In March 2022, the Russian-controlled Estonian crypto payment processor Garantex Europe OÜ had to surrender its crypto license for money laundering issues. It allegedly processed more than €5 billion annually, primarily for merchants from Russia and other high-risk countries. The U.S. Department of Treasury sanctioned Garantex but they seem unimpressed. Their business seems to boom, and Garantex founder Sergey Mendeleev announced a new DeFi venture.

Key Data

| Trading name | Garantex |

| Business activity | Crypto exchange |

| Domain | https://garantex.io |

| Legal entity | Kihonzi Buzhaga OÜ |

| Related individuals | Sergey Mendeleev, co-founder Raul Pint (nominee director) Pier Kampor, Russia (LinkedIn) Evgenia Burova, Russia (LinkedIn) Vladimir Yelenskiy, Russia (LinkedIn) Vladislav Rychagov, Russia (LinkedIn) Alexander Lebedev, Russia |

| Jurisdictions | Estonia, Russia |

| Regulator | FIU Estonia |

| License status | surrendered in March 2022 |

U.S. Sanctions Against Garantex

According to the U.S. Department of Treasury, an analysis of Garantex transactions exposed more than $100 million in transactions are associated with illicit actors and darknet markets, including nearly $6 million from the Russian Ransomware-as-a-Software (RaaS) gangs Conti and also including approximately $2.6 million from the Russian darknet marketplace Hydra.

While Garantex was sanctioned by the U.S. authorities, its co-founder Sergey Mendeleev just recently announced that he launched the decentralized finance (DeFi) venture InDeFi together with Alexander Lebedev, the former owner of Russia’s National Standard Bank and publisher of U.K. newspapers The Independent and Evening Standard.

Read our initial report on Garantex here.

Still The Old Operator

The Terms and Conditions of Garantex as of 1 June 2022 still state Garantex Europe OÜ as the operator and Estonia as the applicable jurisdiction. In fact, the crypto company’s offices are likely to be in Russia. Garantex claims to be the only exchange with no fee for depositing or withdrawing cash rubles. They allegedly operate in all major cities of Russia. BTC, USDT, and RUB are available for exchange.

However, the business became a bit more complex for Garantex. Deposits in FIAT (USD, EUR, RUB) are only possible indirectly via other crypto exchanges like Binance or the P2P marketplace of Garantex, where users can trade codes (“Garantex Codes“) for top-up and withdrawal with other participants and also pay via bank or e-wallets like AdvCash or Payeer.

The support of the customers takes place via various Telegram channels.

Kihonzi Buzhaga OÜ (prev. Garantex Europe OÜ) is doing business as Garantex (https://garantex.io). Raul Pint is the company’s nominee director. The Estonian entity was authorized to provide virtual currency services between 27 November 2020 and 24 February 2022. On its website, it presented Russian phone numbers for contact purposes.

The Exploding Russian Business

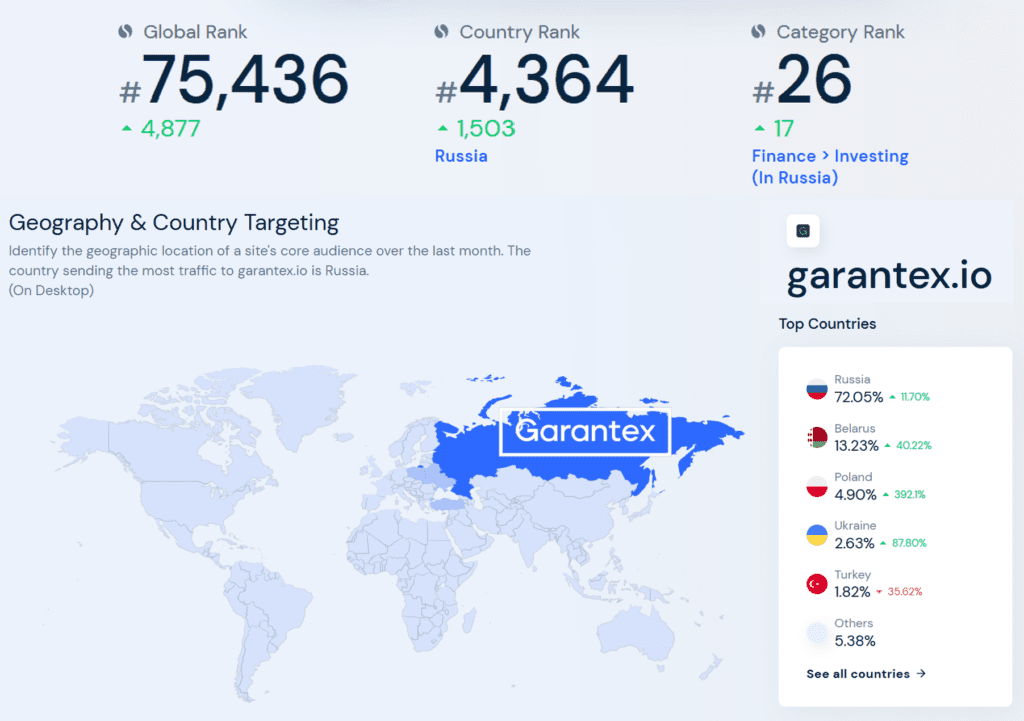

Garantex continues to be a very busy crypto exchange with impressive growth rates considering the Western sanctions. Similarweb lists it at #75,436 in Global Rank (August 2022), and in Russia, it is #4,364. More than 85% of the website’s visitors came from sanctioned Russia and Belarus in August.

Share Information

If you have any information about Garantex, its operators, and partners, please let us know through our whistleblower system, Whistle42.