The following article is based on the article published by Dina-Perla Portnaar (LinkedIn profile) a few days ago on the Risk & Compliance Platform Europe. It describes the Ashton Whiteley boiler room scam between 2017/18 and apparently cost some victims a lot of money. Regulators and lawyers in different jurisdictions have warned against the scam. In great detail, Dina-Perla describes the criminal modus operandi of the scammers and their tricks to lure out (steal) new money from victims constantly. FinTelegram was asked to republish the article to raise the danger of scams and cybercrime in public awareness. We are happy to do so and support the cause.

The Asian approach

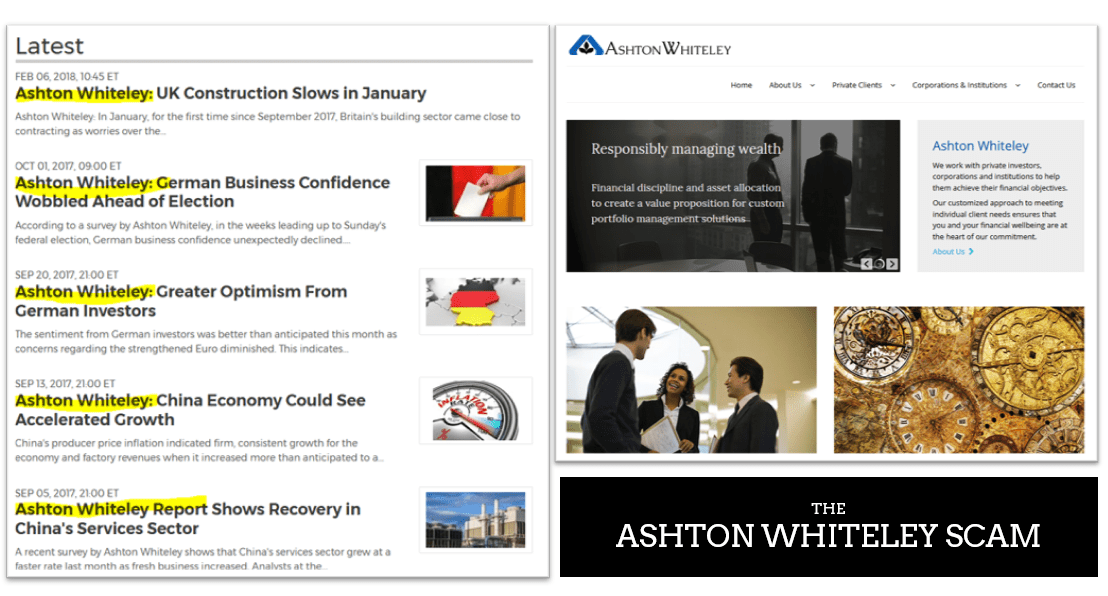

The Ashton Whiteley scam used to operate with the domain www.ashtonwhiteley.com (see archived website) and appeared as a wealth management company in Hong Kong or Shanghai offering (fake) investments in promising Asian companies. You can find many details about it in various forums on the Internet. In September 2019, Finance Magnates reported about the investor warning issued by the Belgian watchdog FSMA against the Ashton Whiteley scam. So, yes, it was a publicly known investment scam.

The scam issued a series of press releases intended to place Asthon Whiteley as a reputable investment house focused on Asia. And yes, the strategy unfortunately worked.

A concrete case of a Dutch victim of this vast scam is presented below.

A professional entrance

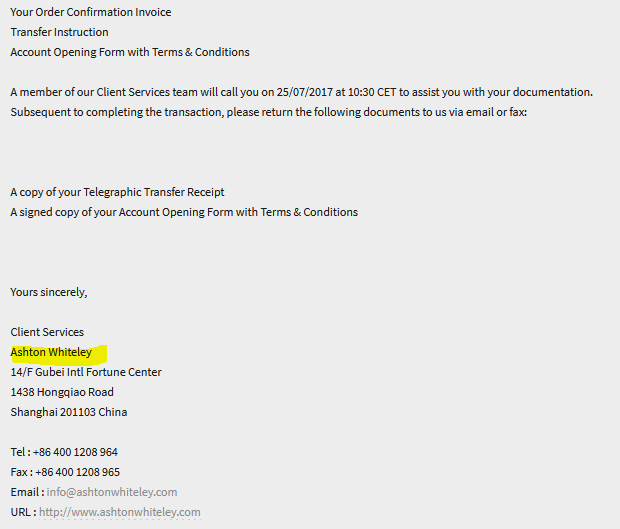

On the 10th of July 2017, the soon-to-be victim was approached by a lady who called herself Julia Wright. She came across as a professional, introducing the company she works for as a well-known, reputable, and solid firm, operating in the financial world with customers from all over the world. Because of expansion ideas in Europe, the company approached a selected number of potential investors for their plans. The meeting via conference call was confirmed with a professional-looking e-mail, and an information leaflet was included as an attachment. He was asked to fill out an account application form, which he did.

No bad headlines

Ten days later, on July 20th, he was contacted by a person who called herself Silly Magrath, acting as a trading officer of Ashton Whiteley and offering him 100 shares in a company called Electronic Arts (EA) for a value of €8819,50. The outlook was a nice return of investment within just three months. In the meantime, he investigated Ashton Whiteley and Electronic Arts. He found nothing negative or dodgy. There were many published articles, nice websites, and many (apparently independent) press releases about the companies they trade in and so on. Even after extensive research, the company and the references appeared to be solid, plausible, and serious.

Upon request, even a native Dutch speaking reference was given, and the man spoke to the Dutchman on the phone, who was also using a local Dutch phone number. He used the name of Victor Borgdorff, speaking in an educated and well-mannered way. He was given all kinds of positive references to Ashton Whiteley and the professional financial services he enjoyed from them.

Another shaddy proposal

Unfortunately, the man accepted the proposal, and the scam began. In the following period, he was contacted by Paul Mitchel and Michael King to inform him that his trade position was doing great and that everything was going just as planned, for the shares to gain a lot of value in about 90 days. They talked about a big announcement of which they had inside information that would be shared afterward.

On September 4th, the man was contacted by a man using the name of Robert Brady, who presented himself as the Senior Vice President of Ashton Whiteley. He approached him with the message that Electronic Arts (EA) made a big jump in the share price. He advised him to cash in the money, but only if it could be traded against another stock. Instead of receiving money, he would be acquiring shares in a company called Lectrifi (LECT). The 100 shares in EA would trade for 6.485 shares of LECT. Lectrifi would be going to the stock market, and with this, he could gain a nice profit. However, trading in LECT could only be done in blocks of 20.000. Thus the man was required to buy an additional 13.515 shares in LECT at €2.00 each + 1% transfer costs, a total sum of €27.301,30. Up to that moment, he spent €36.120,80 on this ‘opportunity.’

The regulatory lie

On September 26th, Robert Brady called again about a volume trading deal by a hedge fund in which the man had to participate to not lose his money. Usually, only trades would take place in blocks of 100.000 shares, but in this case, he could merge the account with another client who was 50.000 shares short of a full block of 100.000. Additional investment in 30.000 shares was required at €2,00 + 1% fee; a total of €60.600. Within six weeks, around November 7th, the shares would be sold at € 5.50. After every transaction, the ‘client’ was transferred to the so-called compliance officer, who used the name of William Danks. He was there to guarantee that all the regulations were followed. He was assured that Ashton Whiteley was legitimate.

On October 26th, Robert Brady called again. Trading in merged accounts, which usually wasn’t an issue, was no longer allowed. The man had to buy another 50.000 shares, or his total amount would be lost. Of course, the other client did not want to buy him 50.000 shares, which he proposed. With increasing reluctance, he forwarded €101.000, in this case, to the Mashreq Bank. Also, he asked for a certificate proving his ownership of the shares. In the meantime, he contacted Mister Michael Beaumont, who was acting as the Investor Relations officer for Lectrifi, and asked if he could verify the shares certificate, which he did.

More money please!

On November 7th, the man had to put up a deposit of 20% of the stock value as bond security, in other words, a total of €108.900, which he would get back after 14 days – a so-called cooling off period – and it would give him a reward of 3%. In return, the man would get 54.450 units in his name as a security mechanism. On November 13th, he received a phone call from William Danks, the allocation officer, to message that the money could not be transferred to account number 023 418205 838 of MINGCIFAR Limited Hong Kong the HSBC Hong Kong because of tax threshold levels being reached. The man had to do a swift recall. On November 17th, he received the money, €108.900,- back on his account. The same day, the man transferred this amount to beneficiary HK lemon Trade company in Hong Kong on bank account number 933 078313 883 at the Hang Seng Bank.

On December 7th, Robert Brady called again. One had dropped out from the 25 clients, so the total amount of shares had to be divided up over the remaining 24 investors. Additional investment in 83.334 shares + 1% fee equals €168.334,68 was absolutely required. The security deposit was covered, so only another €168.334,68 was needed. The transfer was made to account 369 317102 883 on behalf of Chengyu Trade Limited at the Hang Seng Bank.

On 08th January 2018, an equity deposit was required. Equaling 87.121 shares, no fee charges, and €174.242,- was sent to account 369 317102 883 on behalf of Chengyu Trade Limited at the Hang Seng Bank. On January 17th, Robert Brady, said that one of the founders of Lectrifi was dumping a large number of shares into the market. These 2.5 million shares had to be bought up by the remaining shareholders. Robert Brady said that these shares needed to be bought to save the deal. Again, a large amount €214.625,00 was paid to account 369 317102 883 on behalf of Chengyu Trade Limited at the Hang Seng Bank.

Enormous psychological pressure

On January 24th, the man received a call from an unfriendly man called Mirko Kostas, acting as director of Mergers and Acquisitions. He told him that Robert Brady was suspended because he helped his clients too much. That he did things he was not allowed to do, such as not charging for the security deposit on the last transaction. To save the investment, the man had to come up with a deposit of €164.094,00. He even confirmed this in writing. The transfer was made to account 369 317102 883 on behalf of Chengyu Trade Limited at the Hang Seng Bank.

On February 5th, the man received an e-mail and phone call from Mirko Kostas about a miserable situation. An agent discovered that one of the clients is a director of Lectrifi. That would be considered inside trading, and that is not allowed. There are 6 million shares that need to be picked up by the other investors. The security was covered. The man was required to buy an additional 260.870 shares in Lectrifi for an amount of €521.740,00. The pressure from Mirko Kostas was enormous. In this case, the last payment of €100.000 was made.

On February 6th, Mirko Kostas requested an additional investment. The man felt enormous psychological pressure. After this, many more phone calls have followed, trying to get more money from him. This whole fraud incident by the Ashton Whiteley group has been reported to the local authorities but has not been resolved to this day.

The victim’s feelings

Despite many attempts from both the victim and his lawyer to get the police and prosecutor to take on the case, after nearly three years a letter from the Court of Amsterdam was received. Apparently, solving this type of fraud is considered of no importance to society. With this letter, the victim got the impression that the hunting season for scammers is facilitated, by which they can attack innocent investors.

After being let down by the police and prosecutor, victims will do whatever they can to find ways to identify and recover their losses. Apparently, the authorities have other priorities. In general, banks are not as eager to solve such matters and reply accurately, using standard text emails and hiding behind insufficient protocols of privacy and KYC.

Using private investigators, internet searches, and through social media, victims can find out that there are more victims out there and that this ‘disease’ of professional and large-scale fraud has spread throughout Europe, similar to Covid-19 and most likely throughout the whole world. Fortunately, there are groups like Investment Scam Asia (www. investment-scam-asia.com) and European Fund Recovery Initiative (www.efri.io) based in Austria that gather victims’ cases and take action.