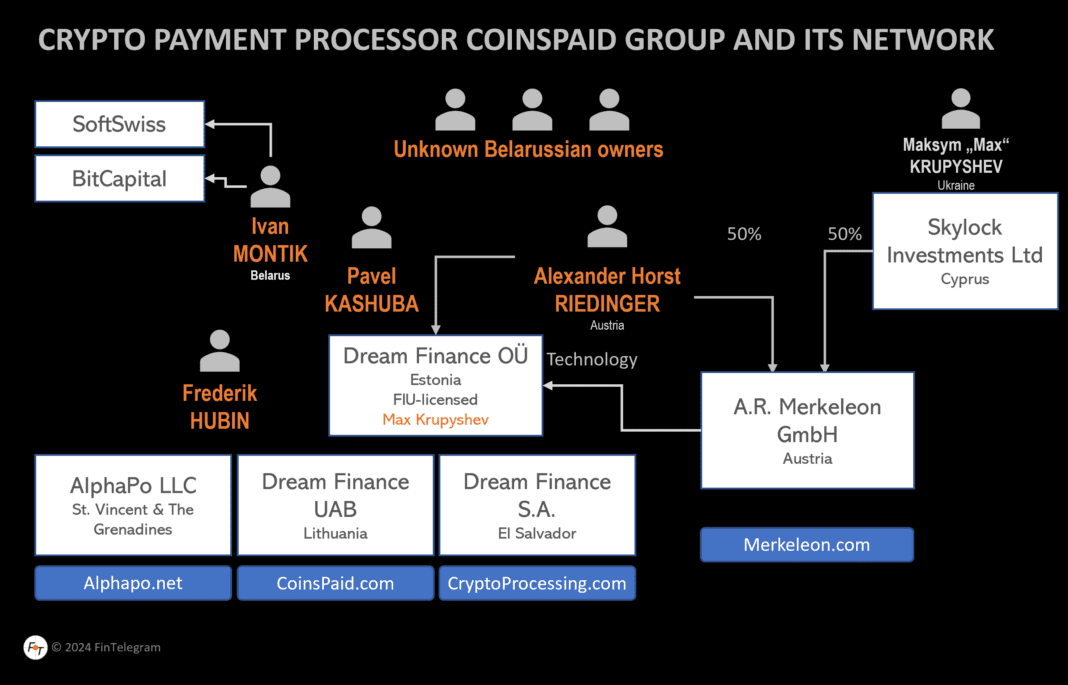

Detailed whistleblower reports have recently surfaced on Medium, unveiling significant allegations of fraud, mismanagement, and regulatory evasion concerning CoinsPaid a/k/a CryptoProcessing and its closely associated entity, AlphaPo. This report provides insights into the operations, financial misconduct, and purported illegal activities facilitated by these entities under the guise of legitimate crypto payment processing services. The information revealed suggests that CoinsPaid is a crypto scheme controlled by people from Belarus and that the Austrian Alexander Horst Riedinger is merely a frontman.

The CoindPaid Key Findings

- Operational and Financial Misconduct:

- CoinsPaid, operating under Dream Finance OÜ, is implicated in a series of financial discrepancies and possible bankruptcy, with declared losses from hacks far exceeding officially reported figures.

- The entities are accused of laundering substantial amounts of money, estimated in the hundreds of millions annually, primarily servicing offshore and illegal gambling platforms across Europe.

- Individuals Involved:

- Alexander Horst Riedinger: This Austrian national is officially the beneficial owner (UBO) of the CoinsPaid Group. However, according to reports, he is only a frontman for the Belarusian owners.

- Maksim Krupyshev: CEO of CoinsPaid and a central figure in the allegations, reportedly managing operations for the benefit of hidden Belarusian owners.

- Ivan Montik: he seems to be a key person in the CoinsPaid network. On his personal website, he bills himself as the co-founder of CoinsPaid, the founder of SoftSwiss and Merkeleon (beneficially owned by the Austrian Alexander Riedinger).

- Pavel Kashuba: referred to by the nickname “Pasha,” he was the CFO and co-CEO of CoinsPaid until his departure, which coincided with the publication of revelations about CoinsPaid.

- Svetlana Prussova and Violaine Champetier de Ribes Christofle: Both hold significant roles within CoinsPaid, with responsibilities spanning from compliance to public relations.

- Frédéric Hubin: Initially brought in to fulfill local regulatory requirements in Estonia as a board member.

- Hanna Drabysheuskaya and Aliaksei Kuzniatsou: Identified as key personnel in handling financial transactions and potentially aware of the laundering operations.

- Regulatory Evasion and Compliance Issues:

- CoinsPaid is reported to have crafted a dual narrative, presenting itself as compliant while engaging in activities that evade financial and corporate governance norms.

- Despite apparent regulatory breaches, the Estonian authorities reportedly renewed Dream Finance’s license, raising concerns about the efficacy and integrity of local regulatory frameworks.

- Security Breaches and Financial Irregularities:

- The entities have been targeted by multiple security breaches, suggesting either complicity or gross negligence in maintaining adequate security measures.

- Financial irregularities include unexplained discrepancies between reported and actual financial states, indicating possible insolvency or hidden liabilities.

- Response from Authorities and the Crypto Community:

- The lack of action from Estonian regulators, despite the availability of incriminating information, suggests potential gaps in regulatory oversight or enforcement.

- The crypto community, including analysts and security experts, has expressed skepticism about the official explanations provided by CoinsPaid regarding the hacks and their financial health.

Connection Between CoinsPaid, AlphaPo, and CryptoProcessing.com:

The whistleblower report sheds light on a critical connection between CoinsPaid, AlphaPo, and another entity known as CryptoProcessing.com, which all appear to be intricately linked and possibly controlled by the same group of Belarusian individuals. The report reveals that CoinsPaid and AlphaPo not only share technology and compliance departments but also exhibit financial interdependencies that suggest they operate nearly as a single entity under different names. This operational intertwining is further complicated by the simultaneous security breaches and the shared management strategies that direct both entities.

CryptoProcessing.com, doing business under the CoinsPaid banner, is another facet of this complex arrangement, offering crypto payment processing services that are deeply integrated with the operations of CoinsPaid and AlphaPo. The seamless movement of clients and funds between these entities without proper compensation or transparency is indicative of a unified business operation managed to obfuscate true ownership and control. These arrangements facilitate the laundering of proceeds from illegal activities, including those from offshore and illegal gambling sites.

This network of entities, controlled by Belarusian interests and potentially involving fraudulent activities, raises serious concerns about the legitimacy of their operations and the adequacy of their oversight by regulatory bodies. The apparent laxity in regulatory enforcement from Estonian authorities, despite clear indications of wrongdoing, underscores the urgency for a comprehensive review and possible intervention by international regulatory bodies.

Implications for Western Sanctions Against Belarus:

Given the allegations that CoinsPaid and its associated entities are controlled by Belarusian individuals, a pertinent question arises regarding the compliance of their operational and financial activities with Western sanctions imposed against Belarus. Could the financial transactions and corporate structuring practices of CoinsPaid, AlphaPo, and CryptoProcessing.com, as managed and directed from Belarus, potentially constitute a violation of these sanctions?

This question underscores the need for a thorough investigation by international regulatory bodies to determine whether these entities are being used as conduits to circumvent sanctions, thereby undermining the intended impact of international punitive measures aimed at the Belarusian regime. This aspect of the investigation could have significant geopolitical implications, affecting not only the entities involved but also the broader international community’s efforts to enforce compliance with sanctions policies.

Recommendations for Stakeholders:

- Regulatory Review: Immediate and thorough investigation by Estonian and EU regulatory bodies to assess the legal compliance of CoinsPaid and associated entities.

- Investor Caution: Investors and users of CoinsPaid services should exercise heightened caution and perform due diligence.

- Community Vigilance: The crypto community should continue to monitor and report suspicious activities associated with CoinsPaid.

Call for Information: FinTelegram encourages anyone with more information about CoinsPaid or its operations to come forward and share their insights through our whistleblower platform, Whistle42. Your contributions are vital for uncovering the truth and ensuring transparency within the cryptocurrency industry.