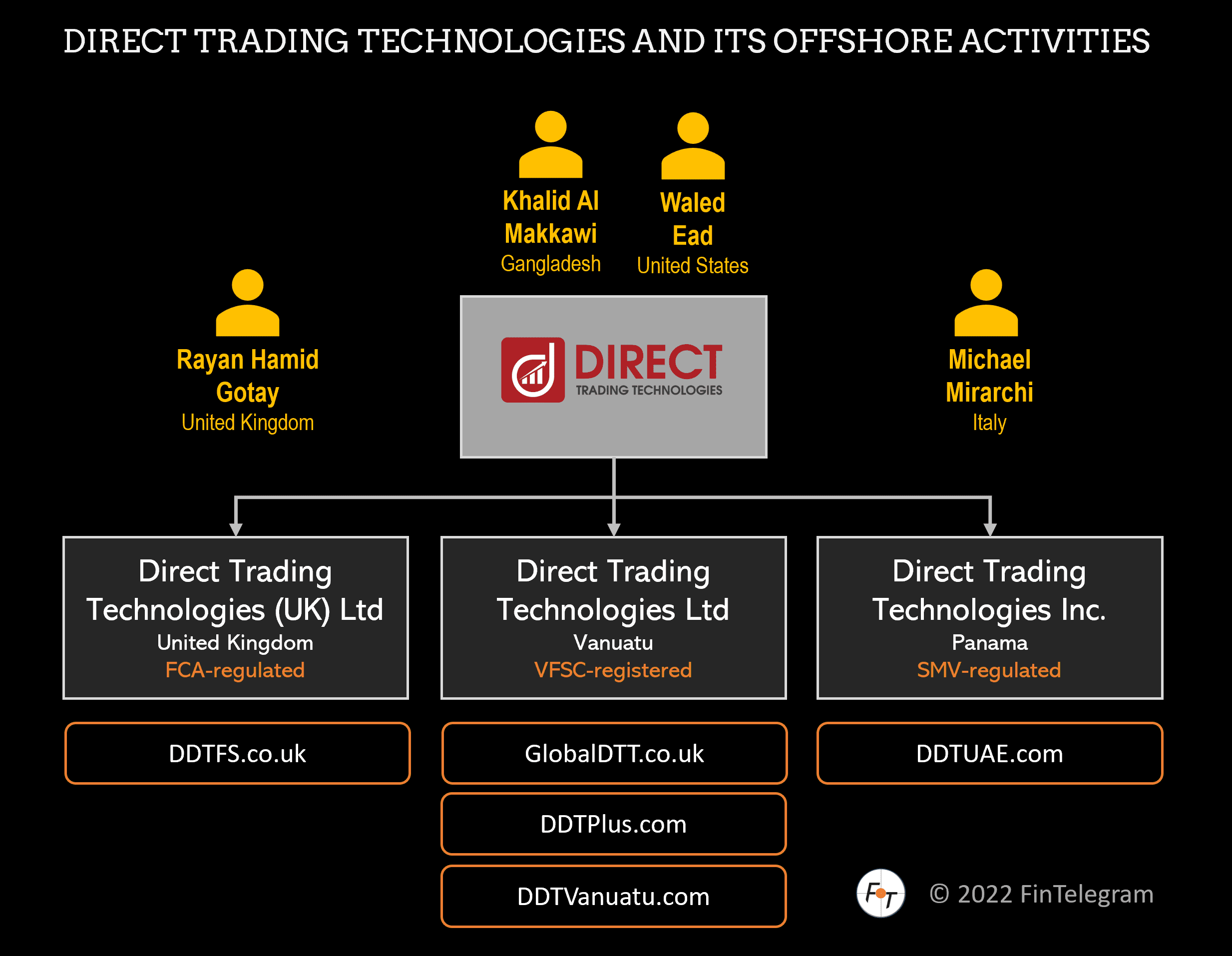

Direct Trading Technologies (UK) Ltd d/b/a Direct TT is an investment firm regulated by the UK Financial Conduct Authority (FCA), which officially operates with a UK domain. In addition, there are Direct Trading Technologies offshore entities in Vanuatu and Panama that also operate an unauthorized broker platform soliciting clients in Europe and across the globe. The Spanish regulator CNMV has issued a warning against these offshore mutations. We advise caution when dealing with offshore broker activities.

Key Data

| Trading names | Direct Trading Technologies Direct TT Global DTT DTT Markets |

| Domains | www.dttfs.co.uk www.globaldtt.com https://dttplus.com https://www.dttuae.com www.dttvanuatu.com |

| Social media | Facebook, Twitter, Instagram |

| Legal entities | Direct Trading Technologies LTD (Vanuatu) Direct Trading Technologies (UK) Ltd (UK) Direct Trading Technologies Inc. (Panama) |

| Related individuals | Michael Mirarchi (Italian) Rayan Goutay (UK) Khalid Al Makkawi (Bangladesh) Waled Ead a/k/a Walid Eid (US) |

| Jurisdiction | United Kingdom Vanuatu |

| Regulator | UK FCA with reference no 795892 |

| Contact data | +44 20 3059 7765 |

| Payment options | Bank wire Credit and debit card USDT (Tether) |

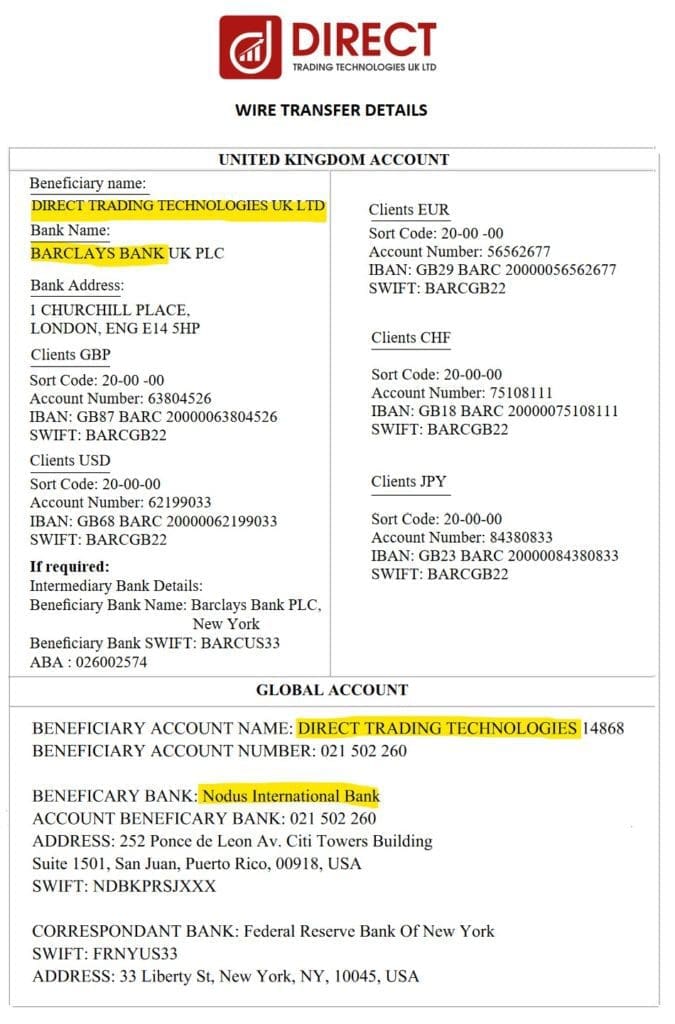

| Payment processors | Barclays Nodus International Bank |

| Maximum leverage | 1:200 |

| Warnings | CNMV |

Short Narrative

The directors of the FCA-regulated Direct TT entity are Italian Michael Mirarchi and the Brit Rayan Goutay. The beneficial owners are Bangladeshi Khalid Al Makkawi, who lives in Saudi Arabia, and American Waled Ead a/k/a Walid Eid, who lives in Lebanon. The latter is also the founder of the offshore entity in Vanuatu.

Direct Trading Technologies‘ unauthorized offshore brokers use the same bank account at Barclays for bank transfers. In addition, the Vanuatu entity also uses a bank account with Nodus International Bank in Puerto Rico, USA. Deposits are also possible with the USDT (Tether) stablecoin.

In our review on May 31, 2022, we had no problem registering as EU or UK residents with the offshore entities. After that, we could theoretically make pre-KYC deposits in unlimited amounts via bank transfer or USDT. At the time of our simulated deposits neither our address nor our ID was uploaded. While FCA, ESMA and most other regulatory regimes provide a maximum leverage of 1:30 for retail clients for CFD, Forex or Crypto, for example, Direct Trading Technologies offers up to 1:200 for offshore clients.

Offshore Warning

We know that a lot of UK or EU regulated brokers use offshore onboarding to systematically circumvent the regulatory requirements of the FCA or ESMA. These clients actually provide for the profits of the brokers, because the operation of these offshore brokers is very cheap and practically without supervision.

Clients of offshore brokers have no Financial Ombudsman protection and no right to payments from Investor Compensation Funds. They should stay far away! Rather go to the casino if you want to gamble with high risk.

Share Information

If you have information about Direct Trading Technologies, GlobalDTT, DTT Markets, Direct TT, its operators, and facilitators, please share it with us through our whistleblower system, Whistle42.