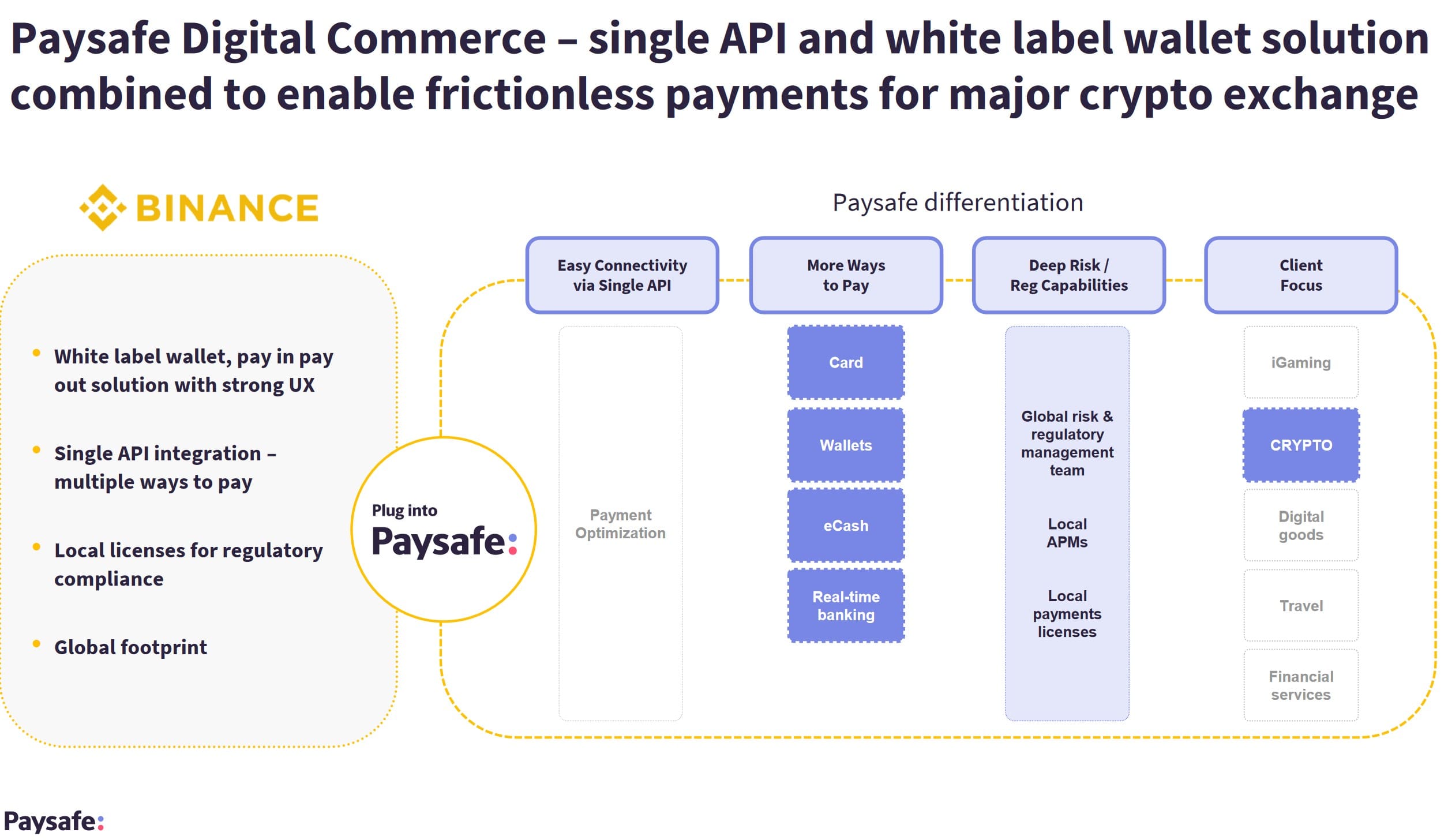

Most recently, public-listed payment processor Paysafe trading as Paysafe, NETELLER, Skrill, and Rapid Transfer attracted attention through its partnership with the world’s leading crypto exchange Binance. The company is expecting strong growth in high-risk segments such as crypto, financial services, travel, or iGaming. Through the partnership with Paysafe, Binance has access to the UK FPS system, which the FCA is concerned about. Paysafe stocks gained more than 17% following its fourth-quarter earnings, which beat analyst expectations.

The company booked revenue of $371.66 million, while analysts polled by Investing.com anticipated revenue of only $357.35 million. Paysafe reported a total payment volume of $31.5 billion in Q4 2021, increasing 20% compared to the prior year. Net income attributable to the company was $90.3 million, compared to a net loss of $3.4 million in Q4 2020.

“We saw continued strong performance from US Acquiring and the turnaround of our digital wallet business is well underway with the actions we’ve taken driving positive results, repositioning the business for success, and enabling us to absorb market risks in Europe,” said Philip McHugh, CEO of Paysafe.

The company expects revenue for Q1 2022 between $355 and $365 million, with full-year revenue expected to be in a range of $1.53 billion t $1.58 billion. The partnership with Binance could well contribute quite a bit to Paysafe‘s growth in 2022.