The European Funds Recovery Initiative (EFRI), co-founded and proudly supported by FinTelegram, helps victims of

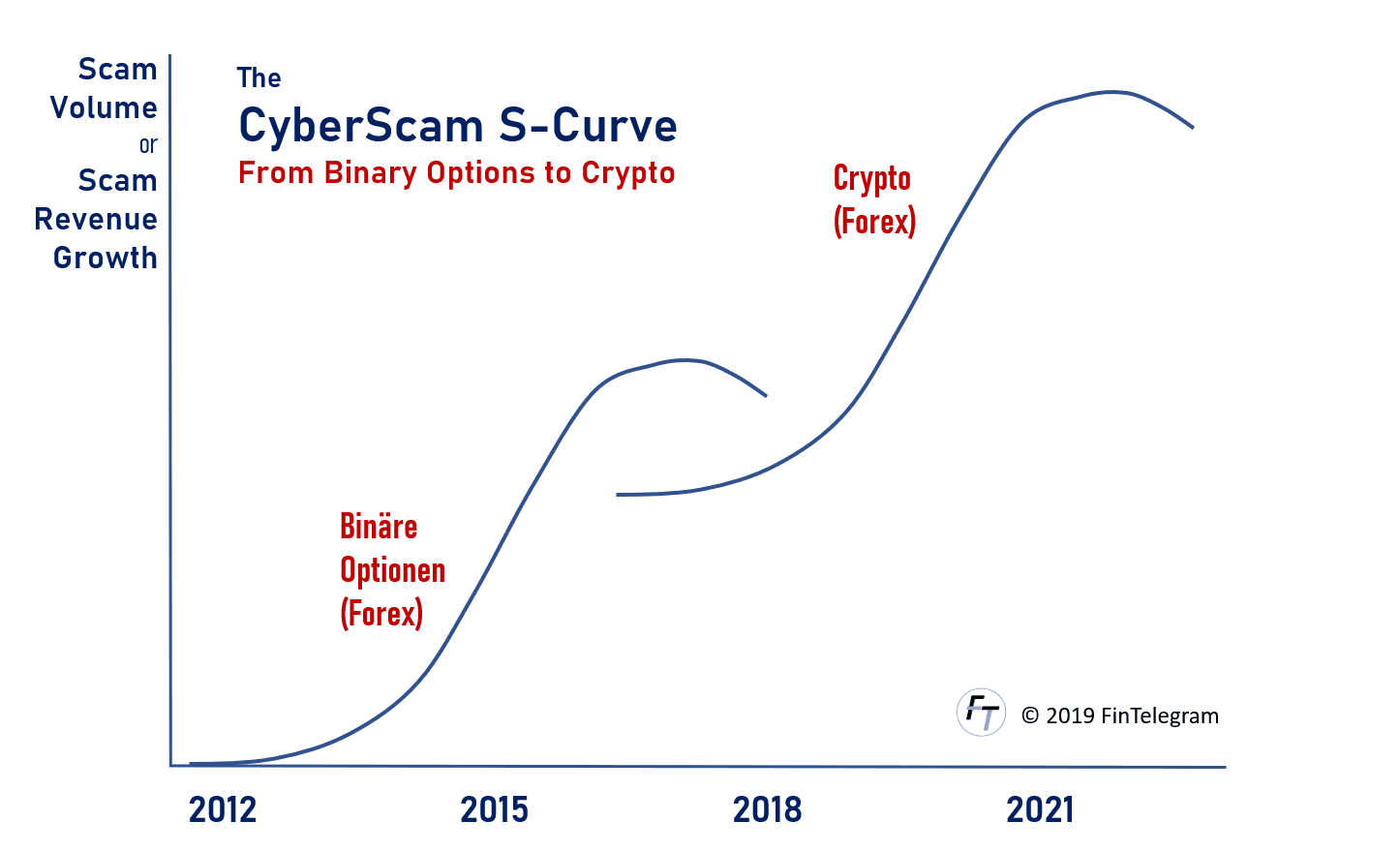

The ban of the binary options and the hype about cryptocurrencies, which has been looming from the beginning of 2017, have prompted the operators of broker scams to increasingly migrate their scams to cryptocurrencies and blockchain. A large part of the FOREX retail market has therefore taken place in recent years primarily around these two major drivers – binary options and cryptocurrencies. The so-called CFDs have a sort of bridging function and are very often a hybrid instrument between binary options and cryptocurrencies. Many CFD offerings refer to cryptocurrencies as their basic assets. Moreover, cryptocurrencies are increasingly being used as a means to receive deposits from retail investors. The scammers try to use cryptocurrencies to blur the traces of the cash flow. The latter is becoming increasingly difficult for scammers in view of the numerous public warnings from regulatory authorities and of course the warnings of FinTelegram.

The EFRI Report on Broker Scams in Europe, which has now been launched, aims to make clear the extent of fraud with online trading websites. The publisher of the report – the former EY partner

With this report, we want to make the public and the authorities aware of the horrible extent of fraud among small investors using broker scams. The report is constantly updated with new data and victim reports. In the future, EFRI and FinTelegram will focus on the systematic collection, structuring,

Elfriede Sixt, EFRI Principaland evaluation of relevant data in order to protect investors as a preventive measure.

The EFRI report is prepared by processing the data provided by the victims of broker scams and the reports from FinTelegram whistleblowers. In addition, publicly available data is also used.