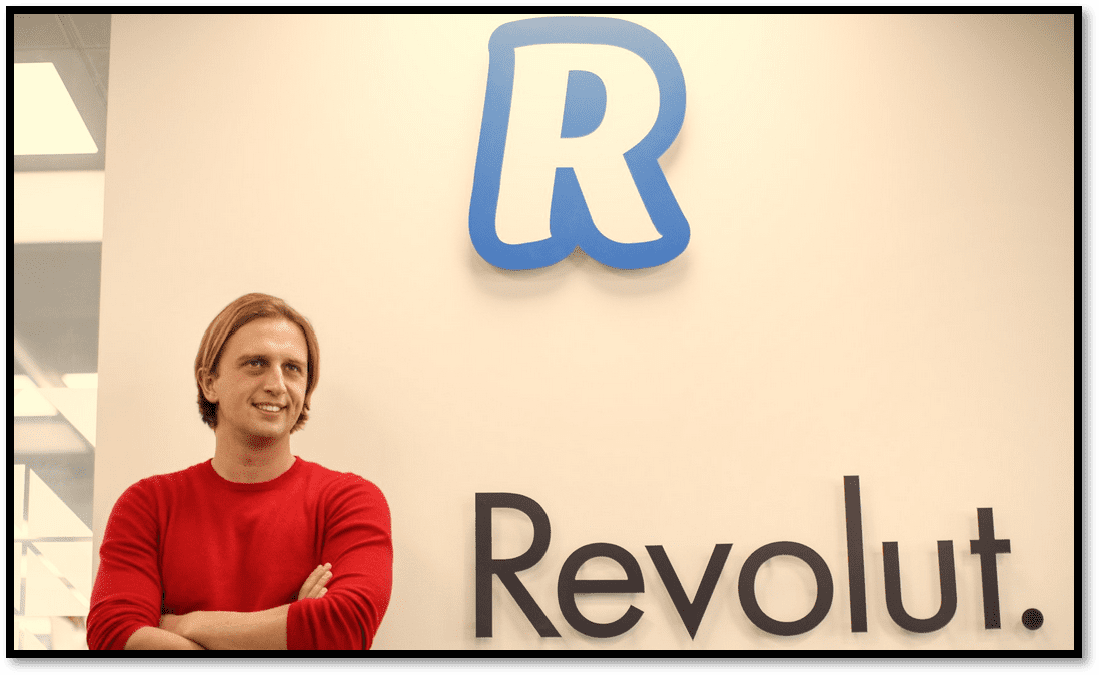

Revolut, the troubled UK fintech, is facing a lawsuit for facilitating a £600,000 fraud, according to a report by This Is Money. Terna Energy Trading, a company listed on the Athens stock market, has initiated legal proceedings against Revolut, claiming that the fintech firm violated money laundering regulations by failing to prevent a “fraudulent” transaction that took place last year. The court battle will present another challenge for Revolut co-founder and CEO Nik Storonsky.

This latest dispute adds to the scrutiny surrounding Revolut’s operations, which have been under intense scrutiny as the company strives to obtain a banking license in the UK. Although the UK’s most valuable fintech was founded in 2015, Revolut has been waiting for full regulatory approval for over two years and has faced embarrassing setbacks.

Documents submitted to the High Court reveal that fraudsters deceived Terna into paying a fraudulent supplier, which was processed through Revolut in February 2022. Although the payment was initially flagged by anti-money laundering software, a Revolut analyst in Lithuania eventually approved it. Terna claims to have alerted an online Revolut agent who did not investigate the payments or escalate the matter to the appropriate team. As a result, Terna is suing for damages under the Proceeds of Crime Act.

Revolut has not yet presented its defense in the case but stated.