Whistleblower Credits: We would like to thank our whistleblowers for their reports and insights, which help us expose scammers and their payment processors. Together we can make a difference in cyberspace. Together we are an invincible force.

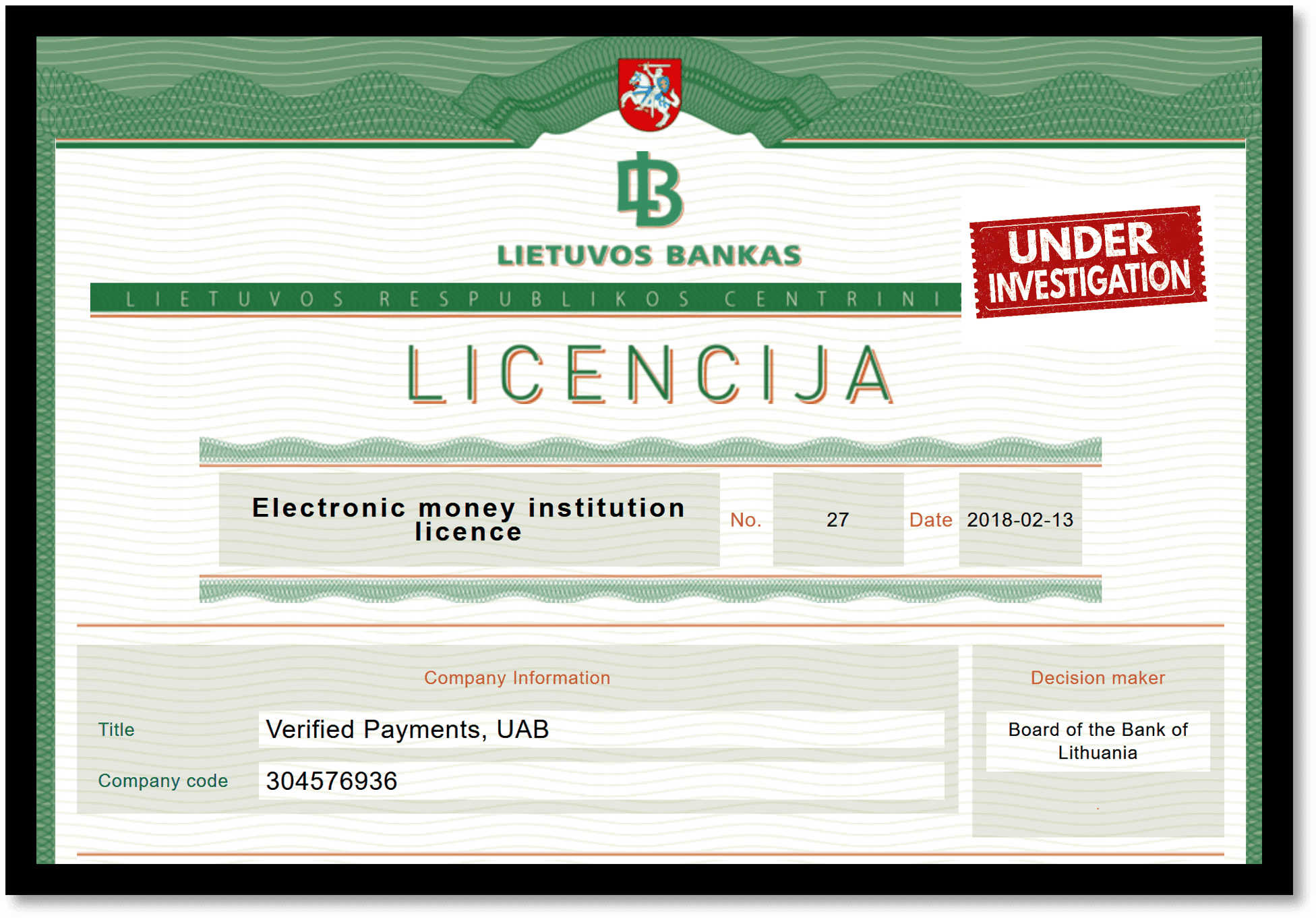

On April 20, 2022, the Bank of Lithuania notified the e-Money Institution (EMI) Verified Payments UAB d/b/a Verifo (www.verifo.com), regulated by license no. 27, of an audit to be conducted during the period from May 6 to June 23, 2022. The purpose of the audit is to assess EMI’s compliance with applicable anti-money laundering and terrorist financing requirements. In addition to the online banking platform Verifo, EMI also operates a white-label banking solution to leverage its license.

Short narrative

Insiders alerted us a few weeks ago that there were alleged problems with Verified Payments paying attention to money laundering and supporting questionable transactions. Allegedly, Verified Payments is targeting companies and individuals that want to enter the payments processing business and offer a ‘shortcut’ to the standard EMI agent registration. They charge between €20,000 and €35,000 upfront promising a white label that can go live in 1-2 weeks. They also offer very fast onboarding for merchants. We have heard that several complaints were filed at the Bank of Lithuania.

Until sometime in 2021, Verified Payments cooperated with UK-based Payecards (www.payecards.com) but evidently, they ended their cooperation. Please read our report here. Payecards currently works with Paypugs Ltd, an EMI and PSD agent regulated by the UK FCA, to provide banking services to its clients.

We have no way to verify any complaints or their very existence. It remains to be seen what the Bank of Lithuania‘s audit will find.

Share information

If you have any information about Verified Payments, its operators, and partners, please let us know via our whistleblower system, Whistle42.