Amsterdam FinTech entrepreneur Rudolf Booker founded the payment processor Payvision in 2002 and ran it more or less successfully. The business evidently took off in 2015 when Amsterdam real estate investor Dirk-Jan Bakker introduced German cybercrime activist Uwe Lenhoff to Booker. Lenhoff and his partners brought dozens of fraudulent binary options operators to Payvision, where Booker welcomed them with open arms. In 2018, Booker sold Payvision to ING for €360 million, fully packed with high-risk and illegal clients; in April 2020, he and his co-founders left Payvision.

A mysterious death in prison

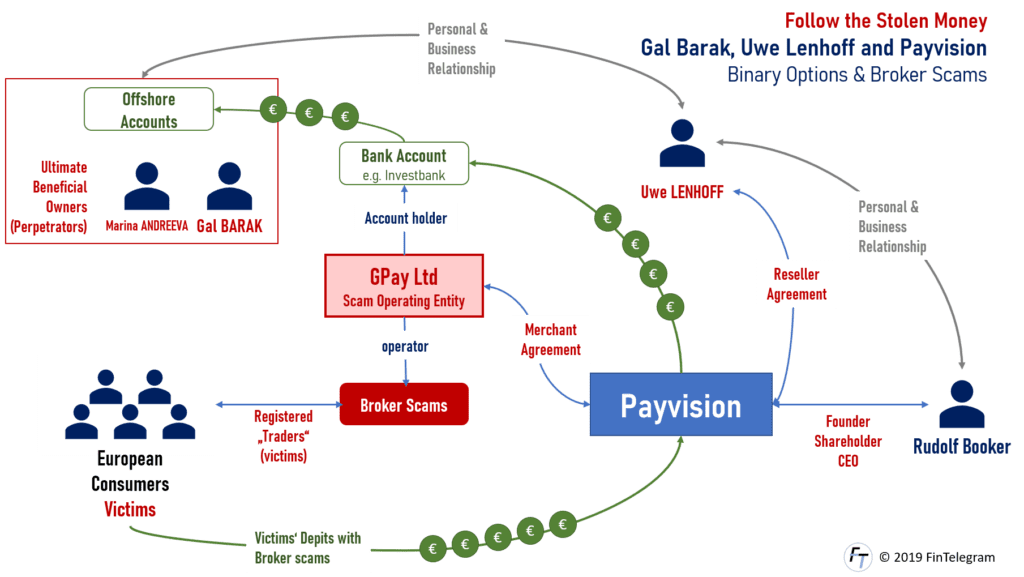

Payvision clients Uwe Lenhoff and Gal Barak were arrested in early 2019. While Barak was sentenced to 4 years in prison for investment fraud and money laundering in September 2020, Lenhoff died in prison in summer 2020. Cause of death unknown, authorities say. In Lenhoff and Barak’s criminal case, Booker and Payvision play an important role as cybercrime facilitators.

The German online veteran Uwe Lenhoff was introduced to Rudolf Booker by real estate investor Dirk-Jan “DJ” Bakker. The latter was already a partner at Lenhoff at the time and co-financed its cyber activities. To FinTelegram, Bakker claimed that the criminal nature of Lenhoff’s activities only became evident later in their partnership. That may or may not be true. In any case, Bakker and Booker confirm that Lenhoff was introduced to Booker and Payvision by Bakker.

The Amsterdam Binary Options Scam Happening.

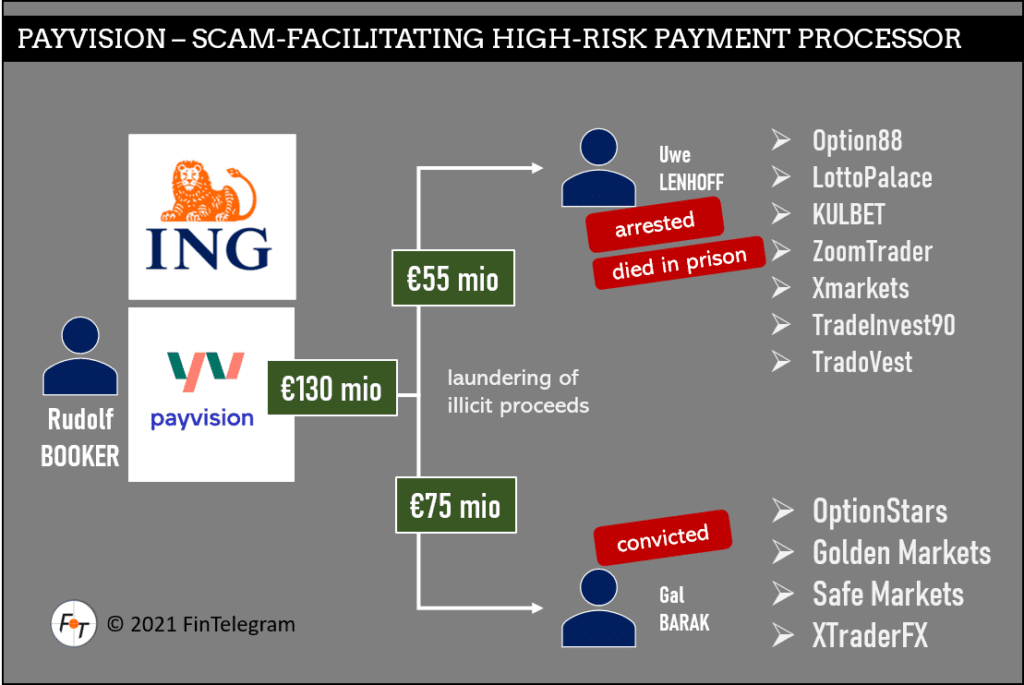

The fact is that the two cybercrime principals Uwe Lenhoff and Gal Barak, laundered tens of millions of funds stolen from victims of their scam platforms during the relevant period between 2015 and 2019. These scam platforms included Option888, ZoomTrader,TradeInvest90, TradoVest, Golden Markets, OptionStarsGlobal, XtraderFX, SafeMarkets, XMarkets and many more.

Lenhoff processed illegal proceeds of his own fraudulent binary options platforms through Payvision and acted as a reseller for Booker’s Payvision. In this capacity, Lenhoff acquired binary options operators like the Israeli Gal Barak and his scam platforms to Payvision. FinTelegram has an affidavit from a participant in a June 2016 one-day client acquisition meeting organized by Lenhoff.

Over the course of hours at Payvision‘s Amsterdam office, Lenhoff introduced binary options operators to Payvision. In total, Lenhoff and Barak alone laundered some estimated €130M via Payvision. This may give an idea about the total volume of illicit proceeds that has been processed by Booker’s payment processor. Payvision volumes from this fraudulent binary options industry must have exploded in 2015/2016. In this respect, the €360 million valuation on the 2018 sale to ING is explainable (read ING press release).

FinTelegram interferes, and a kill order

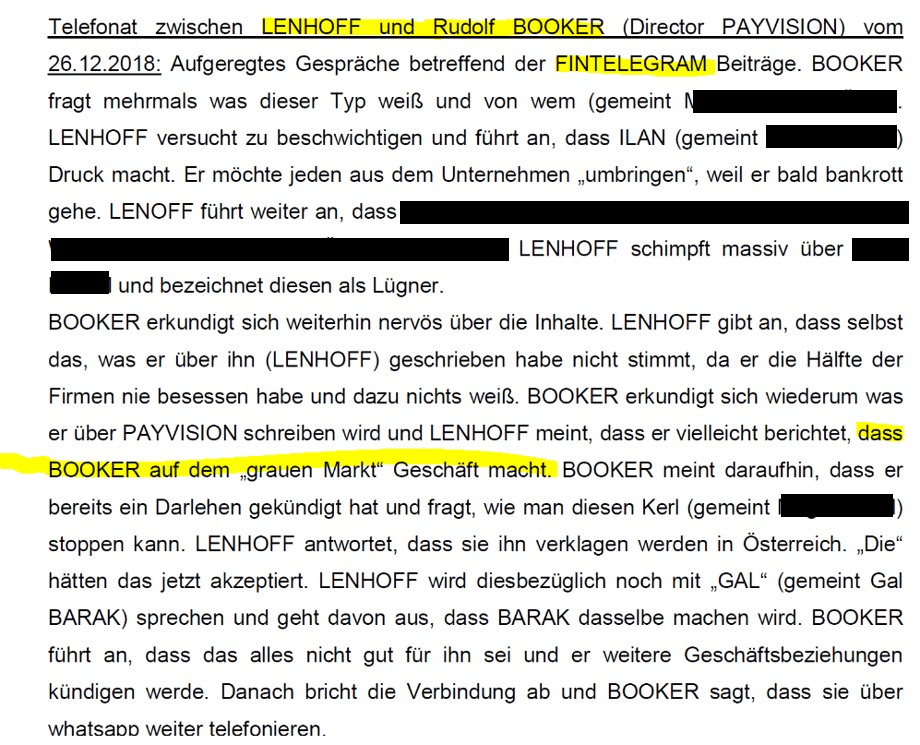

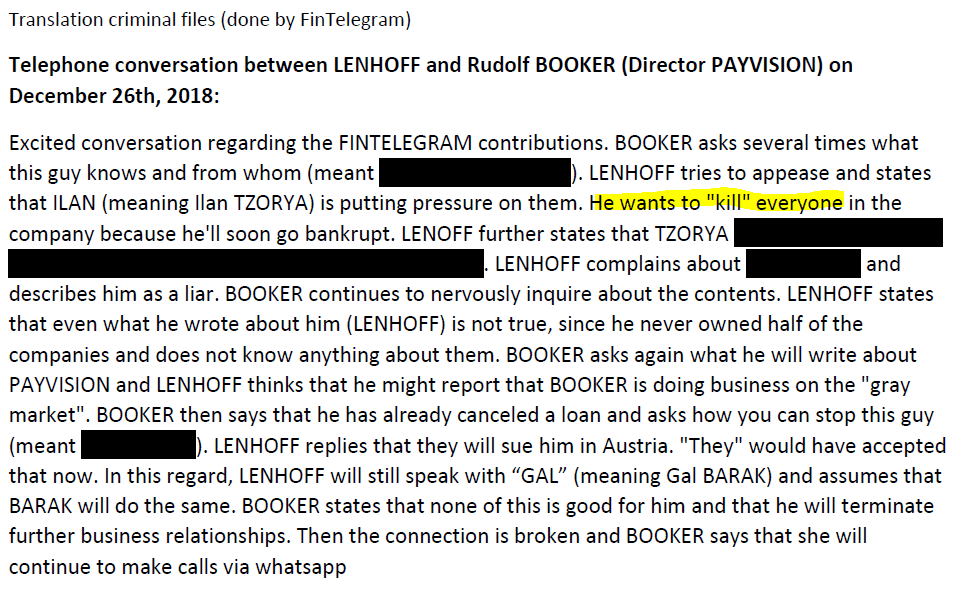

At the beginning of 2018, FinTelegram published the first reports about Uwe Lenhoff, Rudolf Booker, and Payvision, also pointing out the warnings of the various financial market regulators. Criminal filings against Lenhoff clearly state that then-Payvision CEO Rudolf Booker was well aware of the illegal nature of Lenhoff’s activities. Furthermore, in various phone calls recorded by law enforcement agencies, Booker discussed the “FinTelegram problem” with Lenhoff and asked what could be done. For example, in a phone call between Lenhoff and Booker on December 26, 2018 (see screenshot left and translation right). At that time, Booker was already aware of the warnings issued by the various financial market regulators against the companies or brands of his client and friend Lenhoff.

In the phone call, Booker asks what can be done to stop the then operator of FinTelegram. Lenhoff said that FinTelegram could also report Payvision’s gray market business. But he told Booker that he had already taken steps to silence FinTelegram’s publisher.

In fact, Lenhoff issued a kill order in 2018, according to one of his business partners. Documentation to this effect can be found in the relevant criminal files of the authorities. Unfortunately, we do not know at this time whether Rudolf Booker was aware of this kill order. However, what is certain is that the law enforcement agency has statements from those people who Lenhoff tasked with the kill.

Suspicion of money laundering

Upon the FinTelegram reports, Payvision intensified its Suspicious Activity Reports (SARs) to the Dutch regulator and included the activities of Lenhoff and Barak. So, on the one hand, Payvision was well aware and reported suspicions of money laundering but at the same time continued to do business with Lenhoff and Barak. This procedure suggests how deeply Rudolf Booker was involved in the illegal business of Lenhoff and Bakker in the first place. He did what he did wilfully and knowingly. Any serious compliant-acting payment processor would have terminated the customer relationship on suspicion of systematic money laundering. Not so Booker, who planned to spend a skiing vacation with Lenhoff in a luxury hotel in Austria in January 2019. Unfortunately, Lenhoff was arrested before the holidays started.

Just days before Lenhoff’s arrest, he met with Booker in London to discuss the problems there. Gal Barak urged Lenhoff by email to find a solution with Booker to the outstanding issues.

Really now? Defamation!

Booker now feels defamed by FinTelegram because it would not be true that he or Payvision was involved in the cybercrime activities of Lenhoff and Barak. So Booker says. Neither would it be true that authorities – law enforcement and/or regulators – investigated this case and/or his role. However, criminal complaints and money laundering complaints have been filed against Booker and Payvision in Germany and Austria, charging them with money laundering and aiding and abetting investment fraud.

Sorry, Rudolf Booker, but all of this is true. Sorry, Payvision and ING, but this is true. Payvision did dirty business with fraudulent binary options operators, at least between 2015 and 2019. The nature of the business relationship and the business practices applied undoubtedly allow to label Payvision as a Wirecard Mini-Me. The final chapter of this drama is not yet written.

Stay tuned for part II