due diligence requirements to prevent money laundering and terrorist financing.

As against Payvision, Wirecard, and PPRO Group, the European Fund Recovery Initiative (EFRI) has also filed money laundering charges against Deutsche Handelsbank. Please read this report here for detailed information. EFRI is reportedly currently in discussions with BaFin and German prosecutors to share details of its findings.