On Day 3 of the Wirecard Trial, the prosecution’s key witness, Oliver Bellenhaus, is called to testify. The former director of the Wirecard business in Dubai speaks quietly and extremely quickly. He wants to get his testimony over with as quickly as possible and avoids any eye contact. In essence, he confirms what he has already said during the questioning at the public prosecutor’s office. The TPA system was a big fraud, audit data was faked, and Wirecard was a cancer, Bellenhaus told the court.

Organized Crime And The Emperor

Oliver Bellenhaus described Wirecard as a system of organized fraud in which former CEO Markus Braun ruled in an absolutist manner. Braun and Bellenhaus have both been in custody for two and a half years.

Braun sees himself as a victim, and that is a familiar pattern, Bellenhaus said of his former boss. Blind loyalty to Braun and former Chief Sales Officer Jan Marsalek, who has been on the run for two and a half years, caused him to break the law and go to jail, he said.

The 49-year-old Oliver Bellenhaus, who led a Dubai-based business at the heart of the alleged fraud, apologised for his own role in the multiyear deception.

The Limited Indictment

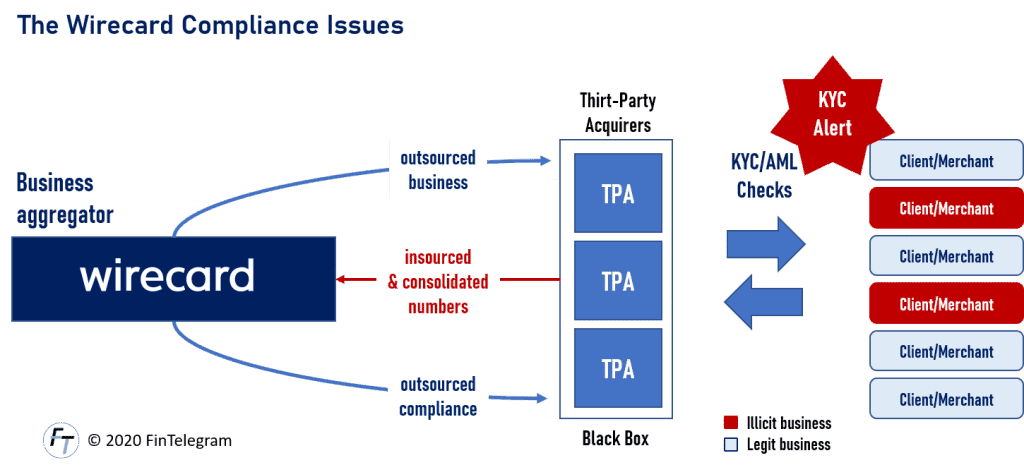

The prosecution has made it clear that only three very specific TPA partners, Al Alam, Senjo, PayEasy, are the subject of the indictment. It is only with regard to these that the accusation is made that trust balances were accounted for when in fact they never existed. This is quite a remarkable shortening of the view by the prosecution.

Non-Existing TPA Business

The third-party acquirer (TPA) system never existed, Oliver Bellenhaus said. The major TPA partners, such as Senjo and Al Alam, had been unofficially controlled by Wirecard employees since 2012, Bellenhaus says. The money coming into the TPA Parter accounts came from Wirecard itself or from the partners themselves. They could not be attributed to the TPA business, Bellenhaus says.

Wirecard often bought customer bases that were moved to third-party partners to document sales, Bellenhaus says. This statement is certainly true. Wirecard was acquired in 2007 by Dietmar Knoechelmann via Ireland Trustpay or Gateway Payment from which Wirecard Ireland was formed. The main focus was on payment volumes from the gaming sector in the US and Europe. Knoechelmann was subsequently appointed CEO of Wirecard Payment Solutions, but in parallel built up a shadow structure around his PowerCash21 and Inatec. A TPA system, in other words.

Read more about the beginnings of Wirecard’s international business.

Bellenhaus told the court, that the escrow accounts would have served the sole purpose of faking billions in profits. Wirecard had, after all, said at the time that the money was to be kept for any default payments. But that would not have been necessary at all, says Bellenhaus.

Faked Data

Bellenhaus told the court that each quarter he was briefed by Von Erffa about the amounts needed to offset the gap between the group’s internal targets and the performance of Wirecard’s real operations. Bellenhaus said that he created seperate IT systems for the fake TPA system in Dubai and Asia.

The data for the KPMG special audit would have been falsified. He says he, Jan Marsalek and von Erffa came to the conclusion that the data should have been created for the entire audit period. Marsalek and two associates would have built the data. Marsalek had decided to manipulate transaction data for the year 2018.

Markus Braun would be the main perpetrator, the accused former chief accountant Stephan von Erffa the accomplice who would lie shamelessly to save himself.

The presiding judge Markus Foedisch informed on Monday that the court would need more time to decide on Braun’s motion to dismiss the trial. Should the motion be rejected, Braun would probably give testimony “in the second half of January”.

Preliminary Conclusion

Oliver Bellenhaus, like Braun, was a Wirecard veteran and was involved from the very beginning. He knew the system from the beginning. Bellenhaus portrays himself (like Braun) as a victim of his blind loyalty that would have led him to participate in the fraud scheme.

Bellenhaus’ statements on day #3 of the Wirecard Trial seem contradictory. On the one hand he says that customer bases were bought and moved to TPA partners. On the other hand, he says that there was no TPA business at all. He also states that the Wirecard system was created in the period before 2015 whereas the indictment focuses on the period after 2015 and only on the three big TPA partners in Dubai. This seems to be a questionable strategy of the prosecution.