John Grisham could have written the story of the (still) London AIM-listed Bet90 Holdings PLC (formerly Veltyco Group PLC). But in fact, the final chapters are still missing in this reality-based novel. On December 9, 2020, the company announced that it had received another €700,000 via a convertible loan. Since the arrest of founder Uwe Lenhoff in January 2019 on charges of operating a cybercrime organization with many online scams and his subsequent death in prison in early July 2020, it is completely unclear how the story will end. Authorities in several countries are still investigating the matter for investment fraud and money laundering.

Business and beneficial owners

In the 2016 prospectus, one can read that Veltyco’s main business and revenue would come from marketing and operating the online platforms Option888 (Binary Options) or LottoPalace. Authorities have exposed these Lenhoff platforms as a scam. The Bet90 sports betting site (www.bet90.com) based in Cologne, Germany, decanted into the Maltese Bet 90 Sports Limited was part of the Veltyo Group. Now it is the centerpiece of the holding company and is expected to make future profits. Well, if and when the authorities do not close the company. Back then, in 2016, the partners, investors, and beneficial owners besides Lenhoff were

- the Dutch real estate investor Dirk-Jan Bakker (“DJ Bakker”) – see latest London Stock Exchange record.

- the German entrepreneur Falk-Uwe Preussner;

- an Israeli entrepreneur who became the second-largest shareholder behind Lenhoff by acquiring the binary options platform ZoomTrader through a share-cash deal.

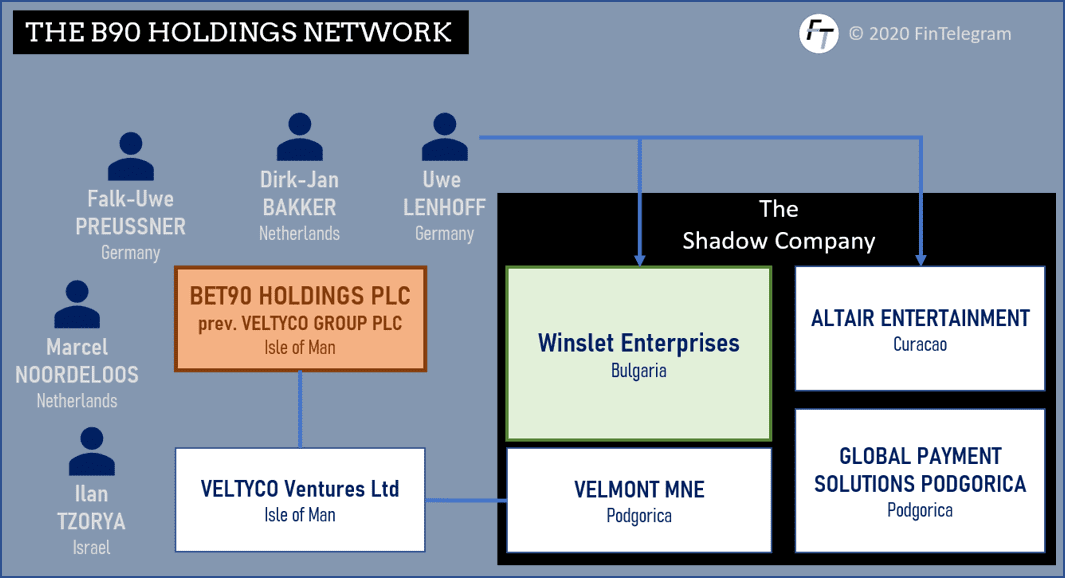

It is currently unclear – apparently also to the investigating law enforcement authorities – who actually owns and controls the company now. Sure, it is known that the British sports manager Paul Duffon acts as Executive Chairman, the Dutch Marcel Noordelos is Finance Director, and the German Rainer Lauffs assumes the role of the Marketing Director. Noordelos and Lauffs were close companions of Lenhoff.

The post-arrest development

When Lenhoff was arrested in January 2019 after more than 18 months of investigations by authorities in several countries, five significant events happened:

- Rebranding: The company was renamed B90 Holdings PLC in February 2020

- Suspension of Trading: In March 2020, the shares of the then Veltyco were suspended from trading.

- New shareholding entity: Lenhoff’s block of shares (more than 25% at the time) was transferred to Ulen Holdings Ltd by his Cypriot trustee Centaur Fiduciaries (OpenCorporates) – see London Stock Exchange record.

- Convertible Loan: The company was financed in several tranches via a convertible loan starting in May 2020. Dutch investor Paul Westerterp and Bet90 Non-Executive Director Mark Rosman acted as investors.

- Emerging Shadow Companies: In Bulgaria, Serbia, and Montenegro, “shadow companies” of Veltyco emerged through which millions were channeled, but which have not been disclosed by the company to date.

To date, the suspension has not been lifted. On December 9, 2020, the company announced that the suspension would either be lifted by March 17, 2021, or the share will be delisted pursuant to AIM Rule 41.

With the new tranche of €700,000, Bet90 Holdings now already has €2,520,000 in convertible loan debt that must be repaid in several tranches by December 2023. The company has not yet revealed where the millions in revenue are to come from after the scam business has been eliminated.

We assume that the convertible loan will be exchanged for shares and that the shares of Lenhoff and his Israeli partner will be divested accordingly.

To be continued with part 2 covering the Shadow Business in Bulgaria and the Balkans.