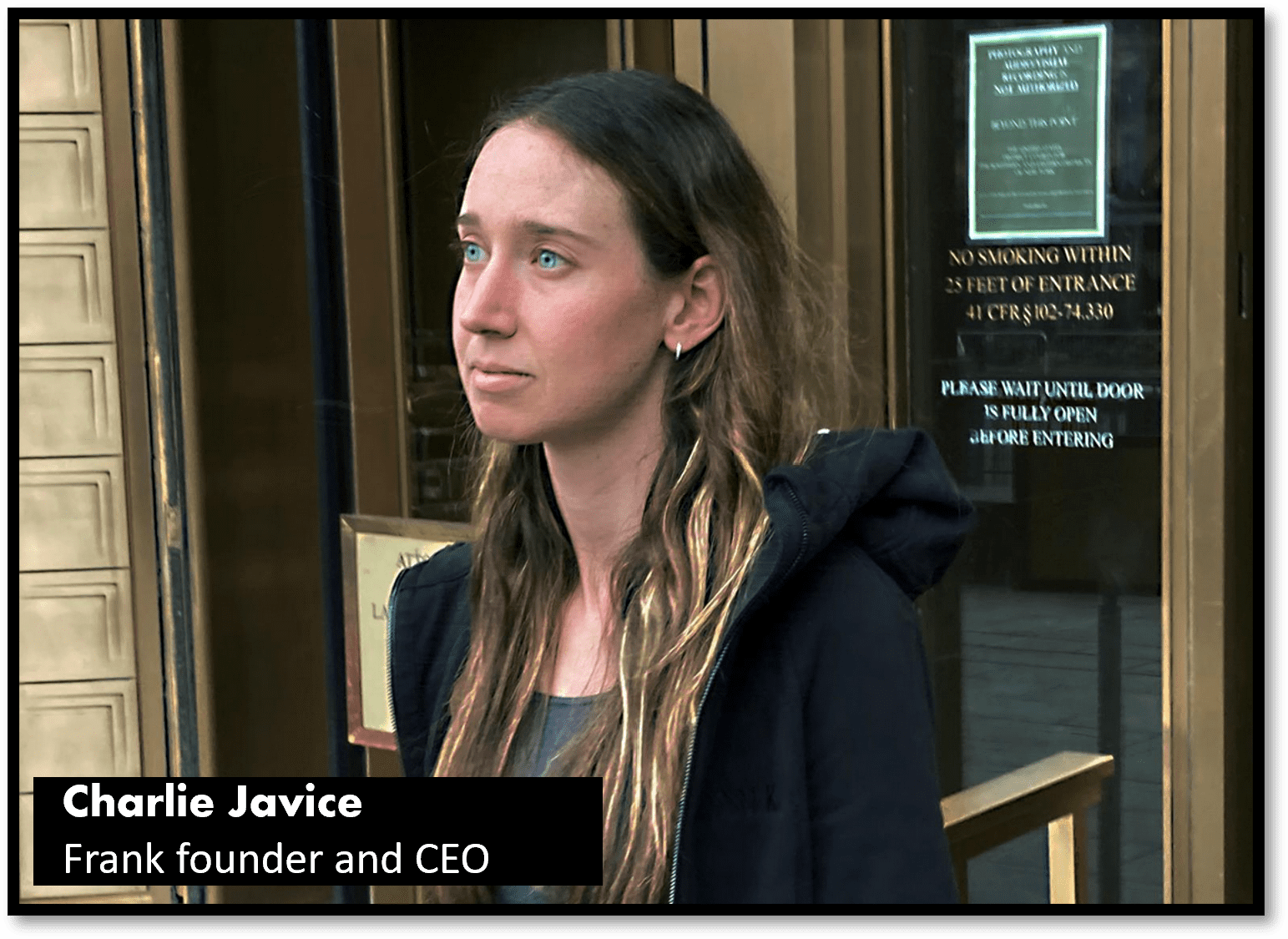

A wild startup story, indeed. Charlie Javice sold her startup Frank for $175 million. Allegedly, however, the number of users would have been inflated by more than 10-fold, JPMorgan claims in a lawsuit – and fired Javice. The U.S. DOJ has also charged Javice with the alleged $175 million fraud. A judge has ordered JPMorgan to bear the defense costs of Javice in response to the bank’s lawsuit as part of her agreement to sell Frank to the bank in 2021.

JPMorgan had agreed to acquire Frank, an online platform facilitating quick financial aid applications and enrollment in online college courses, for $175 million in late 2021. However, the bank filed a lawsuit against Javice last year, alleging that she had fabricated a substantial list of fictitious users to finalize the deal.

Javice initiated her own legal action against JPMorgan in a countermove, seeking to compel the bank to cover her legal expenses. Delaware Chancery Court Judge Kathaleen McCormick recently dismissed JPMorgan’s argument that Javice’s alleged fraud fell outside the scope of the merger agreement. The judge ruled that the bank is legally obligated to cover Javice’s legal fees. The ruling likely includes Javice’s defense in criminal fraud charges brought by federal prosecutors.

Furthermore, the court ruling also extends to covering the defense costs of Olivier Amar, Frank‘s chief growth officer, who is similarly accused of collaborating with Javice in soliciting a senior engineer to create the list of fictitious names.