Israeli lawyer Moshe Strugano, 52, is a greedy man always looking for more money. He was one of the facilitating lawyers of the fraudulent Israeli binary options scene. Scammers like Yossi Herzog, Kobi Cohen, Lee Elbaz, David Cartu, et al. have run dozens of binary options scams worldwide, defrauding tens of thousands of consumers out of hundreds of millions. They could not have done this without the support of lawyers like Moshe Strugano. The US prosecutors charged him with conspiracy to commit securities fraud and securities fraud and sought his extradition from Israel.

A notorious lawyer

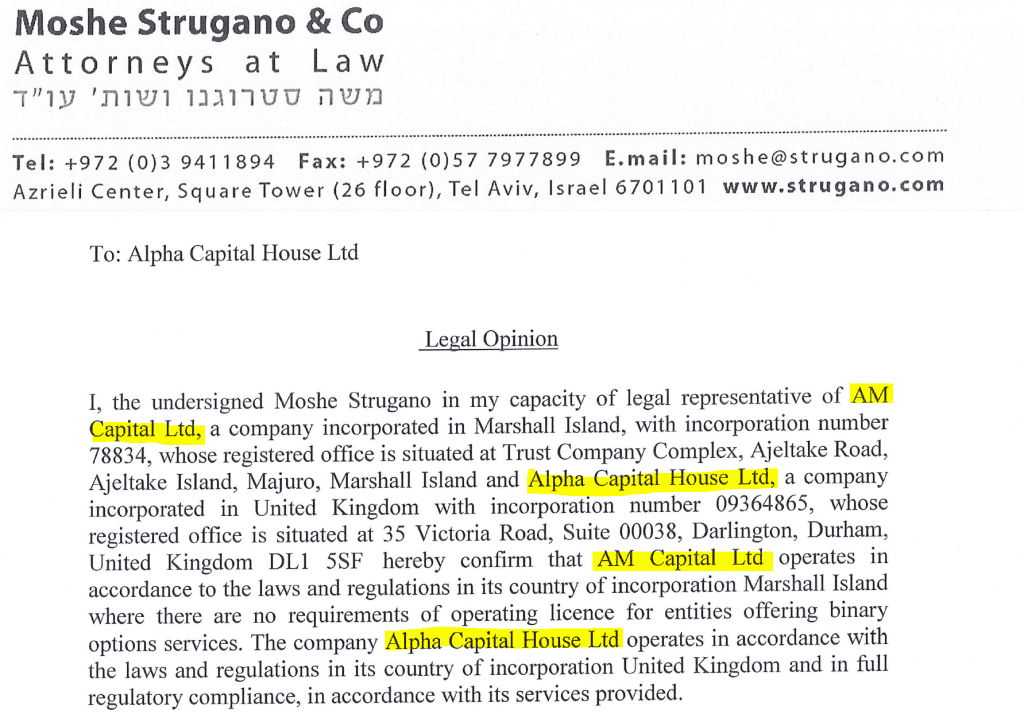

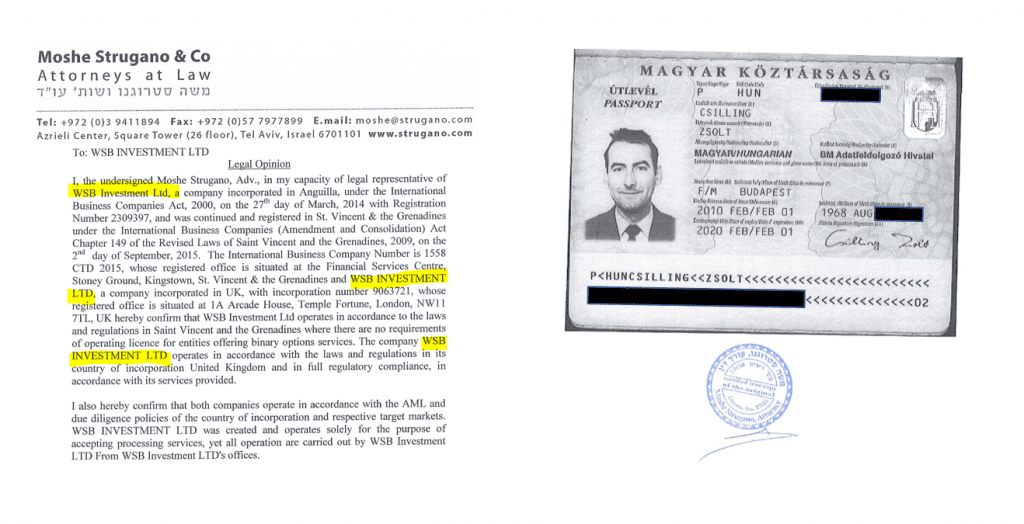

Moshe Strugano and his Tel Aviv law firm (www.strugano.com) was one of the first addresses in Tel Aviv for binary options scammers to get favorable legal opinions needed to open bank accounts or register as a merchant with payment processors.

As exposed by FinTelegram time and again, Strugano happily provided such legal opinions in the GreyMountain Management (GMM), Tradorax (see screenshot left), or Yukom (see screenshot right) fraud schemes. Just to name a few. In 2019, the UK authorities probed Strugano for possible money laundering and conspiracy to defraud, the Financial Times and The Times of Israel reported. He was detained by the City of London police and later released on bail.

The Israeli Lee Elbaz, the former CEO of Israel’s Yukom Communication Ltd of Yossi Herzog and Kobi Cohen, was sentenced to a 24-year prison term and $28 million restitution payment for binary options fraud. Yukom operated the scams BinaryBook, BigOption, and BinaryOnline. Herzog and Cohen, wanted by US authorities, are on the run.

The security fraud case

The US prosecutors announced that they charged Moshe Strugano, an Israeli lawyer specializing in creating offshore companies, with securities fraud and conspiracy to commit securities fraud in connection with a scheme to commit insider trading. In particular, Struganon allegedly was involved in insider trading activities around Ormat Technologies and U.S. Geothermal; both are publicly-traded renewable energy companies.

According to the indictment, between in or about September 2017 and January 2018, Ormat Technologies engaged in merger negotiations with U.S. Geothermal. An Israeli co-conspirator (CC-1) not named in the Indictment served as Ormat’s Head of Mergers and Acquisitions and was one of Ormat’s principal negotiators for the deal. He had access to material, nonpublic information about the deal in that role. CC-1 and Moshe Strugano, who both lived in the vicinity of Tel Aviv, Israel, maintained a personal relationship and friendship.

On or about December 19, 2017, the Ormat board approved acquiring U.S. Geothermal at a price of up to $5.50 per share, which was U.S. Geothermal’s asking price before the Ormat board meeting. Immediately after the Ormat board meeting ended, CC-1 tipped off Moshe Strugano that the Ormat-U.S. Geothermal deal was going to close through a coded WhatsApp message.

Within minutes of receiving that message, Strugano placed a telephonic order with the Swiss bank to purchase over $20,000 in U.S. Geothermal shares via his Seychelles entity Liversey Holdings Limited. This was the first time Strugano had ever asked to buy U.S. Geothermal stock for his accounts. Over the next several weeks, Moshe Strugano directed his broker to purchase large blocks of U.S. Geothermal shares. By January 18, 2018, he had purchased over $2.7 million in U.S. Geothermal shares for an approximately 3.8% equity stake in the company. From December 19, 2017, through January 18, 2018, Strugano was responsible for about one-third of the total trading volume in U.S. Geothermal stock.

On January 24, 2018, Ormat and U.S. Geothermal announced their merger. When the market opened that day, the U.S. Geothermal stock price jumped, and Strugano sold all of his shares realizing approximately $1.2M profits.

Indictment counts and sentencing

The statutory maximum sentences are prescribed by US Congress and are a sentencing guideline for the ruling judges. Moshe Strugano is charged with one count of conspiracy to commit securities fraud, which has a maximum sentence of five years in prison, and two counts of securities fraud, which have maximum sentences of 20 and 25 years in prison, respectively.