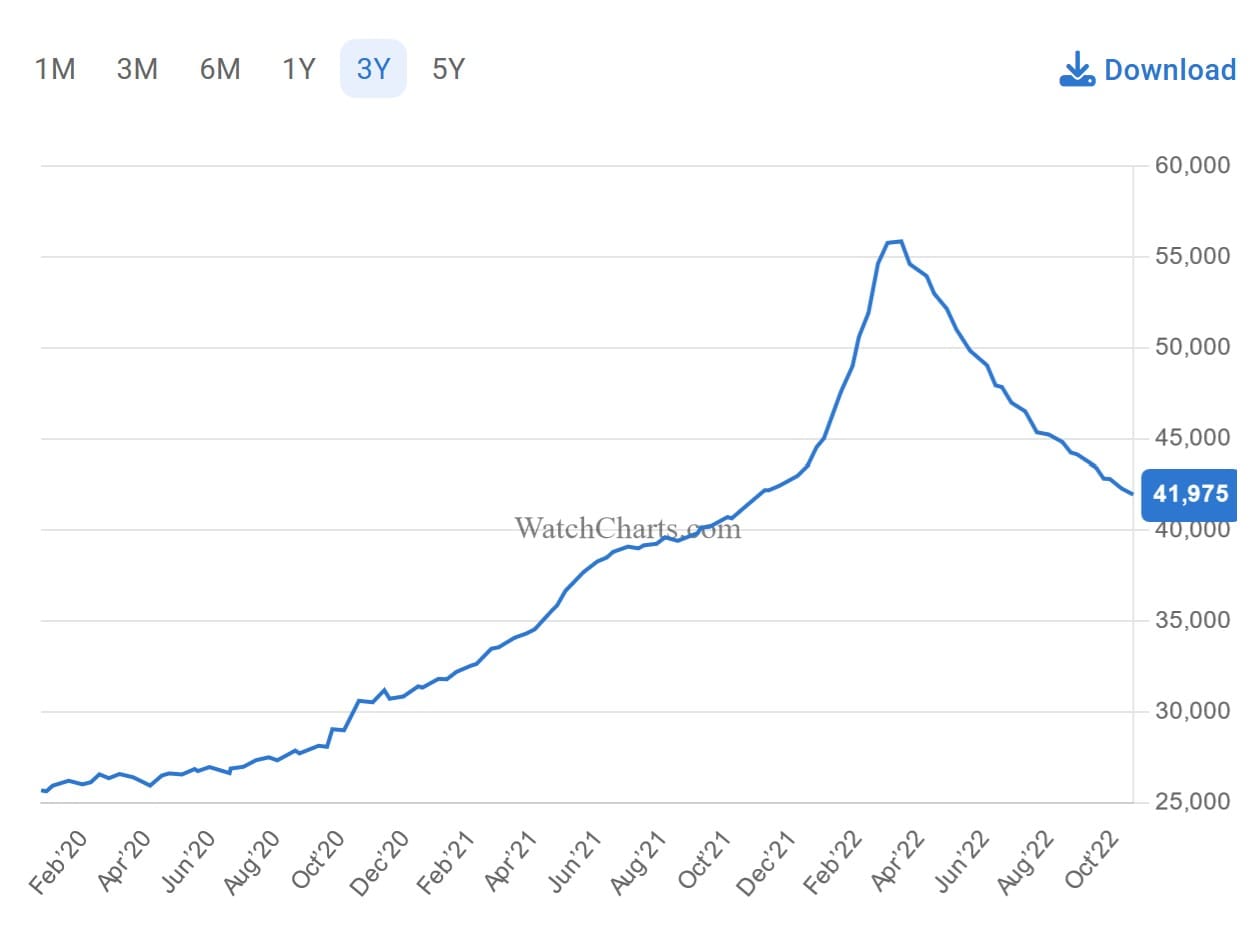

The era of cheap money is over! Inflation is hitting the markets! Stock markets have noticed this, as have the cryptos. In times of rising interest rates and restrictive monetary policy, investors withdraw from speculative markets. In Q2/Q3 2022, the market for luxury watches was flooded with supply. The WatchChart Overall Market Index for the secondary market of luxury watches has slumped by almost 25% since its peak in March 2022 and has fallen back to the level of October 2021.

The Nasdaq index has lost almost 30% since the beginning of the year, and the crypto lead currency, Bitcoin (BTC), lost more than 50%. Apparently, investors are now also withdrawing from the luxury watch market, which, after a rise in Q1, also lost around 25% in Q2 and Q3. A Morgan Stanley report says that prices for the most popular pre-owned Rolex, Patek Philippe, or Audemars Piguet watches continue to fall further as the market is flooded with supply.

Morgan Stanley advises investors that the decline in prices on the secondary market will continue into Q4, but adds, “There is, for now, no cause for alarm for three key reasons. First, nearly all asset classes are down so far this year but the market for second hand watches is actually down less in comparison to others. Second, relative to history, second hand prices are currently at a healthy level vs. the prices of new watches. Lastly, price contraction has been (so far) very orderly considering the dramatic increase in supply — a function of the fact that demand has remained strong.”