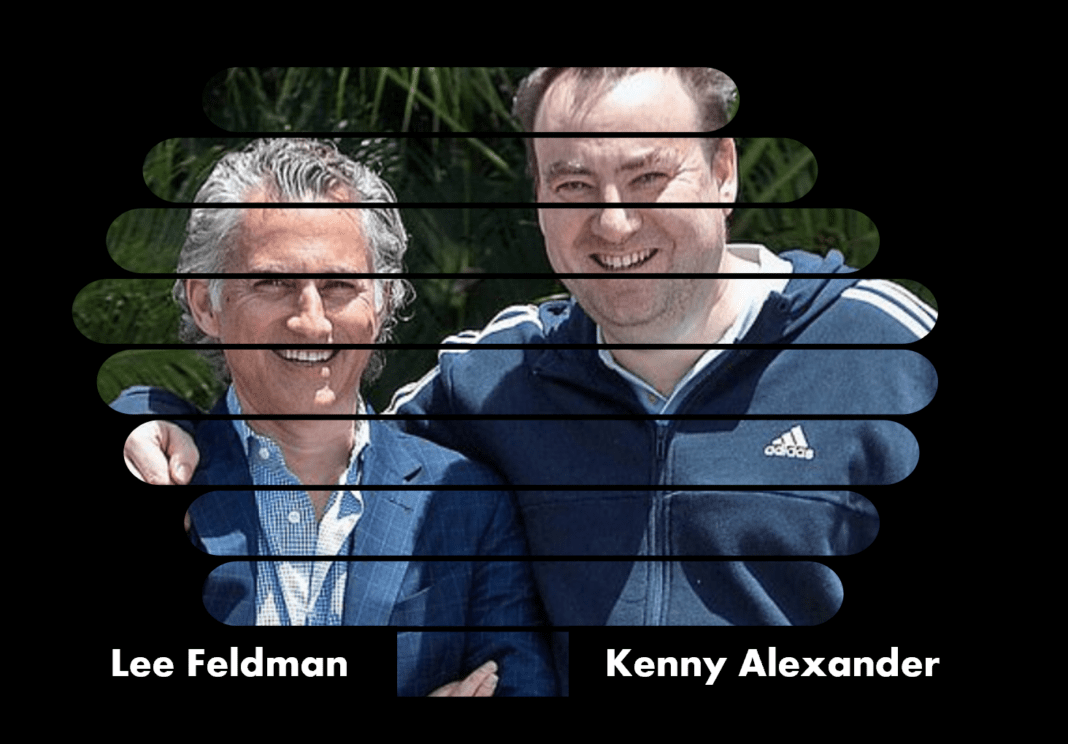

Two former senior gambling executives—Kenny Alexander (ex-Entain CEO) and Lee Feldman (ex-Entain chair)—have lost a civil case against the UK Gambling Commission after alleging the regulator misused private information and breached confidence during a licence-review episode linked to their attempted move into 888 Holdings. The ruling lands against the backdrop of a separate criminal prosecution in which both men are charged with bribery– and fraud-related conspiracies connected to gambling operations in Turkey.

Key facts

- Civil claim dismissed (19 Jan 2026): Mrs Justice Eady dismissed all claims and ordered the claimants to pay the Gambling Commission’s costs.

- Reasoning temporarily restricted: Reporting on aspects of the judge’s reasoning is subject to a temporary reporting restriction.

- Trigger event: The dispute stems from the Commission’s intervention around 888’s proposed leadership/control changes involving FS Gaming—linked to Alexander and Feldman—prompting a licence review risk that helped collapse the talks.

- Related criminal case: Alexander and Feldman are among 11 defendants charged (CPS) with conspiracy to bribe and conspiracy to defraud; trial is expected in 2028.

- Entain DPA context: Entain previously entered a Deferred Prosecution Agreement with the CPS over alleged Bribery Act failures tied to its legacy Turkish-facing business, involving £585m penalty/disgorgement plus £20m charitable donation and £10m costs (with “£615m” referenced as the discounted cash cost in company materials).

Court & Docket

Civil (privacy/confidence claim)

- Case: Feldman & Alexander v Gambling Commission (Media & Communications / King’s Bench context reported)

- Case ref (reported): KB-2024-003588

- Trial heard: 8–12 Dec 2025 (reported)

- Outcome (order/publicly reported): Claims dismissed; costs awarded to the Commission

- Reporting restriction: Temporary restriction affecting disclosure of reasoning/material linked to the criminal proceedings

Criminal (bribery/fraud conspiracies – Turkey-linked)

- Charging authority: Crown Prosecution Service (CPS)

- Charges (headline): Conspiracy to bribe; conspiracy to defraud (among others in the wider set of defendants)

- Next-stage venue (reported): Southwark Crown Court (post-initial appearance)

- Trial timing (reported): 2028

Case Background

Kenny Alexander and Lee Feldman—former chief executive and chair of Entain (the Ladbrokes/Coral owner) and now facing criminal charges alleging bribery and fraud—have also fought a separate battle in the civil courts after the UK Gambling Commission stepped into their attempted move to take control of 888. Their plan unravelled in 2023 when the regulator warned 888 that its gambling licence could be reviewed if the pair gained influence, citing concerns linked to an HMRC investigation into alleged bribery at Entain (reported as “Operation Incendiary”) and pressing 888 on whether the men had been interviewed under caution or treated as suspects.

888 publicly said it could not obtain “the most basic assurances” to address the regulator’s concerns, and the talks collapsed. Alexander and Feldman then sued, arguing that the Commission effectively breached their privacy and confidentiality by prompting a market statement that disclosed the licence-review risk and the reasons for it—an argument the court has now rejected.

Short analysis

This is a classic regulatory transparency vs reputational privacy collision—but with unusually high stakes because the regulator’s disclosures were tied to licensing objectives (who controls a licensed operator, and whether that control change is compatible with the public-interest regime). The civil claim attempted to reframe a fit-and-proper licensing response as a private-information breach—and the court has, at least at this stage, rejected it.

The more unsettling compliance signal sits inside the criminal allegations: conspiracy to defraud is described as targeting financial institutions or those performing financial monitoring/compliance functions by allegedly concealing the source of money from Turkish gambling activity. If proven, that is not merely “bad governance”; it is an allegation of active deception of the AML/CFT perimeter—the exact seam where banks, PSPs, auditors, and “second-line” controls are supposed to prevent tainted flows from becoming “clean”.

Finally, the temporary reporting restriction is itself a story: the public can see that a regulator won, but cannot fully see why—because the court is balancing open justice against potential prejudice to a future jury trial. This is legally orthodox, but operationally corrosive: it leaves markets with outcomes without reasoning—a vacuum that tends to be filled by PR narratives rather than compliance learning.

Call for information (Whistle42)

If you have first-hand compliance, audit, payments, or licensing intelligence connected to (a) 888’s 2023 licence-review episode, (b) due diligence conducted around FS Gaming’s proposed appointments, or (c) historic Turkey-facing gambling/payment structures tied to the Entain/GVC period—submit securely via Whistle42. We are specifically seeking documents on bank/PSP onboarding, transaction-monitoring overrides, third-party supplier flows, and governance sign-offs.