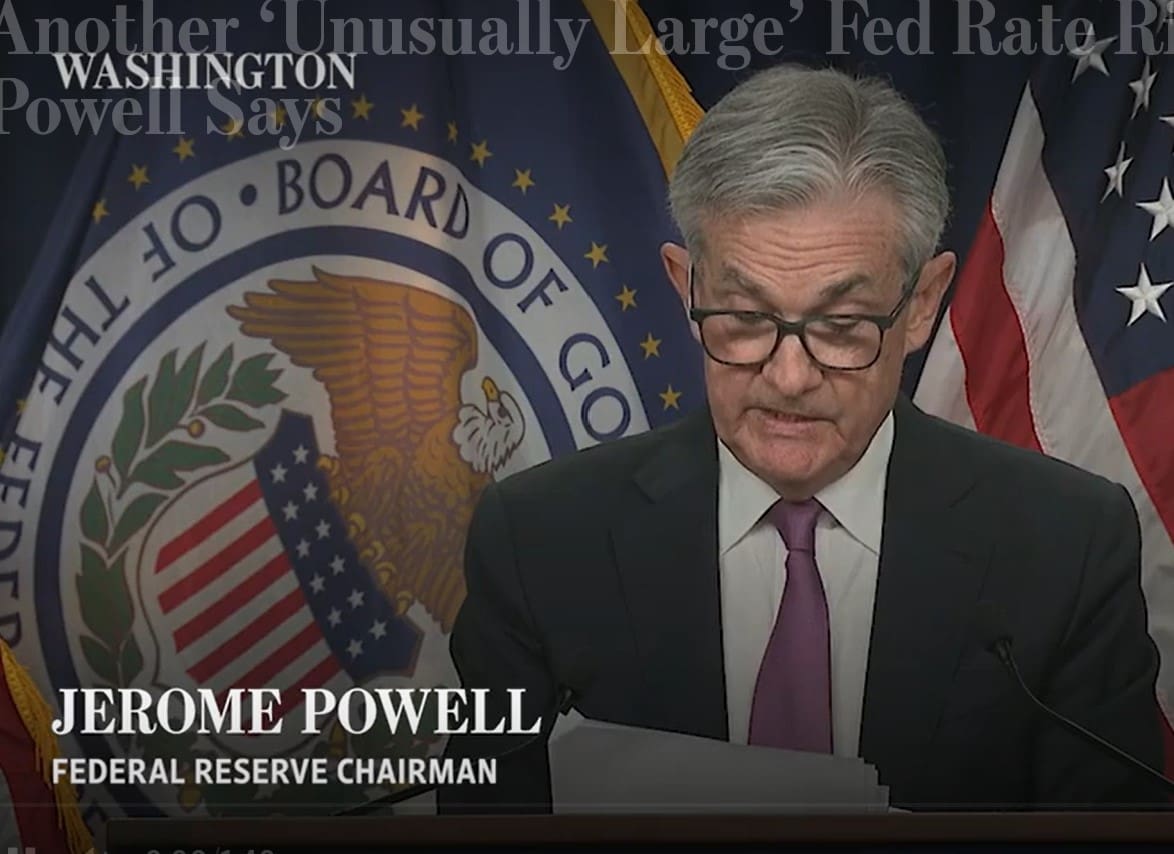

The U.S. Federal Reserve continued to reverse its easy-money policies by approving another unusually large interest rate increase and signaling that more rises were likely coming to combat inflation at a 40-year high. According to WSJ, FED officials decided to lift the benchmark federal-funds rate to a range between 2.25% and 2.5%. However, markets rallied after the meeting because Fed Chairman Jerome Powell offered fewer specifics about the magnitude of upcoming rate rises and hinted at an eventual slowdown.

Given Powell’s insistence that the FED has to cause slower growth and accept rising recession risks to bring down inflation. it was too soon to say whether the FED would dial down the size of its rate increases to a half-percentage point or a quarter-percentage point at its next meeting in September. But he said that at some stage, it would be appropriate to slow the pace of rate increases to assess their cumulative impact on the economy.