Moneta Markets (www.monetamarkets.com) is one of the numerous brokerage and trading brands of the Vantage Group. The website claims that Moneta Markets is operated by the offshore entity Vantage Global Limited in Vanuatu, which works with a financial dealer license from the Vanuatu Financial Services Commission (VFSC) with the number 700271. However, an offshore license like this does not entitle the licensee to engage in regulatory regimes in North America or Europe. Most recently, Vantage Group entered into a settlement with the Canadian regulator OSC because of their illegal offshore approach, and they continue to move on. Here is the review!

The Canadian compliance case

Vantage Group had offered investors in Ontario, Canada, to trade on the VantageFX platform through its Cayman Islands-registered offshore entity Vantage International Group Limited (VIG). Neither VIG nor Vantage Group had the required permission to offer financial services to Ontario consumers.

Please read our updated report on the Vantage Group here!

The VantageFX platform allowed retail investors to engage in leveraged trading from 100:1 to a maximum of 500:1 on various CFDs, the OSC states in the settlement. Under the ESMA regime, a maximum of 30:1 is permitted.

The Vantage Group was operating without authorization, violated Ontario securities laws, and earned CAD 3 million. As part of the settlement agreement with the OSC, Vantage Group agreed to pay an administrative penalty of CAD 600,000 and to disgorge USD 3 million. Vantage Group has also agreed to pay a further CAD 10,000 towards the cost of the OSC’s investigation.

The Moneta Markets compliance case

The approach of Moneta Markets is similar to the Canadian case except that it deploys the group’s offshore entity in Vanuatu. The broker, licensed by the offshore regulator VFSC, is not authorized to acquire clients in Europe and North America or to offer them regulated financial products in the first place.

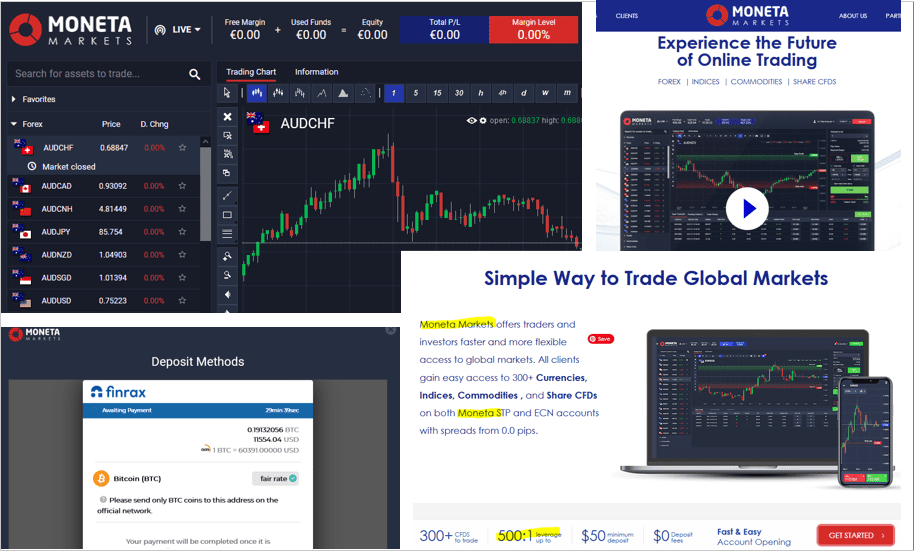

On its website, Moneta Markets offers leverage of up to 500:1. This is not allowed in the EU but it’s not the only violation of regulatory provisions.

In our review, we were able to register as a fictitious client from both the UK and the EU without any problems. Moreover, we could have deposited unlimited sums of money into the offshore entity Vantage International Group Limited’s bank account at National Bank Australia and at least €12,000 via credit and debit card and crypto deposits even before the proper KYC/AML review.

For credit and debit card processing, Moneta Markets works with Praxis Cashier and the crypto processing is done with the licensed Estonian Finrax (www.finrax.com).

Preliminary conclusion

Overall, the many brokers operated by Vantage Group appear to be deliberately operated within the network of FCA and ASCI regulated and offshore regulated firms in a joint effort approach. The websites of Moneta Markets, FXBit Mining, or VT Markets list all regulated firms without explicit explanations about other respective roles. In August 2021, the Spanish regulator CNMV already issued a warning against VT Markets (report here).

In our view, the Vantage Group approach is not compliant with the regulatory regime of ESMA or FCA. And we are pretty sure that this approach is also not compliant with the ASIC rulebook. The responsible regulators FCA and ASIC should take a closer look to protect their consumers.