In 2016, Uwe Lenhoff, the alleged German head of a global cybercrime organization, celebrated the IPO of Veltyco Group PLC in London together with his partner, Amsterdam real estate investor Dirk-Jan Bakker. Veltyco was to become the cybercrime organization’s white flagship and be used for money laundering. In January 2019, Lenhoff was arrested. In July 2020, he was found dead in his prison cell in Germany. Cause of death unknown. Consequently, Veltyco was renamed Bet90 Holdings and has now repositioned itself. While it received fresh funding, acquired new shareholders, the legacy issues remain with looming victim claims.

The cybercrime past

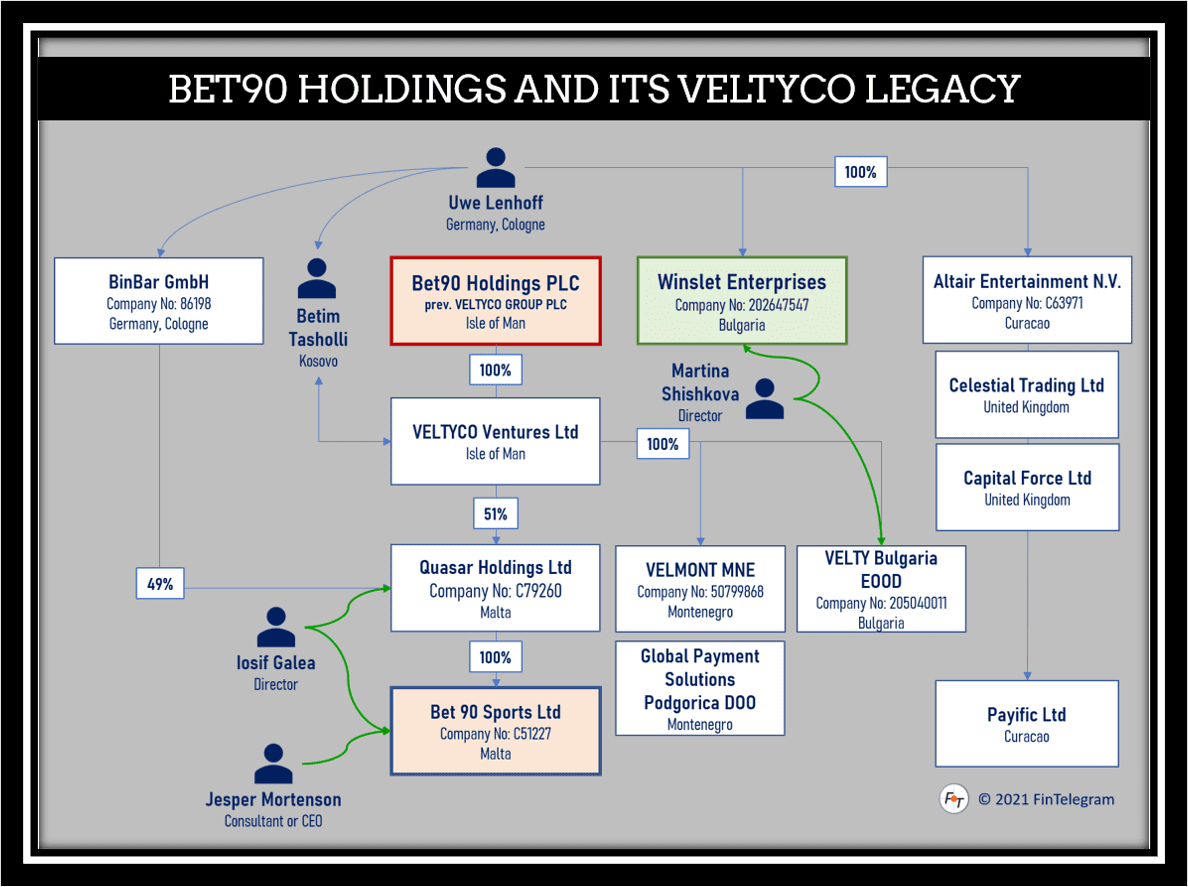

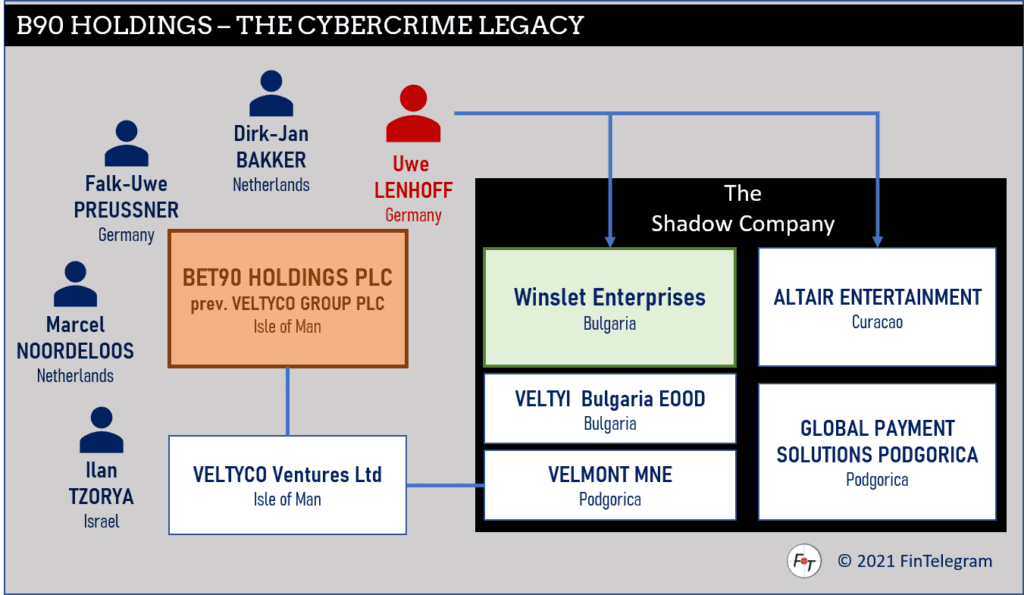

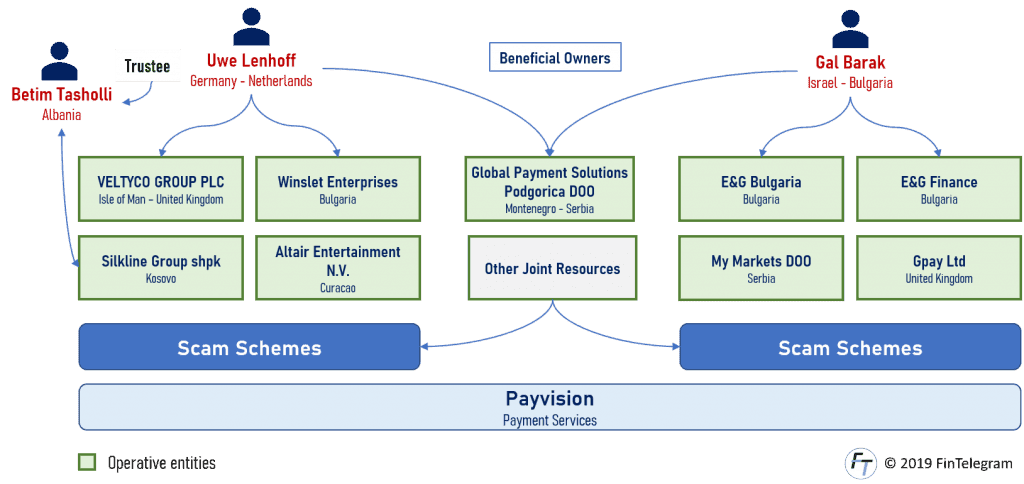

Between 2016 and 2019, the public-listed Veltyco Group PLC was the hub in a huge cybercrime organization dealing with investment fraud and money laundering. It concluded so-called marketing and consulting agreements with the operators of big scam sites like Option888 or LottoPalace. Regulators in different jurisdictions issued many public warnings, but the Veltyco board around Uwe Lenhoff and his Dutch fellow Marcel Noordeloos didn’t care.

These scam operators were controlled by Lenhoff and his Bulgarian Winslet Enterprises EOOD. They established offshore vehicles and illegal boiler rooms. In 2017, Veltyco had acquired ZoomTraderGlobal from Ilan Tzorya‘s DTIG Holding. This made Tzorya the second-largest shareholder of Veltyco.

Lenhoff and his Israeli partner Gal Barak established Global Payment Solutions Podgorica DOO (GPS) in Montenegro in 2017 together with lawyer Marko Vujosevic, a Montenegrin with offices in Belgrade and Podgorica. This entity has processed millions of stolen funds from scam platforms Option888 or XMarkets as an illegal payment processor. Victims from Germany, Austria, Italy, and Switzerland have lost tens of millions through GPS. We know of victims from Germany who have lost more than one million euros via GPS.

Veltyco has also worked with subsidiaries in Montenegro, Velmont MNE (OpenCorporates), and Bulgaria, Velty Bulgaria EOOD, which are not mentioned in its annual reports or disclosures. Veltyco director Marcel Noordeloos managed these investments and the flow of funds on behalf of Lenhoff.

Download Velty Bulgaria articles signed by Marcel Noordeloos

The trials

Veltyco and its connected individuals are part of law enforcement investigations and trials in several jurisdictions. Gal Barak was sentenced in September 2020 to four years in prison and millions in restitution payments. The trial against his wife, Marina Barak, is currently ongoing. A verdict is expected in May 2021. The Barak’s are also to be indicted in Germany and other EU countries, an insider confirmed to FinTelegram.

The authorities are also investigating former partner of Uwe Lenhoff and major Veltyco shareholder Ilan Tzorya. Tzorya parted ways with Lenhoff in 2018.

Insiders from various law enforcement agencies report that more indictments against Lenhoff and Barak’s former partners are expected in the weeks to come. COVID-19 pandemic problems have delayed investigations. Attorney Marko Vujosevic is also listed as a suspect.

The new game with new players

The Bet90 sports betting brand already has a long history under Lenhoff and Veltyco. The German venture with its legal entity Bet 90 Sports Limited (www.bet90.com) in Malta, regulated by the Malta Gaming Authority (MGA), has been a part of the group for several years already. It was first set up by Lenhoff and later acquired by Veltyco via Lenhoff’s partner Betim Tasholli, who has also been arrested in Germany as one of Lenhoff’s main co-conspirators.

Effective April 9, 2021, Bet90 Holdings has refinanced and repositioned itself. B90 Holdings announced that it has raised £1.1 million through a subscription of 7,796,427 new shares with “certain existing and new investors” at a price of 14 pence per share. The subscription shares represent 7.6% of the company’s existing issued share capital. Furthermore, the company announced that it will issue 285,571 new shares to settle placing fees amounting to £39,980 payable to third parties (the “Fee Shares”).

In the course of the repositioning, the old shareholders from the Veltyco era sold all or some of their shares:

- Ilan Tzorya and/or his Cypriot DTIG Holding Ltd (OpenCorporates) have sold most of their shares.

- The Lenhoff Family and its Cyprus-based Ulen Holdings Ltd (OpenCorporates) also sold shares and now holds just over 18%.

- Dirk Jan Bakker and his companies Diman B.V. and Vancom Ventures Ltd have also sold shares and now hold a total of 13.6%.

The new shareholders are

- the Norwegian Jens J. Sundet,

- the Norwegian-Latvian RB Journalism SIA d/b/a Oddsen (www.oddsen.nu) as a sports betting site and

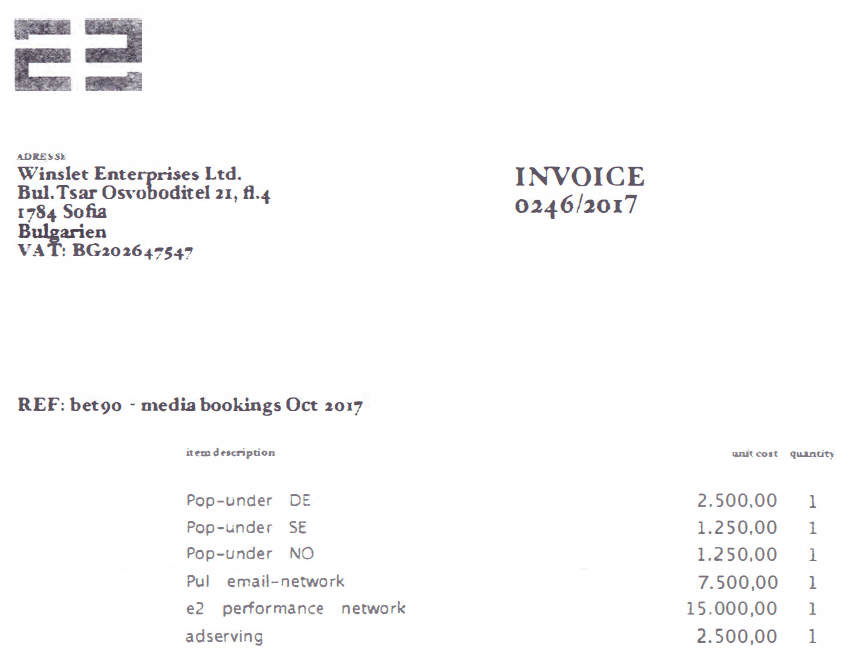

- Austrian E-2 Communications Ltd, owned by Leonard Vogel. E-2 has been doing business with Veltyco and its shadow organization Winslet Enterprises for years.

Oddsen and E-2 are the operators of affiliate and/or marketing systems and are supposed to provide corresponding services for Bet90 Holdings. In return, they have received upfront shares as prepaid affiliate fees. Oddsen will receive an upfront affiliate fee of €200,000, payable via 3,500,000 new Ordinary Shares; E-2 will receive €100,000, payable via 1,800,000 new Ordinary Shares. These Consideration Shares represent 5.2% of the Company’s existing issued share capital.

The victims’ claims

Investigations and indictments delayed by the COVID-19 pandemic have also meant that victims’ claims against Veltyco (now Bet90 Holdings) have not yet been filed. Elfriede Sixt, board member and founder of the European Fund Recovery Initiative (EFRI), comments:

The criminal files in Austria and Germany clearly prove that Veltyco facilitated the fraud via scams like Option888. Therefore, we will pursue civil and criminal claims against Veltyco and its officers. The name change to Bet90 Holdings and the change in shareholder structure does not change a thing.

Elfriede Sixt, EFRI

EFRI (www.efri.io) currently already represents more than 1,000 victims with total damage of more than 50 million euros. It remains to be seen how much of this will be claimed against Bet90 Holdings.

Stay tuned!