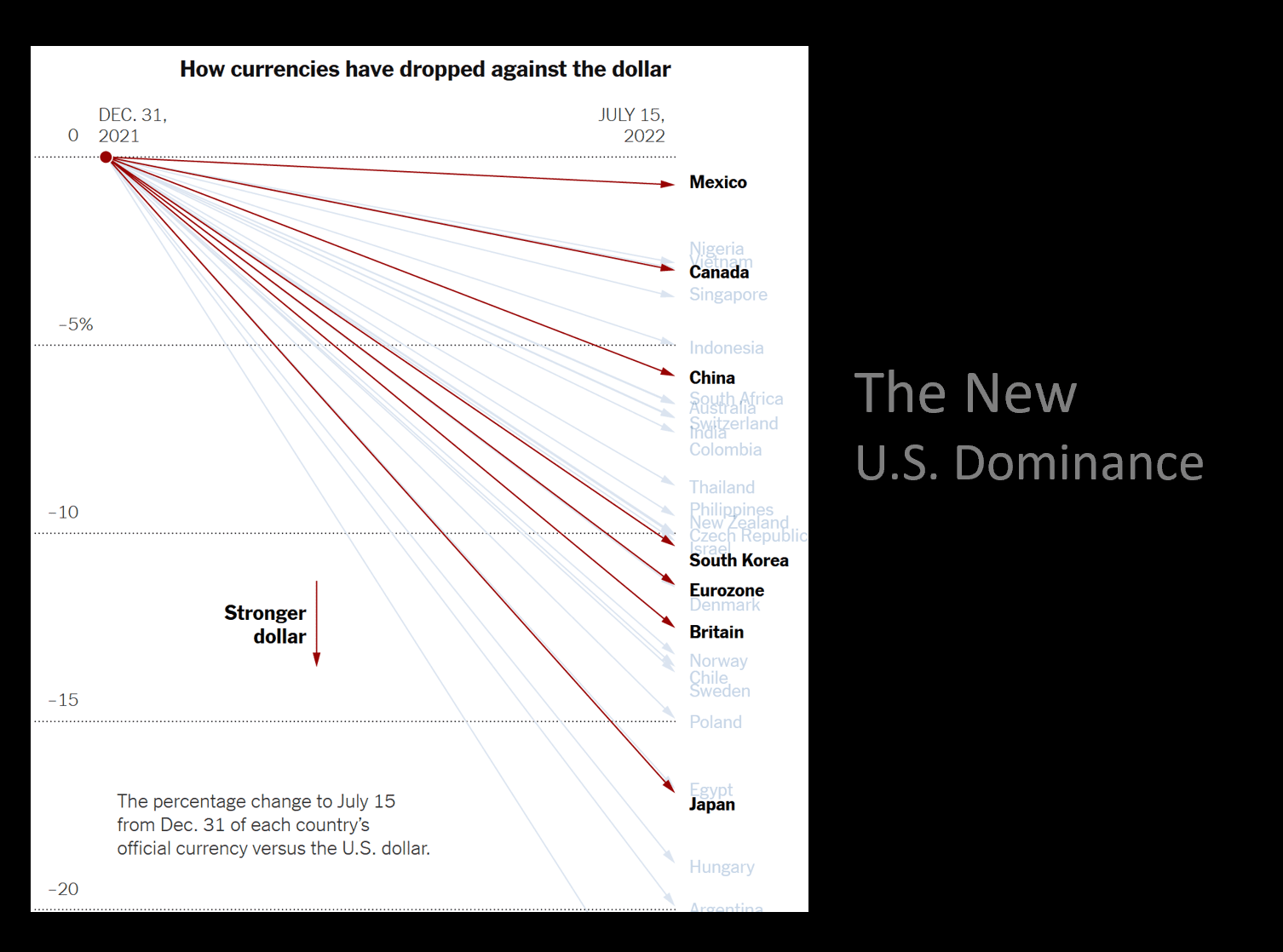

The value of the U.S. dollar is the strongest in decades, devaluing currencies worldwide and unsettling the outlook for the global economy as it upends everything from the cost of a vacation abroad to the profitability of multinational companies. The dollar is one side of about 90% of all forex transactions, accounting for $6 trillion in daily activity. Analysts estimate that more than half the rise in the dollar this year could be explained by the Fed’s comparatively aggressive interest rate policy.

Rates in the U.S. are now markedly higher than they are in most other large economies. luring investors attracted by the higher returns. As money flows in, the value of the dollar has increased. Also contributing to the dollar’s strength are high energy prices. They are hitting the economies of importers, including most of Europe, harder than the U.S., which is less reliant on buying oil and gas from abroad.

In the past week, the yen sank to a 24-year low against the dollar, and the euro fell to parity, a one-for-one exchange rate, with the dollar for the first time since 2002.

The strong dollar appears to be giving back to the U.S., at least for the near term, a power long lost to China. So far, the proxy war in Ukraine may have benefited the U.S. first and foremost.