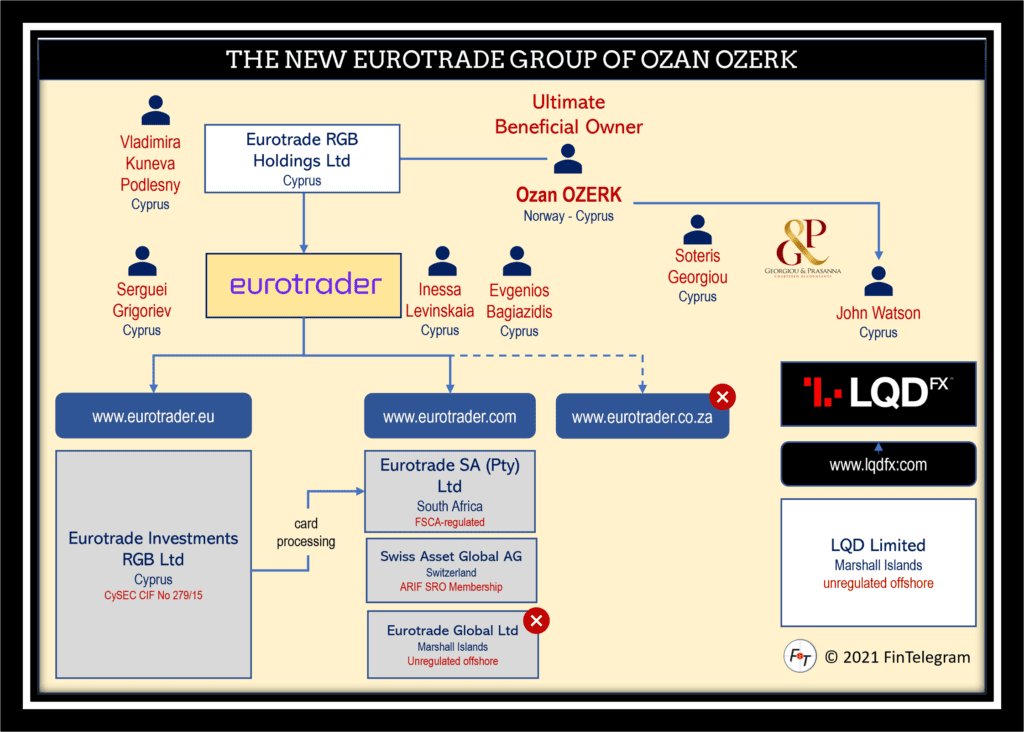

Self-proclaimed FinTech guru Dr. Ozan Ozerk controls EuroTrader Group and its twin scheme LQDFX. Eurotrade Investments RGB Ltd d/b/a EuroTrader with the approved domain www.eurotrader.eu is a CySEC-regulated investment firm (CIF) with license number 279/15. Through the license passporting scheme, EuroTrader can offer its services in other EU regulatory regimes. Eurotrade SA (Pty) Ltd, registered and regulated in South Africa, on the other hand, is not allowed to offer regulated financial services in the EU. However, it does but its bonus program is a joke!

We have already reported many times about CySEC-regulated CIFs attacking EU consumers via offshore companies with offers that are not compliant. The EuroTrader Group is no exemption and also applies this offshore approach.

Regulatory violations

First things first. The EuroTrader Group‘s regulatory violations start with its South African subsidiary Eurotrade SA (Pty) Ltd being active in the EU and soliciting investments from EU citizens. The license in South Africa does not entitle the company to offer regulated financial services in the EU. Rather, the South African entity is used to circumvent EU regulations.

The regulatory violation that follows suit is that the offshore entity has not implemented proper KYC/AML procedures. In our review, we would have been able to make deposits of over €20,000 via credit or debit card before completing the KYC/AML process. There is no restriction in terms of amount, nor is there any indication of this. At this point in our review, not even our email address was confirmed.

A bogus bonus program

Lastly, we looked at the 111% Deposit Bonus Program a/k/a Funded Trading Program offered. In our opinion, this bonus program is a trap; or you may call it a motivation to invest if you please. EuroTrader promises to pay a 111% bonus on all deposits up to €22,200. However, the bonus is not credited to your trading account but is only “added to the client area.” First, the client must make numerous trades, and then the bonus will be released for trading only under further restrictions.

If the clients’ trades with their original deposits result in profits, they cannot withdraw these profits or parts of them. Otherwise, the bonus is forfeited in whole or in part to the extent of the withdrawal. EuroTrader calls this an “early profit withdrawal.” Moreover, EuroTrader reserves the right to cancel the 111% deposit bonus without prior notice. They strongly recommend that you refrain from factoring in the bonus when calculating the profitability of your trading strategy. We call the 111% bonus a lousy joke. It sounds promising but is used to trap clients.

As written in our previous reviews, in our opinion, the methods of EuroTrader Group through its offshore companies are not compatible with ESMA or CySEC rules, and the bonus offers are rather a trap. Do yourself a favor and stay away.