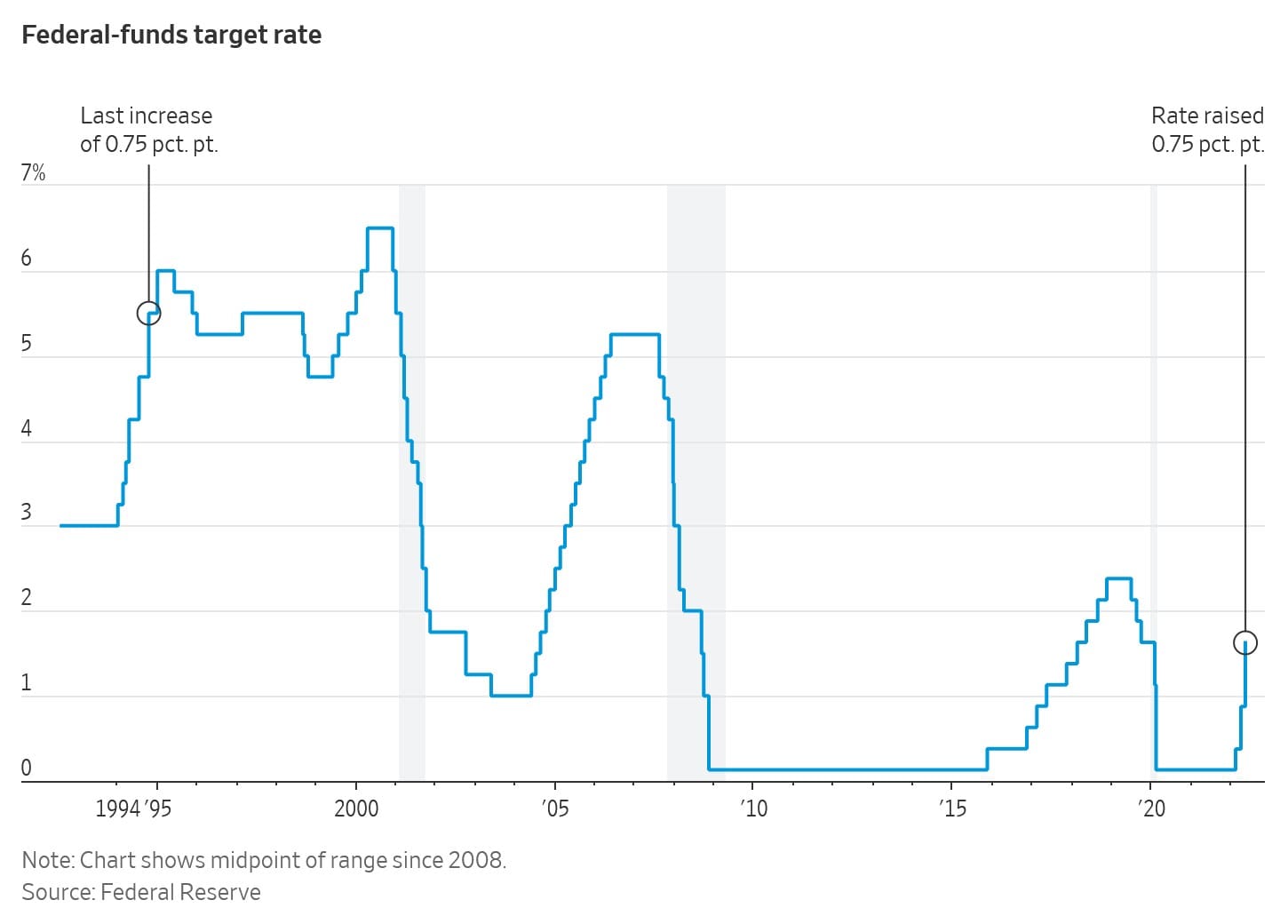

The U.S. Federal Reserve (Fed) announced the largest interest-rate increase since 1994 and signaled it would continue lifting rates this year to fight inflation that is running at a 40-year high. Fed Chair Jerome Powell indicates that the economy may go into recession without a soft landing. Officials agreed to a 0.75-percentage-point rate rise, which will increase the Fed’s benchmark federal-funds rate to a range between 1.5% and 1.75%. It is expected that the Fed may raise rates to at least 3% this year. Projections showed officials see the fed-funds rate peaking at around 3.75% by the end of 2023.

“We’re not trying to induce a recession now. Let’s be clear about that,”

Fed Chairman Jerome Powell

Fed Chairman Jerome Powell said it was becoming more difficult to achieve a soft landing, in which the economy slows enough to bring down inflation while avoiding a recession. The risks of a downturn could rise as the economy digests tighter monetary policy.