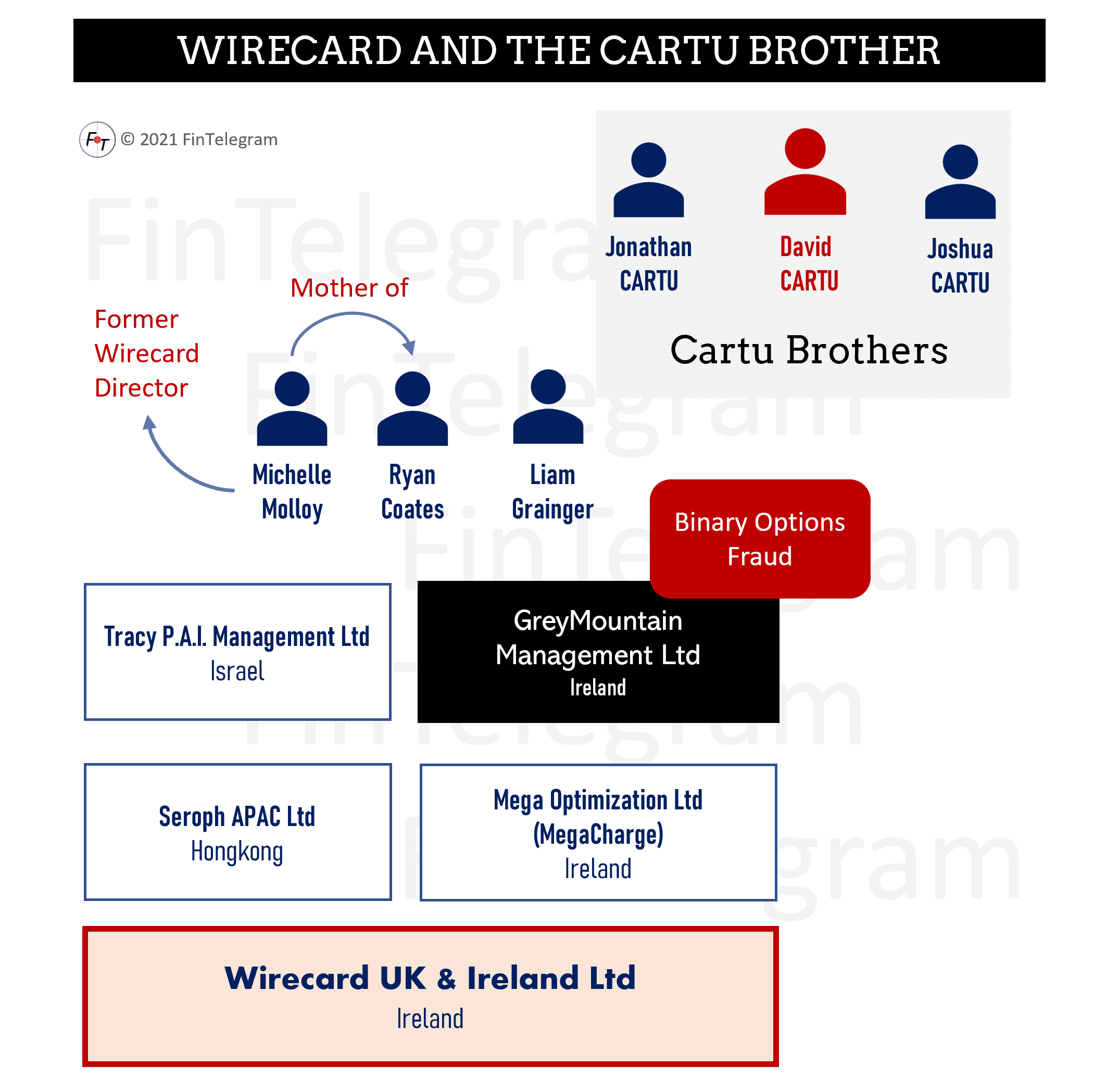

The binary options scheme GreyMountain Management (GMM), run by the Cartu Brothers was probably one of the world’s largest binary options fraud schemes between 2014 and 2017. According to various estimates, they received between €150 to 250 million from investors. The Irish High Court found that the Canadian-Israeli brothers David Cartu and Jonathan Cartu were shadow directors of the Irish GMM and actually ran the Irish company and the GMM fraud scheme. They are liable for investor losses.

Read our report on the Irish Court Order here.

The Irish court found that the Cartu Brothers had “syphoned off considerable sums of money,” leaving it just €600,000 to fulfill its obligations. The judge made them “personally liable to Mr Powers for the loss he suffered.” The Irish directors of the company, Ryan Coates and Liam Grainger, were found jointly liable for the loss of the investors due to their “complete dereliction of duty” in not knowing what GMM was doing.

The Victimized Son

Ryan Coates, the son of former Wireceard executive Michelle Molloy, was a student who had been persuaded to take on the role by his mother and received €1,000 per month for being a director. He had no role in the day-to-day running of the business. Grainger had a minimal role in the company by signing payment processing agreements with banks and received €10,000 per month for his role. They were unaware or negligent that the two shadow directors were committing a large-scale fraud.

According to an opinion of the Irish lawfirm DAC Bechcroft, the recent decision in Powers v. Greymountain Management Ltd highlights the consequences of directors who neglect their duties when running a company and rely on others to fulfill their duties. By failing to carry out their duties, two directors were found liable for loss relating to fraudulent investments, which, unbeknownst to them, were carried out by the other two shadow directors. 35 investors brought this claim for losses totaling over $4m.

The Failed Defense Line

Ryan Coates and Liam Grainger argued they should not be liable because they were directors in name only. However, the Court found they had abrogated their duty in favor of the shadow directors and were obliged to acquire and maintain sufficient knowledge and understanding of the business to discharge their duties. No other Irish decision has lifted the corporate veil before this one.

The Court found both directors and its shadow directors, David Cartu and Jonathan Cartu, to be personally liable due to the fraud.

Although the Court found the two directors did not have any role in the fraud and were sympathetic to their situation, this was not sufficient to absolve them of any wrongdoing because the directors’ impropriety and dereliction of duty were of such a degree as to justify both the directors being held personally liable to the Plaintiff.

The Conclusion

In its conclusion CAD Beachcroft said that the GMM case is a first for Ireland as the “corporate veil” typically provides strong protections for directors. This serves as a warning shot for all directors that they must make sure that they fulfill their duties owed to the company or otherwise risk being held to account for the decisions of others. Any director with a claim brought against them should have D&O Insurance in place, which may cover the costs of defending proceedings. However, like in this case, if fraud is proven to have been committed by that director, insurers may rely on policy exclusions pertaining to fraud to exclude cover for the claim.