On March 4, 2010, the Munich I Public Prosecutor’s Office received a report with a lot of explosive power that could have an impact on the current Wirecard trial. “Criminal complaint for money laundering in the billions against Wirecard AG, Management Board Markus Braun,” is the (translated) title of the new complaint, the Austrian Kurier reports. It states that Wirecard‘s entire business model “is based on the processing of highly profitable but illegal transactions.“

Old Allegations

The public prosecutor’s office, as was customary at the time, did not pursue the complaint because it did not see any suspicion. At that time, all charges against Wirecard were dropped by the public prosecutor’s office and the financial market supervisory authority BaFin. They protected “their” German fintech unicorn.

Allegedly, Wirecard had to pay €16 million in contractual penalties to a major credit card company in 2010. According to the complaint, Wirecard allegedly used false Merchant Category Codes (MCC) to process illicit deposits and withdrawals from US poker sites via flower stores. Internet gambling has been banned in the U.S. since 2006. According to the complaint, Wirecard may have processed up to one billion euros per year with these US gambling operators. Instead of the usual one percent, Wirecard is said to have collected at least a 6% fee per transaction.

With profits of €50 million at the time, it is quickly apparent that the poker sites must have been almost Wirecard’s entire business.

It was only when the FBI finally shut down the poker sites in 2011 that Wirecard faced massive problems. After that, the build-up of the sham business in Asia and Dubai is said to have begun. Wirecard presented constantly increasing profits. According to the key witness Oliver Bellenhaus, Braun provided the figures, which the employees then had to bend over.

The 2010 complaint plays no role in the current Wirecard trial because the indictment deals only with incidents after 2015. Why we don’t know. However, for one of the prosecutors at the time, it is “a scandal that the history of that time” has so far not been mentioned in the trial.

The Markus Braun Provocation

One of the individuals behind the 2010 complaint spoke with the Austrian Kurier and explained that she is upset with the testimony of former Wirecard CEO Markus Braun at Monday’s trial. The line of defense is that the Austrian CEO never knew anything about criminal dealings at the payment service provider. Doubts are now being sown about that.

The Responsible Managers

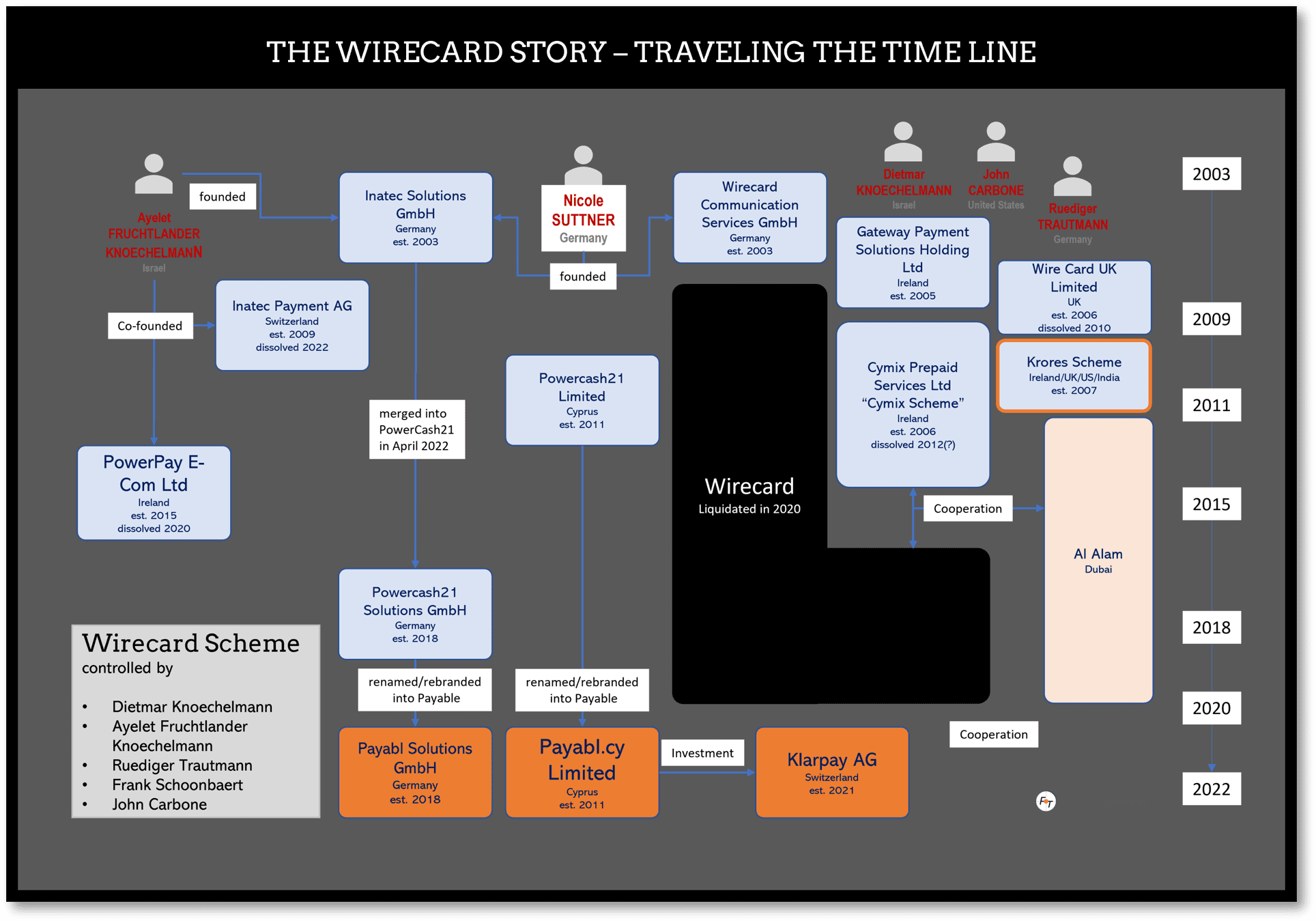

The 2010 complaint is also explosive in that it relates to the period before 2010 as, in addition to Markus Braun, Dietmar Knoechelmann and Ruediger Trautmann also held top positions at Wirecard. They worked for Wirecard until 2009 and 2010, respectively. According to the Zatarra Report of Fraser Perring and a JCAP analysis, Knoechelmann brought U.S. gambling activities into Wirecard in 2007 (read the report here) After their departure, Knoechelmann and Trautmann continued to operate their companies in the Wirecard shadow organization.

The total cost of this acquisition appears to have been roughly USD 20 mln. For the 14 months to the end of 2006 Gateway reported revenue of USD 45.2 mln, operating profit of USD 2.8 mln and net profit of USD 1.4 mln … Gateway had a heritage in online gaming, and so did its promoters. Gate way’s sister company BingoWorkz was a Cyprus-based online gaming company … The vendors of Gateway were principally John Carbone and Dietmar Knoechelmann. Knoechelmann subsequently served as a director of the Wirecard subsidiaries from acquisition until March 25, 2009.

JCAP report (Dec 2015)

In 2011, Knoechelmann and Trautmann founded the high-risk payment processor Payabl (formerly PowerCash21), now regulated by the Central Bank of Cyprus, which operates with the same business model as Wirecard and does business with merchants in the porn, gambling, and online investment sectors.

Share Information

If you have any information about Wirecard, Payabl, or the people involved, please let us know via our whistleblower system, Whistle42.