Guest post: Charles Cross is a financial expert who analyzes the financial market incredibly well. He works for the company ICOholder global analytics platform with the largest crypto database. Charles is more than sure that the best work is done quickly and accurately.

Personal finance can be challenging to understand. There’s planning and managing a personal budget, saving money, and cutting expenses, credit cards, investments, bank accounts, utility bills, loans, retirement plans, and insurance to consider. Even before the global pandemic, many people struggled financially, and today’s situation isn’t improving. According to the Federal Reserve, almost 40% of American adults could not cover a $400 emergency with cash or their savings.

Moreover, not everyone even has an emergency cushion to cover unexpected expenses. Financial literacy across the globe isn’t much better compared to the U.S. The impending economic downturn will only worsen matters, and people should be prepared. That’s why we offer you to check out some of the best finance blogs to learn useful skills.

What Are Some Basic Financial Skills?

You may be wondering what other skills, except math, you need, but there are quite a few helpful money skills. Moreover, it’s always a good idea to learn more about finance, and the statistics prove that.

Despite recent efforts to teach high school students basic financial skills before graduating, it’s not enough. A recent survey revealed that 65% of over 30,000 graduate from high school without taking a single personal finance course.

That’s why we created this article with the best finance blogs so that you can acquire a few important money skills. These skills include:

- Keeping a checkbook in order.

- Creating and managing a budget.

- Investing.

- Financial planning for the long term.

- Credit building and credit card management.

- Renting an apartment and covering bills.

All these skills help people manage their finances. Instead of mindlessly spending, you can learn how to spend wisely and earn passive income.

5 Best Personal Finance Blogs

Most people believe they have everything in order if they can cover their bills. However, proper budget management and good financial skills enable people to generate income from their funds and plan for the future. You can feel secure in your future today, but everything may change tomorrow.

Thus, we have prepared the top five best personal finance blogs so that you can improve your money skills, plan for the future, and learn about other useful financial aspects.

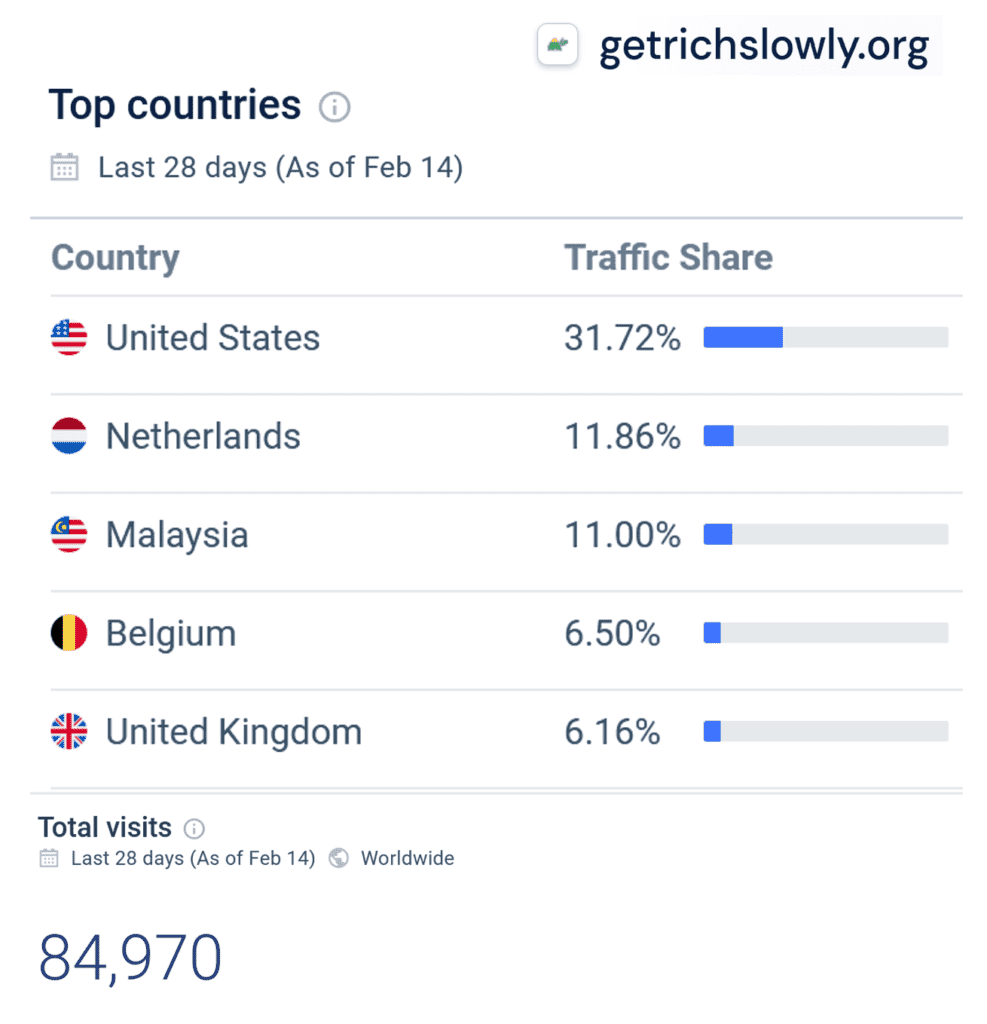

Get Rich Slowly

Get Rich Slowly (website), founded in 2006, is one of the first personal finance blogs. J.D. Roth accumulated over $35,000 in debt from personal loans, credit cards, and auto loans before becoming a financial expert. When he realized he was on the wrong track, he devised a strategy to pay off his debts. Yes, he achieved all his goals and now offers help to those who still struggle.

Thousands of articles on Get Rich Slowly are dedicated to improving people’s financial skills. Topics include how to make, save, and invest funds. Roth also discusses the mindset and how to cultivate a positive attitude toward finance. Roth’s blog also covers tools to help people manage their funds more effectively.

A Purple Life

A Purple Life (website) was founded in 2015 by a then-25-year-old blogger. The idea of her blog is that she wants to retire at the age of 35 (ten years after creating the blog). It’s an exciting concept and brings a lot of fun to the rather serious financial topic.

Despite the economic downturn after the global pandemic, she is still on track to retire when she reaches 35. You can check out her blog today since she’s supposed to reach her goal in two years.

A Purple Life blog articles are about early retirement, but there is also information about budgeting, investing, and spending. This blog about financial independence is personal, relatable, and a great source of inspiration.

Frugalwoods

Frugalwoods (website) was founded to assist people in making well-informed financial decisions to achieve financial stability and freedom. On the blog, you’ll learn how to save more money to achieve all your goals. The Frugalwoods blog teaches how to accumulate and use your savings to live the life you want.

The Frugalwoods blog’s content focuses on living a frugal lifestyle through homesteading. The Frugalwoods blog also covers real estate, travel, affordable home improvement hacks, retirement plans, investments, etc.

Inspired Budget

Allison Baggerly

The Inspired Budget (website) blog hints that it offers help in creating a personal or family budget. Allison Baggerly is the founder of Inspired Budget. Like the already mentioned Get Rich Slowly blog, the Inspired Budget offers tips from the founder’s personal experience.

Baggerly married while in debt that had six figures! She and her husband paid off the debt in five years. The blog reflects on the results and the entire process. Baggerly’s goal is to teach how to manage finances and achieve financial independence.

Modern Frugality

The Modern Frugality (website) strategy is to regulate your spending and then plan finances accordingly initially. The blog’s author, Jen Smith, and her husband paid off $78,000 of debt in two years, so she talks from personal experience.

Once you open the home page, you have to complete a short challenge. After its completion, proceed to one of two broad blog posts based on your financial goals: saving money or paying off debt.

Final Thoughts

If you check out these five blogs, people can easily find articles on almost any topic. Countless blog articles cover any data or topic you require. Whether you’re new to managing your finances or looking for new ways to grow your wealth, these top five blogs will help you reach your goals.