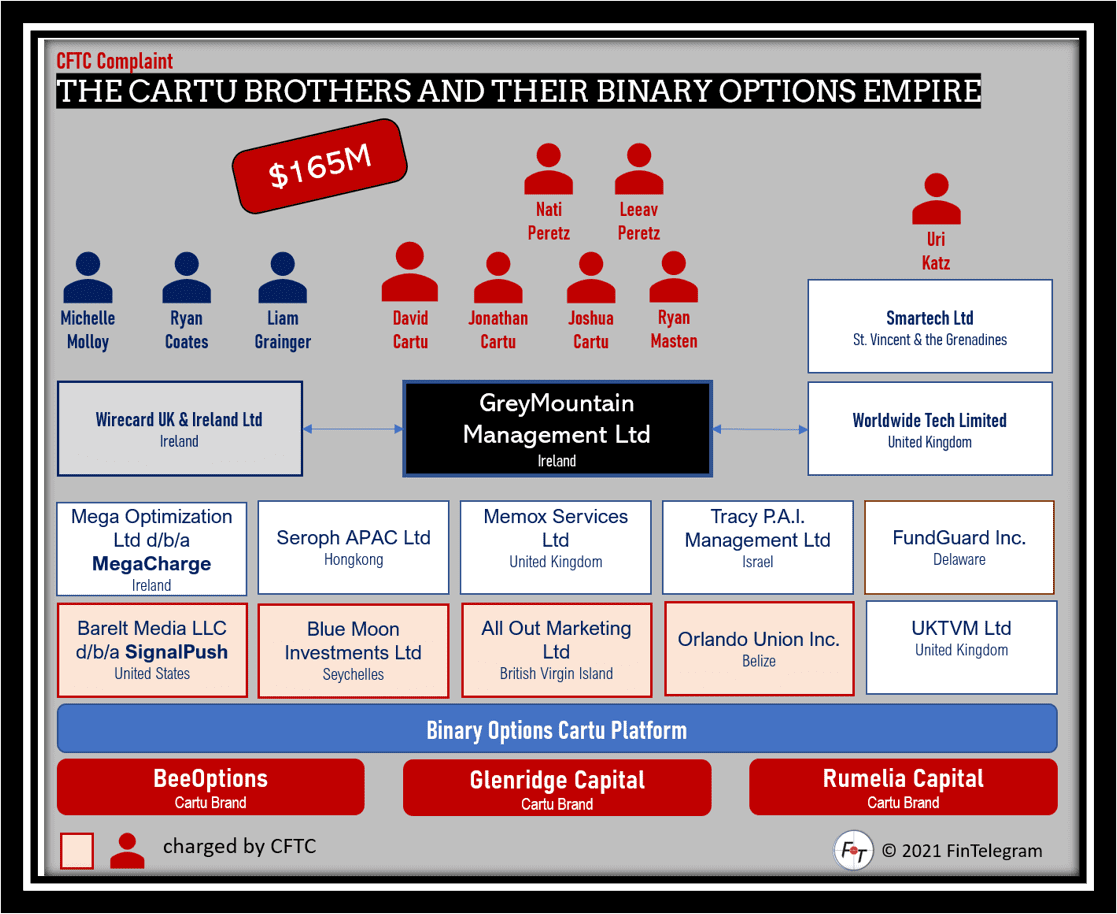

The Canadian-Israeli Cartu Brothers were the operators of a $165M binary options fraud scheme, according to the U.S. Commodity Futures Trading Commission (CFTC). As a result, the U.S. regulator filed a fraud complaint against David Cartu, Joshua Cartu, Jonathan Cartu, and Nati Peretz, and Leeav Peretz in September 2020. In addition, the Canadian regulator Ontario Securities Commission (OSC) has also taken action against the Cartu brothers for binary options fraud. But now, the Cartu Brothers can buy their way out of the OSC fraud charges for just CAD 300,000. A bargain the brothers will probably laugh about for a long time.

The Cartu Brothers have operated a huge network of binary options scams through the Irish registered GreyMountain Management Ltd (GMM). Payments for the dozens of scam firms were processed through GMM, an unregulated payment processor with close ties to the now collapsed Wirecard. The OSC and CFTC have named BeeOptions, Glenridge Capital, and Rumelia Capital as just three of the dozens of scam brands operated within the GMM network. We, therefore, estimate that binary options scams processed more than half a billion customer funds through GMM.

In its Statement of Allegation, the OSC claimed that GMM and the Cartu Brothers obtained CAD 1,4M from approximately 700 Ontario-based investors. In this respect, the settlement payment of CAD 300,000 seems reasonable (read the settlement here).

But, unfortunately, the OSC has also sent a fatal message with this dirty settlement. The message from the OSC to the global investment community is that nothing actually happens to scammers. At worst, when caught red-handed, they pay a ridiculous amount as a symbolic fine. In return, you can live a life of luxury and wealth with the stolen millions. Bravo, OSC!