According to the Times of Malta, millions flowed through the MFSA-regulated Maltese investment fund Southern Cross SICAV plc without proper controls to prevent money-laundering and terrorism financing. The Financial Intelligence Analysis Unit (FIAU) found that Southern Cross SIVAC had a “disregard” for its anti-money laundering obligations. The fund is in the process of surrendering its MFSA license. The FIU has imposed a fine on the company in the amount of €303,710 for the “serious” failures during its years in operation.

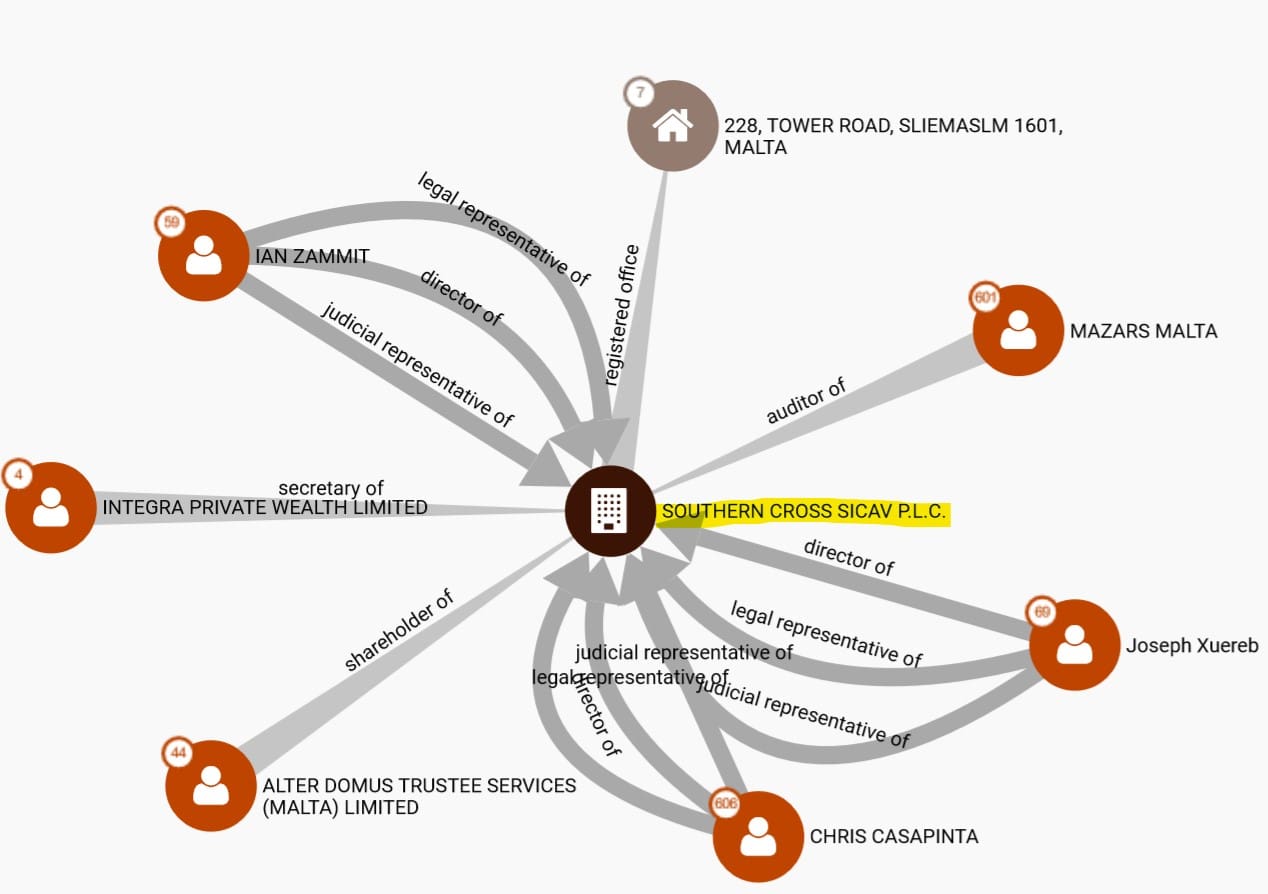

Founded in 2015, Southern Cross SICAV can also be found in the Offshore Leaks Database. Alter Domus Trustee Services (Malta) Limited acts as a nominee shareholder. Joseph Xuereb, Ian Zammit, and Chris Casapinta are named as directors.

Southern Cross Sicav’s “lack of regard” towards its anti-money laundering obligations could have had an impact not only on its own operations but also had repercussions on Malta, the FIAU noted. Malta was last year greylisted by the FATF, a global anti-money laundering body, over failures to adequately fight financial crime.

Failures were also observed in the Company’s measures to obtain the source of wealth (SoW) and expected source of funds of its customers. On at least three occasions the company invested its own funds in the business of its customers. This happened through payments of approximately €1 million to each of the investors, as well as being issued with units in fund. The FIAU said that the investment rationales provided by the company were “rather difficult to understand” as well.

The FIAU found Southern Cross failed to adequately document its internal procedures to fight money laundering and did not properly screen its customers before accepting their money.