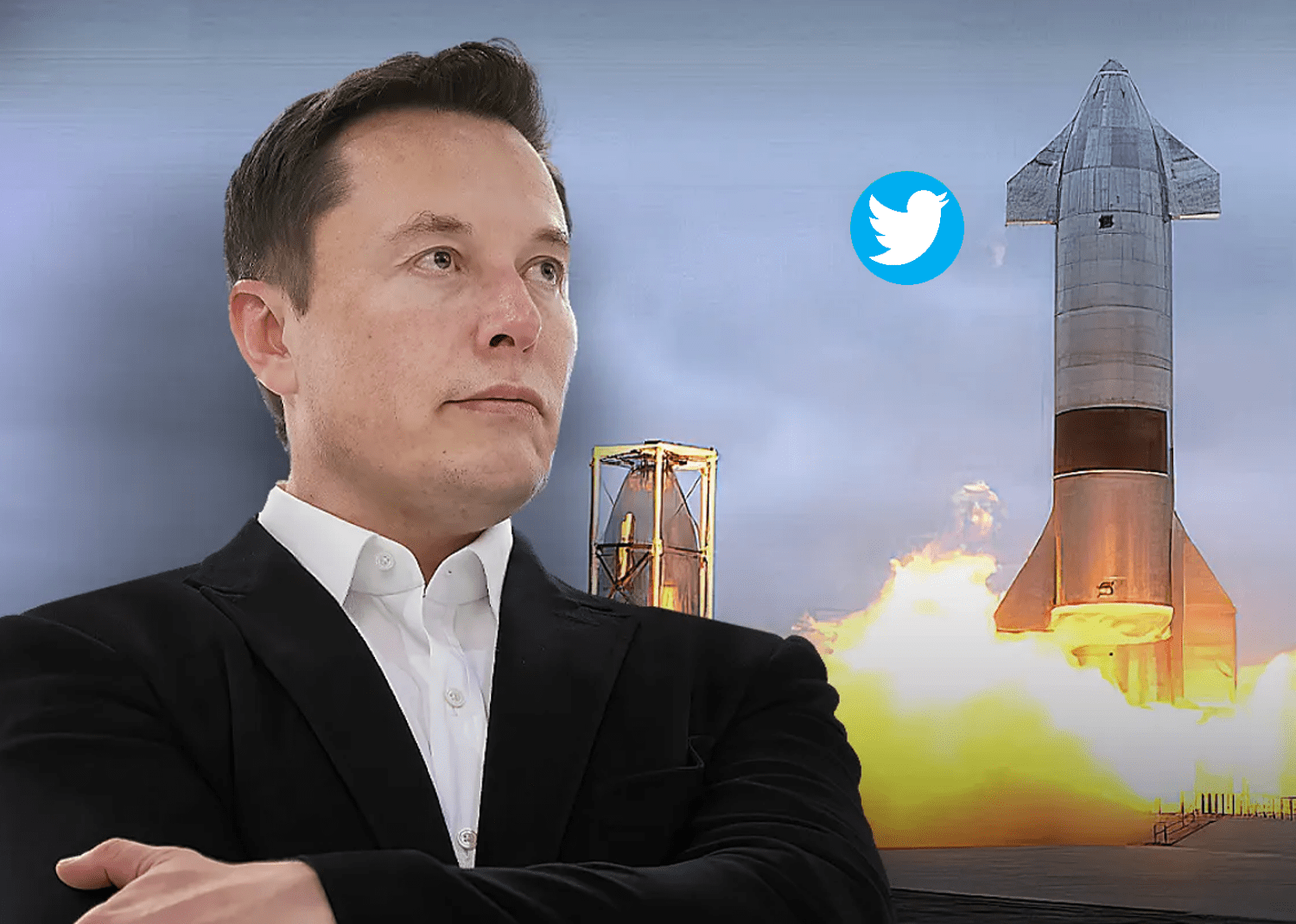

Twitter reported a surprising decline in revenue that the social-media company blamed on advertising weakness and uncertainty related to its pending $44 billion acquisition by Elon Musk. The company’s revenue fell to $1.18 billion from $1.19 billion a year ago and was below the average analyst estimate of $1.32 billion. It was Twitter’s biggest revenue miss ever. Despite the disappointing numbers, Twitter shares rose around 1% to close at $39.94 Friday.

However, Q2 average monetizable daily active usage (mDAU) increased 16.6% to 237.8 million compared to Q2 of the prior year. The increase was driven by ongoing product improvements and global conversation around current events.

The net loss was $270 million, representing a net margin of -23% compared to a net income of $66 million, a net margin of 6%, and diluted EPS of $0.08 in the same period last year.

Twitter‘s net cash provided by operating activities in the quarter was $30 million, compared to $382 million in the same period last year.

The company partially blamed the revenue drop on ad industry headwinds tied to the broader challenging macroeconomic environment, as well as “uncertainty related to the pending acquisition of Twitter by an affiliate of Elon Musk.” Given the pending acquisition by Musk, Twitter said it will not provide forward-looking guidance for the third quarter.