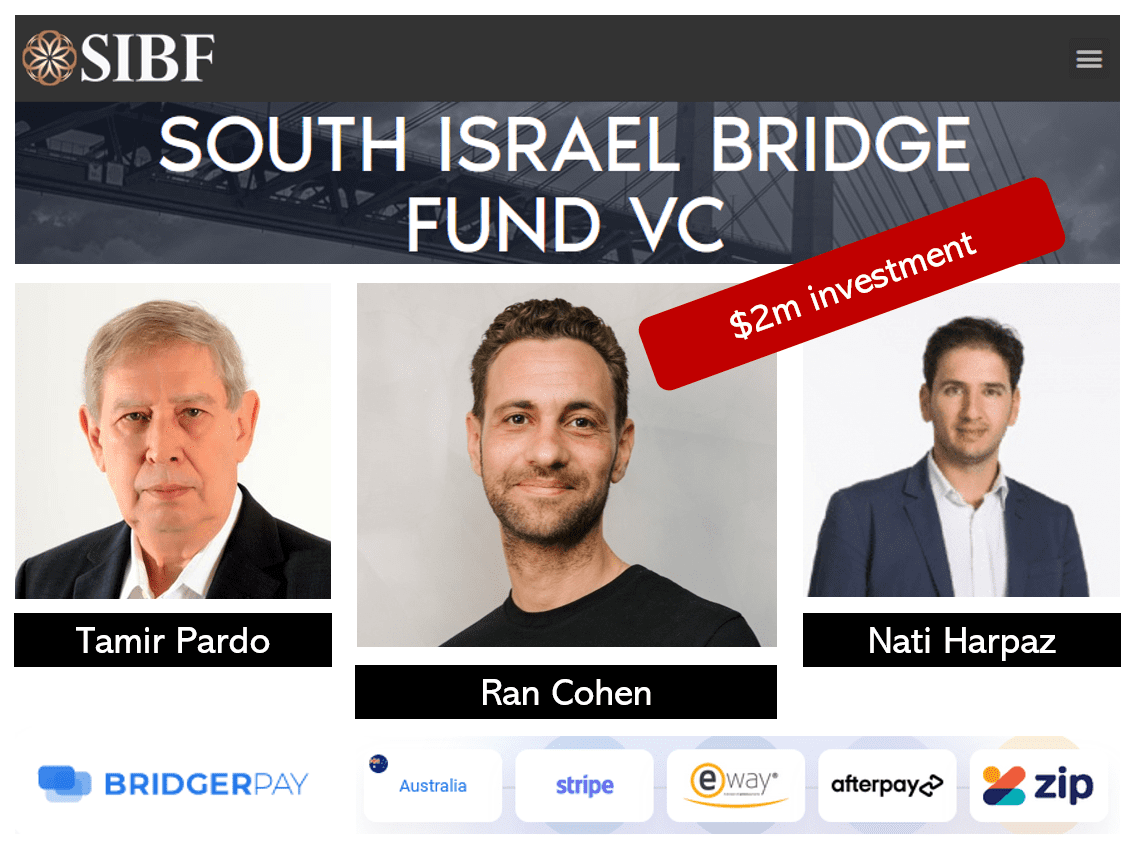

Interesting rumors! Israeli forex expert Ran Cohen established his Bridger AI Limited in Cyprus in Feb 2019 to operate the BridgerPay payment processor. In November 2020, BridgerPay announced that it had hired Nati Harpaz, the former CEO of Australian e-commerce group Catch.com as Executive Director. Harpaz is said to play a significant role at BridgerPay and allegedly organized the financing round with the Israeli South Israel Bridge Fund (SIBF), co-founded and presided by the former Mossad boss Tamir Pardo. Why is a reputable Israeli fund investing in a scam facilitating PayTech?

The incredible valuation

We have heard from reliable sources that the SIBF (www.sibf.vc) is to take a 10% stake in Bridger AI Limited based on a valuation of more than $20 million. Specifically, the SIBF is to pay $2M into the company for this 10% we have heard from several sources. That’s a nice valuation for a two-year-old company. Ran Cohen and Nati Harpaz must have made good presentations there. The valuation is all the more surprising given that BridgerPay is an unregulated PayTech that is massively involved in cybercrime.

This does not send a good signal to the entire FinTech market. Scam activities are thus indirectly seen as good and value-driving.

Value driver scam business

In recent months, FinTelegram has reported many times on BridgerPay‘s involvement in broker scams. Again and again, we see the BridgerPay Cashier as the central payment element of these scams. The PSPs to which the payments are routed via a “smart” algorithm are integrated into the cashier. To those PSPs, the cashier is the layer that distances the PSPs from the scams. In a mid-2020 conversation with FinTelegram, Ran Cohen asserted that he would actively crackdown on scams. However, the opposite is true – BridgerPay builds its business model and revenue on scams. The revenues and projections should obviously be correct; otherwise, the $20M+ valuation would be inexplicable.

It would be straightforward for a company allegedly working with Artificial Intelligence and “smart” routing algorithms to identify scams and fraudulent payments via software algorithms. This is especially true when public investor warnings have already been issued against these scams (a/k/a BridgerPay clients) by regulators.

Tamir Pardo and SIBF

At SIBF, former Mossad boss Tamir Pardo is co-founder and president. Also, David Aviv and Eyal Danino are listed as co-founders and managing partners. Tamir Pardo was the 11th director of the Mossad from 2011 to 2016 (see Wikipedia). In case these SIBF rumors turn into reality, it would raise some questions, wouldn’t it?

We will report on further developments.