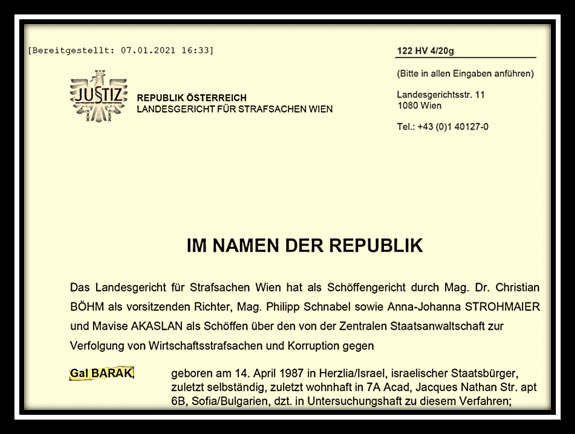

Undoubtedly, high-risk payment processors (#HRPP) are at the very center of cybercrime and scams. Very often, they facilitate consumer fraud and related money laundering. In early September 2020, Gal Barak was sentenced to four years in prison for investment fraud and money laundering in the Vienna Cybercrime Trials (#VCT) for operating a global scam broker network. A breakthrough in the fight against cybercrime.

The extensive investigation for the #VCT in which FinTelegram was involved, the forensic analysis of banking and financial data by law enforcement, the trial findings, and the court’s reasoning in the verdict also allow investigating the anatomy of money laundering networks and high-risk payment processors such as Payvision or iPayTotal. In our new series “High-Risk Payment Processors Report,” we describe selected high-risk processors such as Payvision or iPayTotal and their business practices. We need to fight bad and crime-enabling payment processors even more aggressively than scams.

The #VCT as a reference case for Europe

In what we refer to as the #VCT, investigations and court cases in various EU countries are being conducted against dozens of alleged scammers and their supporting payment processors and co-conspirators. The indictment and conviction of Gal Barak in early September 2020 was only the prelude. The trial against his wife, Bulgarian Marina Barak (formerly Marina Andreeva), will soon occur in Vienna. The evidence is so compelling that Barak and his accomplices face further charges in other European countries. Germany has already filed an extradition request and wants to indict Barak.

In our opinion, however, the people behind the participating payment processors should also be indicted. It is clear from the wiretap transcripts and documents in the #VCT case how Payvision laundered the millions of stolen customer funds despite knowing about Barak’s scam business.

VCT ruling finds misconduct by payment processors

The #VCT written verdict specifically states that ING subsidiary Payvision was part of Barak and his organization’s money-laundering network. The Dutch high-risk payment processor Payvision laundered millions of stolen funds for the Barak organization – and, additionally, forfeited millions of the illegal proceeds. Many high-risk payment processors rip off their customers (a/k/a scammers) by forfeiting illegal proceeds for their own benefit.

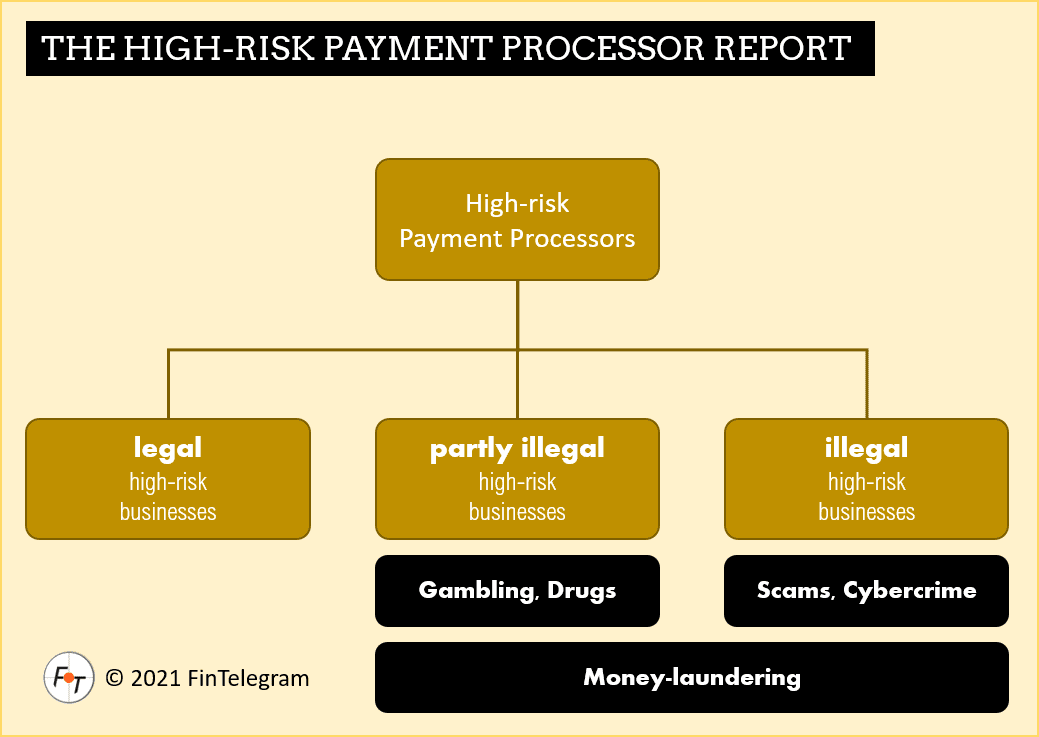

The business model of high-risk payment processors

High-risk businesses do not necessarily have to be illegal in the first place. At least not in all jurisdictions. Hence, not all operators of high-risk businesses are necessarily criminals or villains. Unfortunately, many are!

While an online gambling website with or without a license may be legally operating in one jurisdiction, it may be considered an illegal venture in another. The same is true for marijuana businesses such as Eaze, for example. On the other hand, scams are illegal in general but are a huge and attractive market segment for payment processors.

Payment processors specializing in high-risk transactions very well know their clients’ business (a/k/a merchants) and their respective challenges. Often the operators of high-risk businesses do not have access to the financial system, bank accounts, or credit card networks. They depend on the high-risk payment processors to facilitate their business.

Offshore banks, fake companies, etc.

High-risk payment processors operate in the deepest swamp. They facilitate the dirtiest businesses, from child porn to drug trafficking to cybercrime and scams. This is how they make their daily living. They obtain bank accounts for their clients through offshore banks, fake companies, and trustees. Moreover, they recruit existing companies from other industries and their bank accounts to launder money and disguise illegal proceeds as legal payments such as consulting services.

Most recently, especially in the crypto space, many new of these high-risk payment processors have become involved and enable their clients to work with cryptocurrencies.

As a result, it is very common for high-risk payment processors to retain funds from high-risk merchants and refuse payouts. Often, high-risk payment processors terminate the business relationship and simply retain the money. Due to the often illegal nature of the business, merchants are unable to defend themselves. It is difficult to file a lawsuit if the stolen money was previously stolen or illegally earned.

We will explain the business model of high-risk payment processors using different merchants and their cases in our series.