FinTelegram recently published an interesting report about the operations of PayDo, a high-risk payment processor regulated by the UK’s Financial Conduct Authority (FCA). The analysis extends into the sphere of online casinos and gambling, revealing PayDo‘s engagements with the offshore crypto casino Gamdom, licensed in Curacao. This relationship notably involves the facilitation of transactions involving Gamdom Coin, prompting a fresh evaluation of PayDo‘s practices.

Overview of PayDo

PayDo operates under Ecommerce Technologies LTD in the UK, holding authorization as an E-Money Institution by the FCA. Its Canadian counterpart, PayDo Canada LTD, is recognized by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a Money Services Business (MSB) equipped to offer payment services. The founder and CEO, Sherii Zakharov, is London-based, with core team members including the Head of Operations, Oleg Pikarevskyi, CTO Matviss Mikhnevych, and Head of Marketing, Ivan Pronchenkov, primarily residing in Ukraine.

Both PayDo and its closely affiliated partner, PayOp, maintain a significant operational presence in Ukraine, alongside entities in Vancouver, Canada, serving merchants within the high-risk payment domain.

The Connection to Gamdom

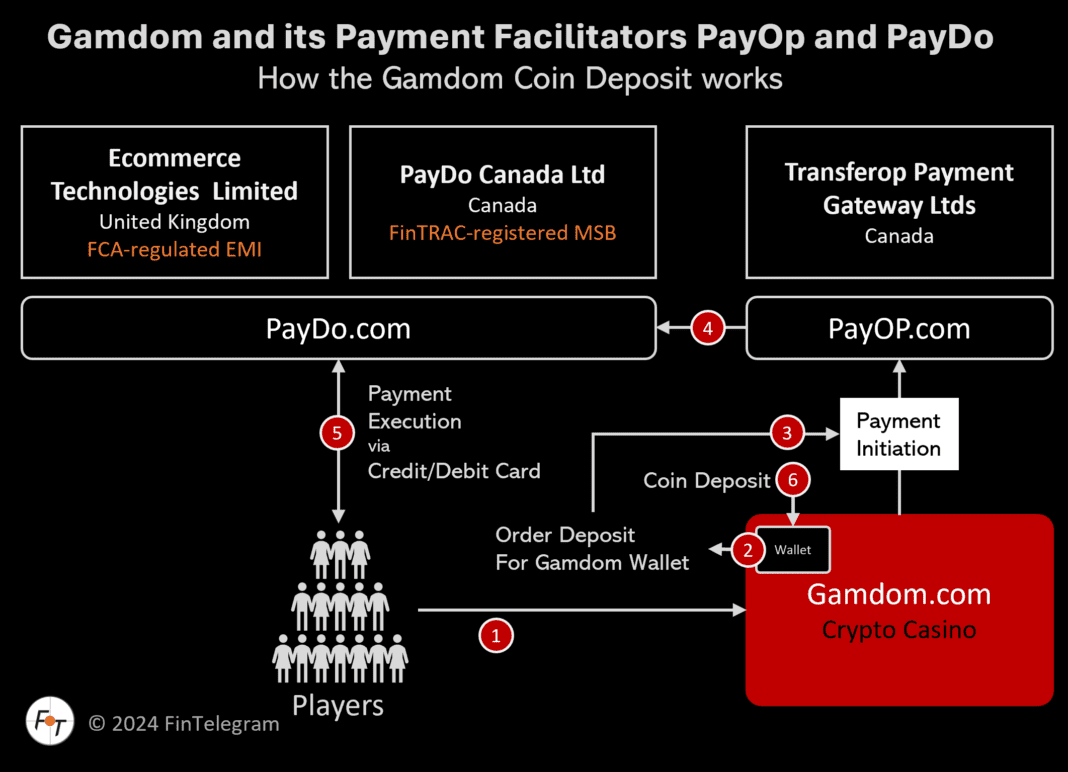

The recent FinTelegram investigations have spotlighted the involvement of PayDo and PayOp with Smein Hosting‘s crypto casino, Gamdom. A deep dive into their operations unveiled the collaborative mechanism behind the purchase of Gamdom Coins, a bespoke cryptocurrency devised for use within the Gamdom gambling ecosystem. Despite Gamdom‘s licensing by Curacao authorities, it notably lacks the requisite permissions to offer its services within the European Economic Area (EEA), yet actively targets and accepts deposits from players in these jurisdictions.

Compliance Concerns

The facilitation of payments from EEA-based players to a non-EEA licensed crypto casino by PayOp and PayDo raises significant compliance questions. PayOp operates without a clear regulatory license, escaping direct supervision. Conversely, PayDo, besides being regulated by the FCA, also holds MSB registration with FINTRAC. This dual regulatory acknowledgment places its operations under scrutiny, especially in light of its association with Gamdom, which processes payments through Vilnius IT Solutions UAB in Lithuania, thus establishing a direct financial channel into the EEA.

Conclusion

The engagement of FCA-regulated PayDo with an offshore crypto casino like Gamdom, especially in facilitating transactions in regions where Gamdom lacks official authorization, presents a complex compliance landscape. This scenario underscores the intricate challenges facing regulators and financial crime investigators as they navigate the evolving digital currency and online gambling sectors. FinCrime Observer remains committed to uncovering and analyzing such relationships, highlighting the importance of regulatory adherence in the increasingly interconnected realms of finance and digital currencies.