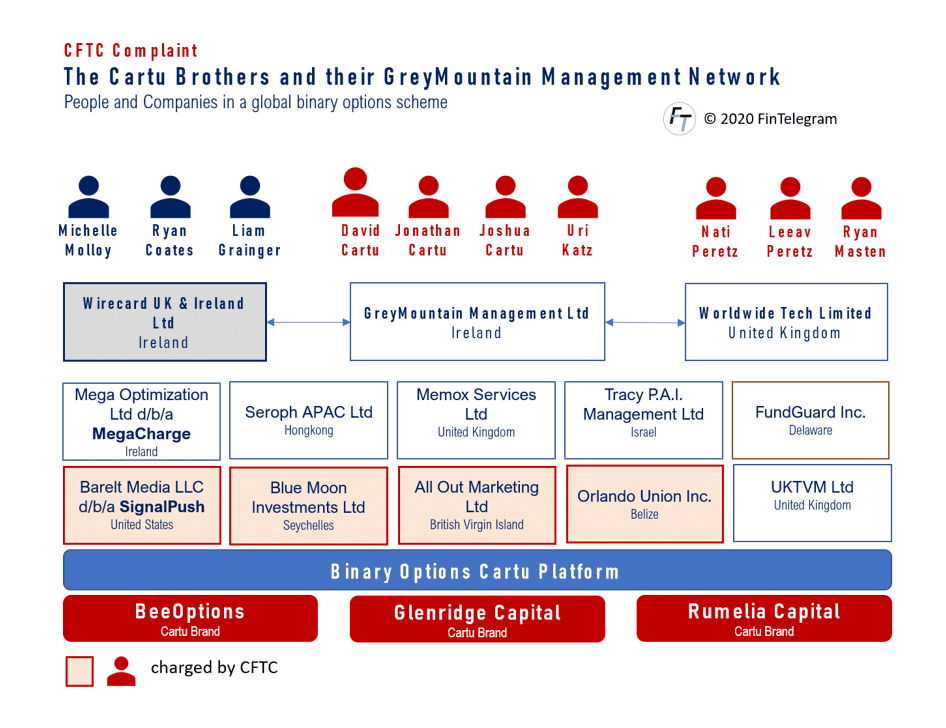

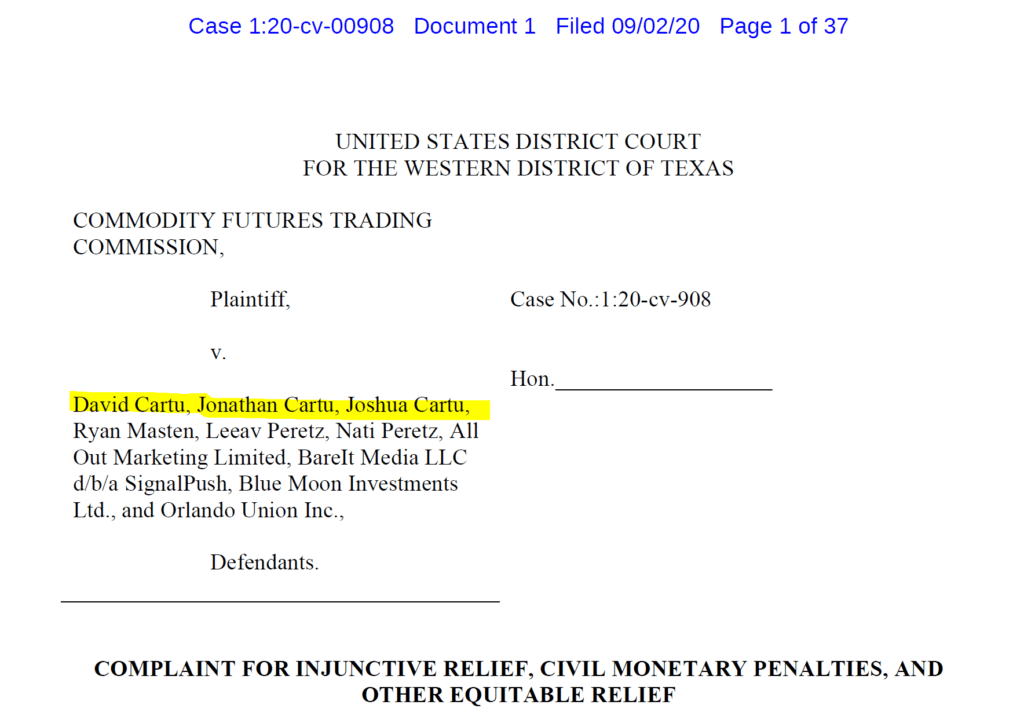

It is a court season for the fraudulent binary options industry and its perpetrators. Among the worst scammers were David Cartu and his brothers. After the Canadian regulator OSC had already sued them for binary options fraud, the U.S. Commodity Futures Trading Commission (CFTC) filed a civil enforcement action. The regulator charges six individuals and four companies with operating a fraudulent binary options trading scheme that received over $165 million via their Irish GreyMountain Management Ltd.

The CFTC Complaint

The CFTC complaint charges that from at least May 1, 2013, through April 29, 2018, the three Canadian Cartu brothers – David Cartu, Jonathan Cartu, and Joshua Cartu – marketed, offered, and sold illegal, off-exchange binary options to retail customers using the brands BeeOptions, Glenridge Capital, and Rumelia Capital.

David Cartu (picture below left) and Joshua Cartu (picture right) are known for their passion for Ferraris and an expensive lifestyle. Joshua lives the life of a celebrity in Hungary. He has been living in Budapest for seven years working on AEGIS LABS, an AI/ML company, he told FinTelegram. He races with the AFCorse Ferrari team and is the Hungarian National Ambassador to special olympics.

The Cartu brothers, along with a pair of Canadian brothers living in Israel, Leeav Peretz and Nati Peretz, operated call centers (boiler rooms) primarily located in Israel that targeted and victimized U.S. residents by promising “quick” returns of between 60-85% by trading binary options. At the direction of the Cartu and Peretz brothers, their websites and boiler room agents solicited U.S. customers falsely represented their financial expertise, compensation structure, physical location, and identity.

These boiler room agents also falsely claimed that the offered binary options transactions were profitable when the majority of customers lost money. Also charged in the alleged fraud is Ryan Masten of Austin, Texas, and his company BareIt Media LLC d/b/a SignalPush, a Texas entity, as well as All Out Marketing Limited, Blue Moon Investments, Ltd., and Orlando Union Inc., each an offshore entity owned and controlled by one of the Cartu brothers.

GreyMountain Management and Wirecard

David Cartu was the founder and CEO of the Irish registered GreyMountain Management Ltd (GMM) which was a close partner of the now collapsed Wirecard. Michelle Molloy, the former CEO of Wirecard UK & Ireland later became David Cartu‘s director and CEO of MegaCharge. As a third party acquirer of Wirecard and other payment processors, GMM has acquired dozens of Binary Options Scams as customers. Many of these scams have used the white label solution of Worldwide Tech Limited. This company was managed by Uri Katz, a close partner of David Cartu.

GMM is also mentioned in the CFTC complaint. Over $165 million in stolen customer funds were processed through this Irish entity, according to CFTC investigations:

In order to facilitate the transfer of funds from customers in the U.S. and elsewhere for illegal, off-exchange binary option transactions, the Cartu Brothers operated Greymountain Management Limited […] the Cartu Brothers and their employees and agents, acting through Greymountain and other related entities, processed over $165 million in credit card payments for binary option transactions offered by the Cartu Brands and other brands operated by third-parties, including processing over $149 million in credit card payments after September1, 2015.

CFTC Complaint against Cartu Brothers (link)

Honey and Money

The binary options transactions offered by the Cartu brands were executed on an Internet-based trading platform (the “Cartu Platform”) operated by the Cartu Brothers and Masten, acting through All Out Marketing Limited, an entity owned and controlled by David, Blue Moon Investments Ltd, an entity owned and controlled by Jonathan, Orlando Union Inc., an entity owned and controlled by Josh; and BareIt Media.

The Cartu Brothers and Masten also utilized GMM to distribute profits generated by the Cartu Platform. Between September 2014 and January 2017,

- Jonathan received at least $9,292,043 from GMM through transfers to off-shore accounts in the name of Blue Moon Investments;

- Josh received at least $9,219,048 from GMM through transfers to off-shore accounts in the name of Orlando Union;

- David received at least $4,868,859 from GMM through transfers to off-shore accounts in the name of All Out Marketing, as well as an additional $4,146,028 through transfers to off-shore accounts in the name of Memox Services Ltd, another entity he ultimately owned and controlled.

- Masten received at least $1,448,209 from GMM through transfers to BareIt Media.

The CFTC seeks disgorgement of ill-gotten gains, civil monetary penalties, restitution for the benefit of customers, permanent registration and trading bans, and a permanent injunction from future violations of the Commodity Exchange Act as charged.