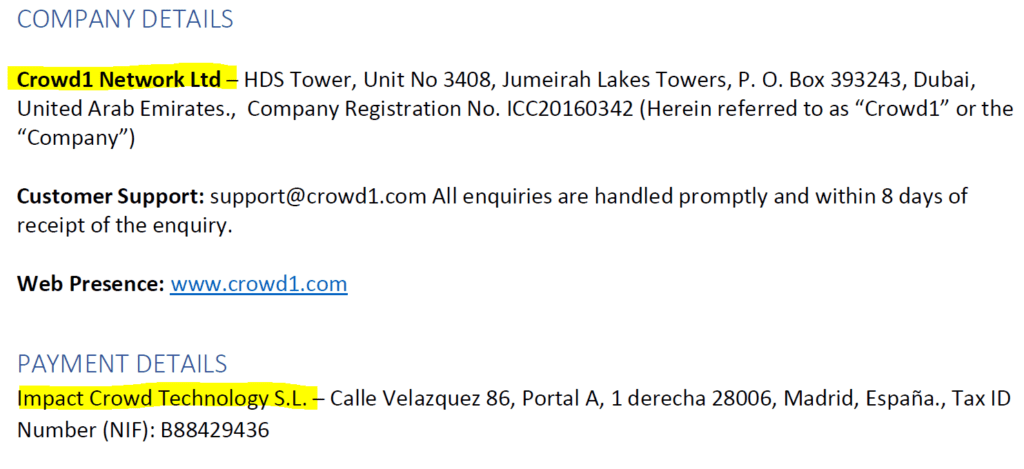

In recent months, the MLM scheme Crowd1 (www.crowd1.com) has apparently become the focus of the attention of various financial market supervisory authorities. Especially the regulators in Africa, Asia, and the Pacific region have issued warnings against the alleged Ponzi scheme, which is active in the gaming, gambling, financial services, and securities fraud. The operator is Crowd1 Network Ltd in Dubai and/or Impact Crowd Technology S.L. in Spain. There is currently no reliable information about the beneficial owners.

MLM veterans at work

The platform behindMLM, specialized in MLM Schemes, has brought some reports about Crowd1 in the last months, analyzed the system and reported about the warnings of the different regulators. A behindMLM report from March 2020 assumed that it is actually a Swedish-Norwegian scheme and named the Swede Jonas Erik Werner who allegedly runs Crowd1 from Stockholm, Sweden. Other individuals who are said to be connected to the scheme are the Norwegian citizens Johan Staël from Holstein and Tor Anders Petteroe. The latter is named as the CEO of Towah Group Limited (Companies House), a meanwhile dissolved UK company that used to operate a payment processor which facilitated Ponzi schemes. According to behindMLM, Petteroe may be behind the money-laundering for Crowd1. All of the individuals associated with Crowd1 are actually MLM veterans.

In June 2020, it became known that the South African National Consumer Commission (NCC) launched a probe into Crowd1. Already in late 2019, the Norwegian Lottery Authority has revealed it has an active investigation into the scheme.

Going South and expanding

Allegedly, Crowd1 perpetrators literally went south and became a Spanish venture. It is said that the Spanish MLM company Impact Crowd Technology S.L. (www.impactct.com) based in Madrid acquired the scheme a few months ago. The

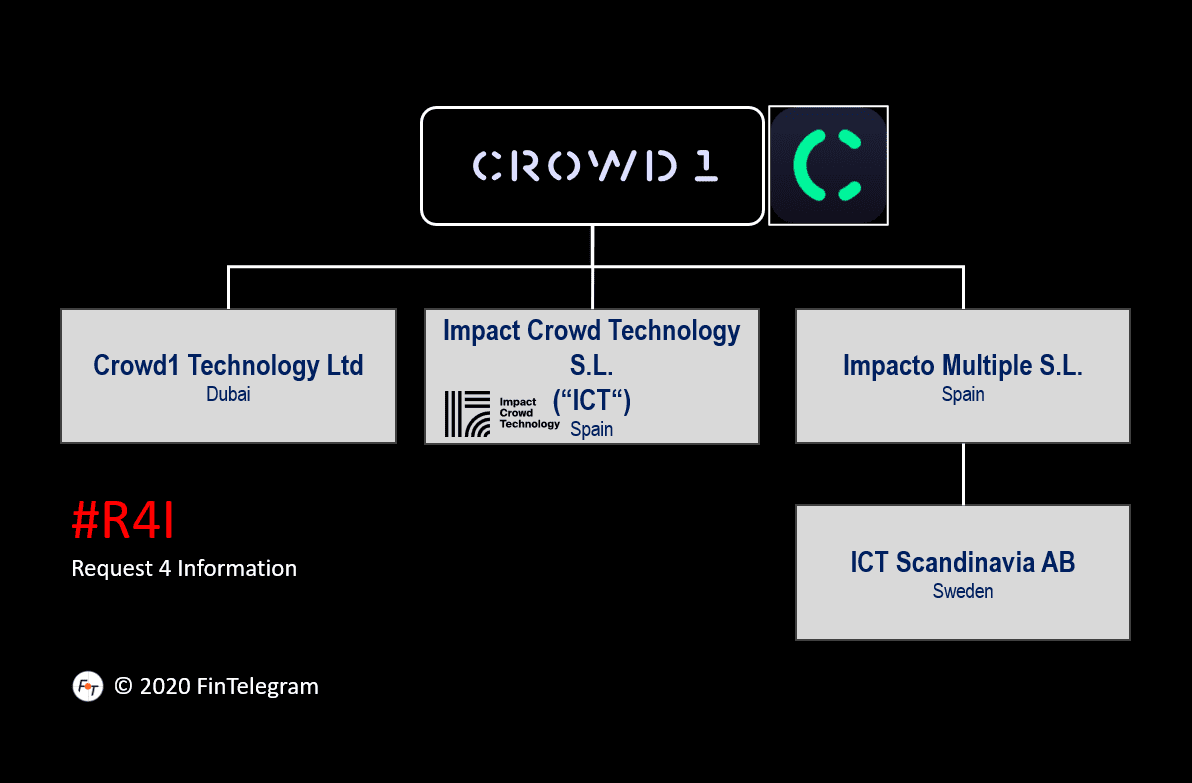

In June 2020 the New Zealand regulator FMA issued an investor warning against Crowd1 and its operator Impact Crowd Technology (“ICT“). In the Crowd1 Terms and Conditions (status 1 July 2020), however, the Dubai entity Crowd1 Technology Ltd is presented as the brand owner while ICT is provided as the schemes internal payment processor (see screenshot left).

On LinkedIn, the Crowd1 brand operates two more presences. One is focused on Crowd1 Gambling & Casinos (here) and one presents the Crowd1 Billionaire’s Club Team (here).

The regulator warnings apparently do not bother the scheme operators. Via its LinkedIn presence, ITC is hiring people for its subsidiary ICT Scandinavia AB in Stockholm, Sweden. In the job description, ITC claims that it has more than 6 million active members in its network. Interestingly, another Spanish entity is mentioned in their – Impacto Multiple S.L.

Share information with FinTelegram

We would like to learn more about the Crowd1 scheme, its beneficial owners, and perpetrators. In case you have experience with them please share it with our FinTelegram News Research team using our whistleblower system.