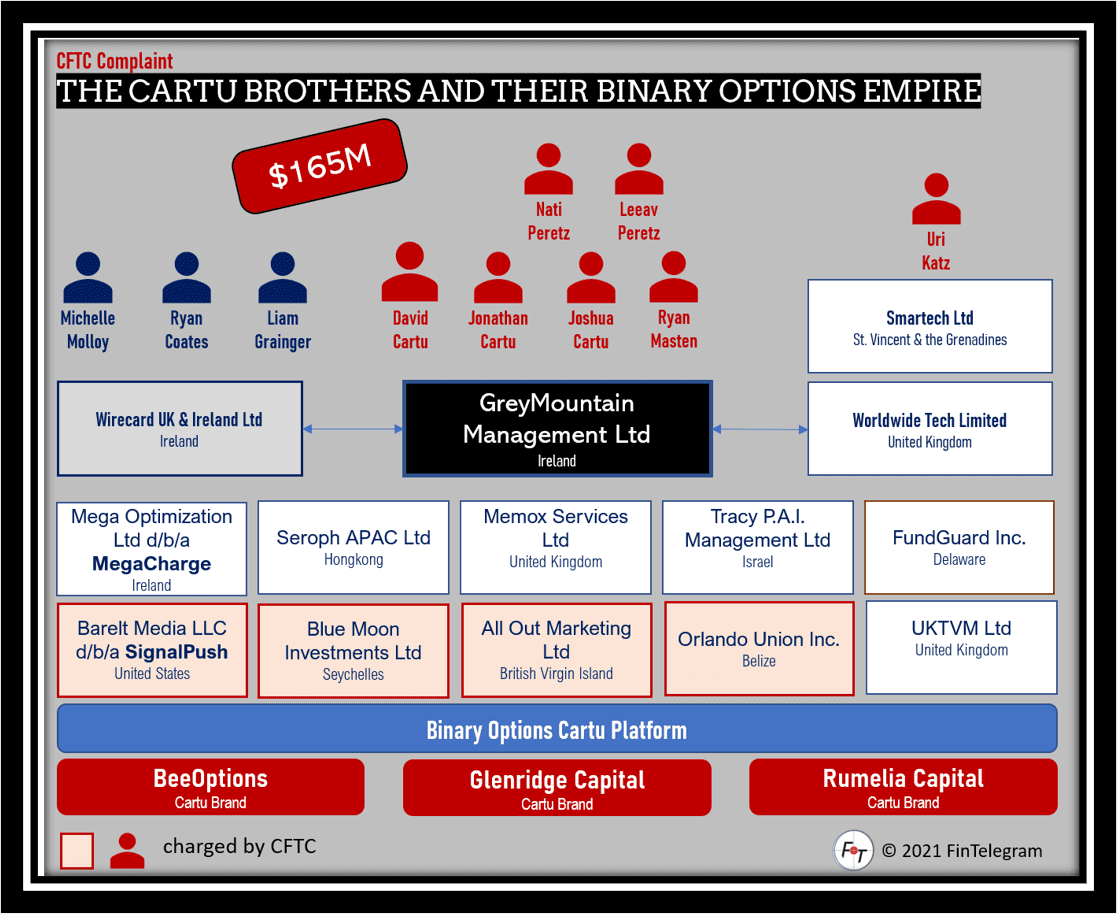

The U.S. Commodity and Futures Commission (CFTC) filed a fraud complaint against David Cartu, Joshua Cartu, Jonathan Cartu (“Cartu Brothers“), and others in September 2020 alleging vast binary options fraud in the amount of $165 million. The lawsuit could not be served by the CFTC or the relevant U.S. court. So, the CFTC, through paid advertisements in media outlets such as The Times of Israel, has conceded notice of the lawsuit, including notice of meetings and deadlines. Below is yesterday’s “legal notice as an advertisement” from the Times of Israel. As a courtesy to the CFTC and in support of the victims, we are also posting this Legal Notice here on FinTelegram for free.

UNITED STATES DISTRICT COURT FOR THE WESTERN DISTRICT OF TEXAS Commodity Futures Trading Commission v. David Cartu, Jonathan Cartu, Joshua Cartu, Ryan Masten, Leeav Peretz, Nati Peretz, All Out Marketing Limited, BareIt Media LLC d/b/a SignalPush, Blue Moon Investments Ltd., and Orlando Union, Inc.

UNITED STATES DISTRICT COURT FOR THE WESTERN DISTRICT OF TEXAS

Commodity Futures Trading Commission v. David Cartu, Jonathan Cartu, Joshua Cartu, Ryan Masten, Leeav Peretz, Nati Peretz, All Out Marketing Limited, BareIt Media LLC d/b/a SignalPush, Blue Moon Investments Ltd., and Orlando Union, Inc.

Civil Action 20-cv-908-RP, Hon. Robert Pitman, District Court Judge

Summons in Civil Case and Notice of Allegations in the Complaint

To: David Cartu, Jonathan Cartu, and Joshua Cartu (the “Cartu Defendants”), Leeav Peretz and Nati Peretz (the “Peretz Defendants”), All Out Marketing Limited (“All Out”), Blue Moon Investments Ltd. (“Blue Moon”), and Orlando Union Inc. (“Orlando Union”)

YOU ARE HEREBY SUMMONED and required to serve on plaintiff’s counsel, Benjamin E. Sedrish or Elizabeth N. Pendleton of the Commodity Futures Trading Commission (“CFTC”), 525 W. Monroe Street, Suite 1100, Chicago, IL 60661, U.S.A., an answer to the complaint that was filed against you in the U.S. District Court, Western District of Texas, within 30 days from August 9, 2021. If you fail to do so, judgment by default will be taken against you for the relief demanded in the complaint. Any response that you serve on the plaintiff in this action must be filed with the Clerk of the Court for the United States District Court for the Western District of Texas.

THE ALLEGATIONS AGAINST YOU are as follows:

Beginning on or around May 1, 2013, and continuing until at least April 29, 2018, the Cartu Defendants marketed, offered, and sold illegal, off-exchange binary options to retail customers on websites under the BeeOptions, Glenridge Capital, and Rumelia Capital binary options brands. As alleged in the complaint, the Cartu Defendants, as well as Defendants Leeav Peretz and Nati Peretz, operated call centers primarily located in Israel that targeted and victimized United States residents by promising “quick” returns of “between 60-85%” by trading binary options. The complaint further alleges that, at the direction of the Cartu and Peretz Defendants, the individual brokers soliciting United States customers falsely represented their financial expertise, compensation structure, physical location, and identity. These brokers also falsely claimed that the offered binary option transactions were profitable, when the majority of customers lost money. The complaint further alleges that the Cartu Defendants and Defendant Ryan Masten controlled the binary options transactions and manipulated the results of some trades to force customer losses and generate profits for themselves. As a result of this conduct, the Cartu Defendants and the Peretz Defendants violated Sections 4c(b), 4d(a)(1), and 6(c)(1) of the Commodity Exchange Act, 7 U.S.C. §§ 6c(b), 6d(a)(1), 9(1) (2018), and Commission Regulations 32.2, 32.4, 180.1(a)(1)–(3), 17 C.F.R. §§ 32.2, 32.4, 180.1(a)(1)–(3) (2019).

The Cartu Defendants also operated Greymountain Management Limited, a now-defunct “payment processor” that maintained its principal place of business in Ireland. Ultimately, through Greymountain and other related entities, the Cartu Defendants fraudulently processed at least $165 million in customer funds in connection with their binary options trading scheme and misappropriated a significant percentage of those funds by utilizing various manipulative or deceptive devices, including by artificially manipulating the results of binary options trades to force customer losses. The Complaint alleges that David Cartu owned and controlled All Out, Jonathan Cartu owned and controlled Blue Moon, and Joshua Cartu owned and controlled Orlando Union. The Complaint further alleges that the Cartu Defendants used these companies to execute the alleged fraudulent scheme, including by transferring, holding, and concealing funds obtained in connection with the scheme.

The Cartu Defendants and the Peretz Defendants may obtain a copy of the complaint by calling Mr. Sedrish at 1-312-989-9571 or Ms. Pendleton at 1-312-596-0629; by making such request in writing to Mr. Sedrish or Ms. Pendleton at the address above, or by visiting the following website on the internet: www.cftc.gov, clicking on News and Events, and typing in Press Release No. 8321-20 (or, alternatively, going directly to CFTC Release No. 8321-20, dated September 2, 2020, available at the following URL:

https://www.cftc.gov/PressRoom/PressReleases/8231-20 and accessing the link to the CFTC complaint.