A few months ago, the Maltese Arbiter for Financial Services ruled that MFSA-regulated Calamatta Cuschieri Investments Services Limited is guilty of not meeting the relevant obligations. The detailed decision describes how an investor lost more than €100,000 through investments that were suggested to him by Malta’s Calamatta Cushieri Investments Services. The company appealed the fine, but on 1st July 2022, the Maltese Courts, through Judge Lawrence Mintoff, confirmed the Arbiter’s decision.

Calamatta Cuschieri was found guilty of negligence and did not act in the client’s best interest. The Judge, in his judgment, ruled that Calamatta Cuschieri Investments Services Limited was guilty of serious and glaring shortcomings. The investment advice given by Calamatta Cuschieri was not suitable for the client, who suffered a loss of around €100,000.

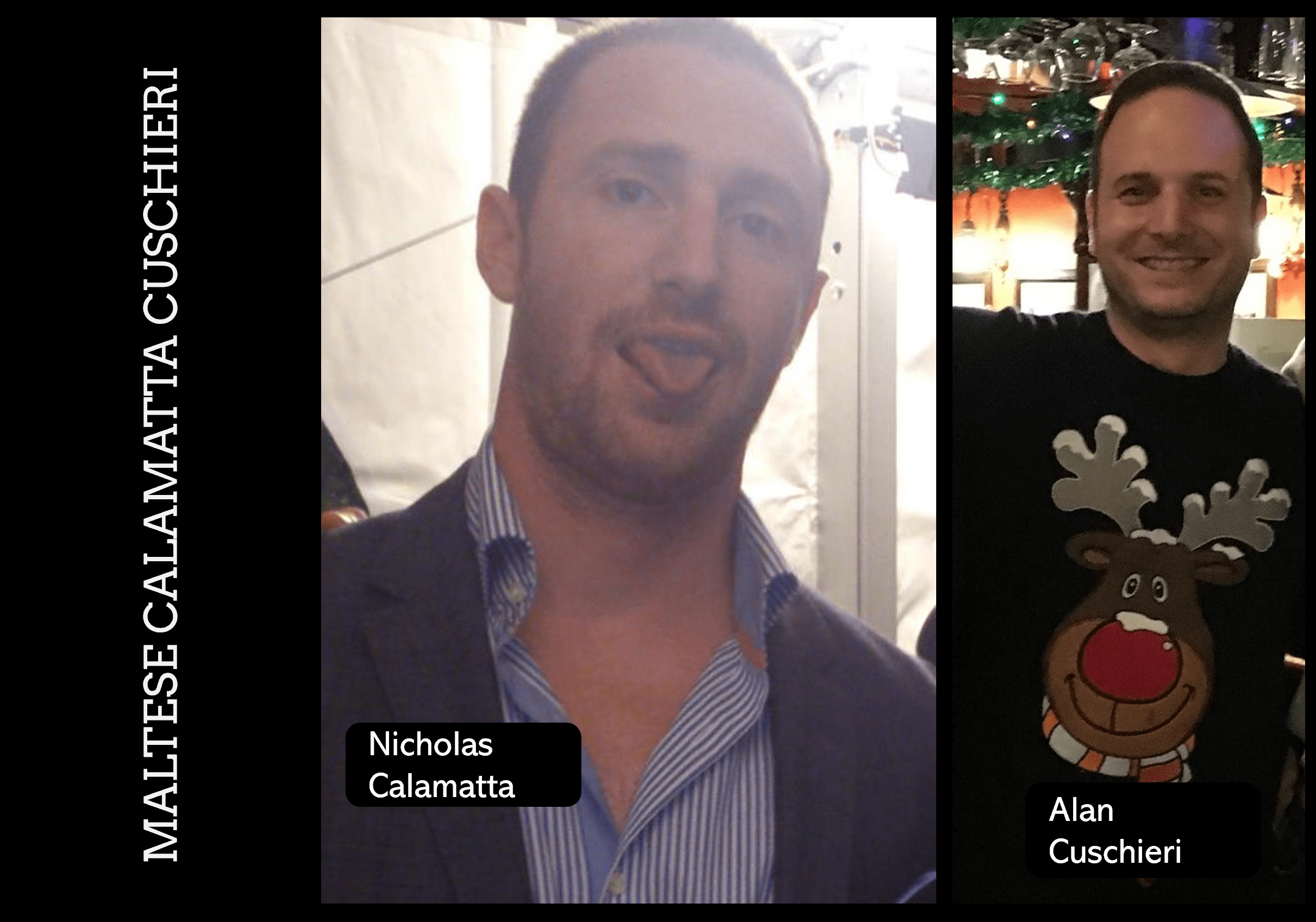

The directors of the company include Alan Cuschieri, Michael Galea, and Nicholas Calamatta. The company’s secretary is Kari Pisani, who previously worked at Sparkasse Bank Malta, which bank was fined hundreds of thousands of euros for serious AML issues.

The Judge confirmed that the MFSA-regulated firm did not meet the relevant obligations. This is particularly so with respect to the aspects involving the Complainant’s ‘investment objectives, including risk tolerance.

Alan Cuschieri, Michael Galea, and Nicholas Calamatta are also directors in a company named Moneybase Limited, for which MFSA has recently awarded a license. Andrew J. Zammit of GVZH Advocates is also a director of this company. Funnily enough, GVZH Advocates act as lawyers for the MFSA in court cases. One wonders how the MFSA can dish out direct orders to GVZH Advocates while overseeing their operations or that of its members in companies like Moneybase Limited and sister companies like Calamatta Cuschieri Investments Services Limited.

Calamatta Cuschieri made the headlines recently after a shocking testimony in courts whereby a witness with a criminal past revealed that he was or still is a client of Calamatta Cuschieri and withdrew half a million euros in cash from this MFSA licensed company. FinTelegram sent questions to the FIAU and the Maltese authorities about this possible money laundering transaction but has so far remained unanswered.

The company is licensed by the MFSA, including Michelle Mizzi Buontempo, Edwina Licari, and Christopher Buttigieg. The MFSA has been harshly criticized for reaching secret settlements with selected Maltese licensed firms. These MFSA officials do not declare their conflicts of interest.