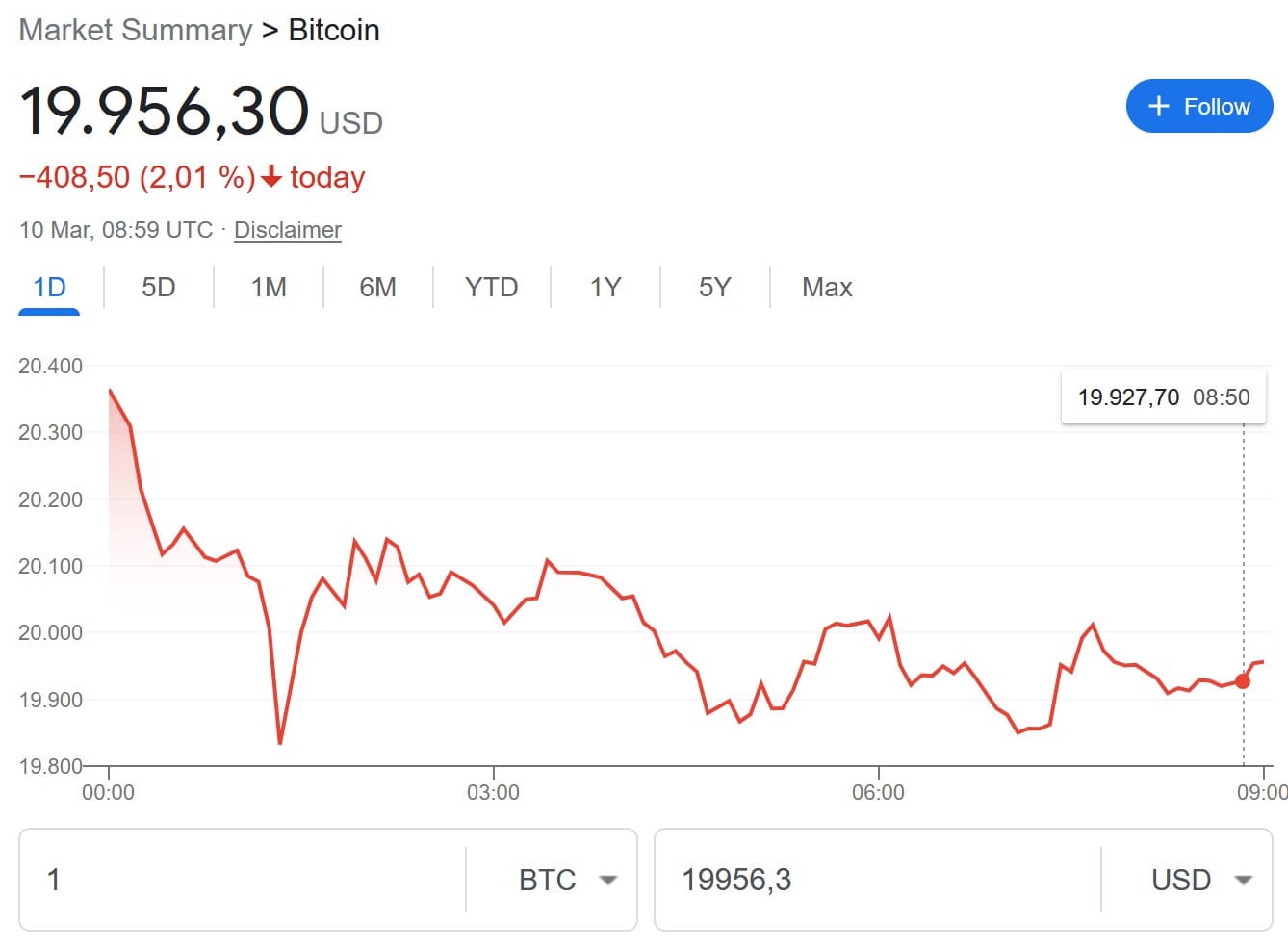

Bitcoin (BTC) is trading below $20.000, down more than 8% over the past 24 hours. Thus, the leading cryptocurrency saw about half its gains from a vibrant first six weeks of the year erased. The slump comes after the announcement of Silvergate Bank‘s liquidation and against the backdrop of rumors surrounding regulatory and legal actions against Binance and Ether. There are currently fears again that BTC could make a run south to $10,000. No environment for fainted hearts.

The bad mood in crypto markets also saw $307 million in crypto liquidations over the past 24 hours, according to Coinglass data. Bitcoin (BTC) traders suffered the heaviest losses, some $112 million, while ether (ETH) liquidations surpassed $73 million. Of the liquidated trading positions, some $282 million were longs, betting on higher prices, but investors of futures contracts still seem largely optimistic.

Not only the crypto segment saw a sell-off, but also U.S. bank stocks sent JPMorgan Chase and Bank of America down more than 5% and 6%, respectively. Stock futures inched lower Friday morning as investors look to upcoming job data for clues into how the Federal Reserve may move forward. The sell-off across the financial sector happened as investors grew increasingly concerned that higher interest rates would result in banks facing loan losses due to borrower defaults.