Events are currently coming thick and fast in the Wirecard causa. Former Wirecard CEO Markus Braun, who was initially released against a bail payment of €5 million, was arrested together with three other managers. This was announced today by the public prosecutor’s office in Munich. Circumstantial evidence would suggest that the decision to inflate Wirecard‘s balance sheet had been taken as early as 2015.

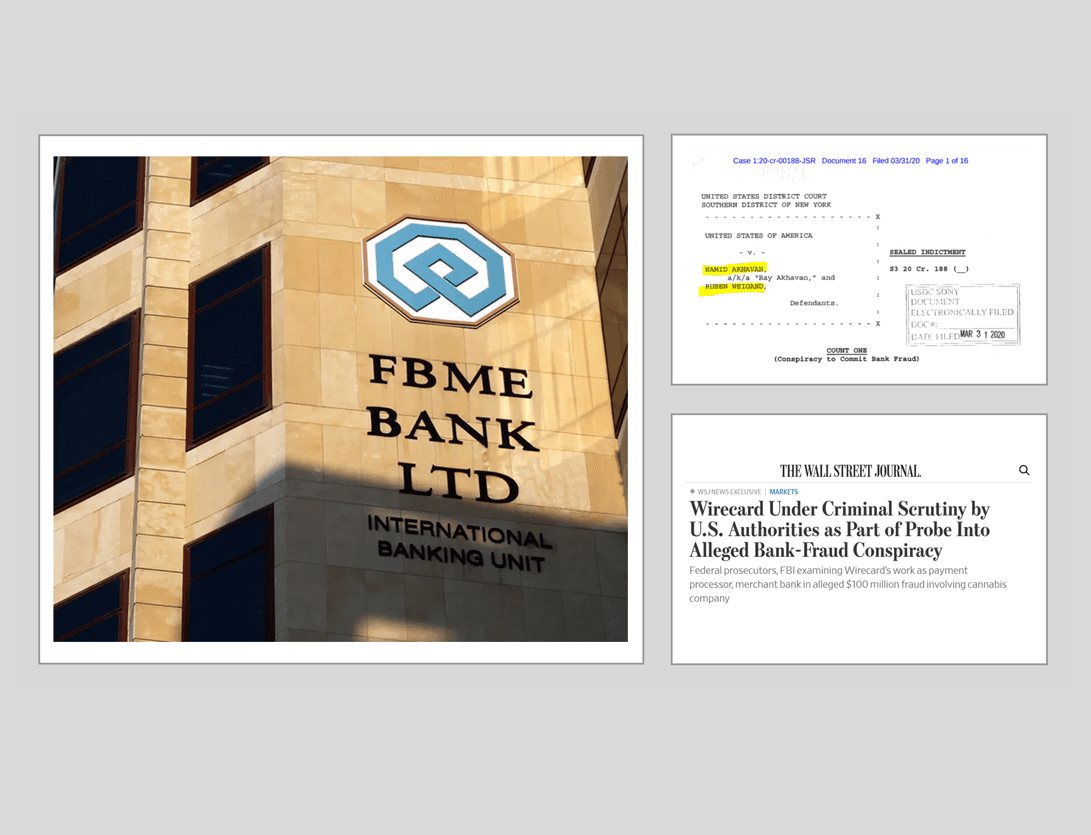

In March 2020, two persons of interest have been arrested by the U.S. FBI in the context of a vast money-laundering scheme. One was the German Ruben Weigand and the other the so-called “porn baron” Hamid “Ray” Akhavan. At the heart of the indictment is one of the largest on-demand marijuana marketplaces, Eaze Technologies Inc., a platform through which customers can buy marijuana for delivery from a network of dispensaries. Both pleaded not guilty but remained in custody at a jail in California. Both have already been involved in the mega-money-laundering scheme of FBME Bank. And yes, there is a rather close connection to Wirecard.

The Global Madhouse

The global financial world is basically a madhouse. Nothing works without money. Neither politics, nor crime, nor pornography, nor the drug scene. The stricter the AML/CTF regulations become, the higher the demand for financial service providers and payment processors with moral and regulatory flexibility. Wirecard is likely to have used this to catapult itself into the German DAX and to develop a billion-dollar rating. Until the collapse in June 2020.

It is not yet known whether the allegedly missing €1.9 billion were never there or perhaps they were but was parked as sort of illicit proceeds on the dark side of the global Wirecard empire – with one of the dark Third-Party Acquirers (TPA) maybe. Following this hypothesis, the dark TPA then pulled the parachute in the face of the increasing public scandalization of Wirecard and made the money disappear. All this is currently fiction, speculation at best, but the facts and rumors that are now coming up would support it. The Wirecard management team around Markus Braun and Jan Marsalek would in any case have the personal profile for this business model. And the best contacts to politics, porn, gambling, and crime.

This hypothesis would also be supported by the fact that the Wall Street Journal (“WSJ”) and Forensic News exposed two individuals in the Wirecard environment who were connected already with the FBME Bank money-laundering scheme. Already at that time, there existed direct connections between FBME Bank and Wirecard through these two individuals. And in the course of the news Eaze money-laundering and bank fraud case, which has now been brought in the United States, it is precisely these persons who are accused by the US prosecutors. WSJ and Forensic News have in their articles established the connection between these two money-laundering schemes and Wirecard.

Eaze, marijuana, and transaction laundering

U.S. prosecutors allege that Eaze executives and other unnamed co-conspirators worked with Ruben Weigand and Hamid “Ray” Akhavan, to devise a “transaction laundering scheme” that hid the true nature of the transactions from banks. According to the indictment, Akhavan is not merely a “porn baron” but the owner of a massive global shell company and dark money empire that have been credibly accused of multiple financial crimes.

According to Forensic News, Akhavan used to be one of the Ultimate Beneficial Owners (UBO) of a money-laundering scheme operated in the ecosphere of notorious and now-defunct FBME Bank (read more on Wikipedia). FBME was an international commercial bank with roots in Lebanon and Tanzania, a branch license in Cyprus, and close connections to Russia. In 2014 the U.S. Financial Crimes Enforcement Network (FinCEN) accused FBME of facilitating financial transactions for multinational organized crime organizations and Hezbollah. Consequently, the Central Bank of Cyprus took over the management of the bank.

In its article, Forensic News refers to a Kroll FBME report and exposes the relationship between FMBE Bank, Eaze, and Wirecard.

Wirecard involvement

The Wall Street Journal recently reported that U.S. investigators are probing Wirecard in an investigation related to this Eaze bank fraud conspiracy.

According to Forensic News, people familiar with the investigation said Wirecard worked with Akhavan and Weigand to create a payment processing network that authorities say skirted banking rules and defrauded U.S. banks. Wirecard is also mentioned twice in the Kroll FBME report. One company used by Akhavan to pay associates and private jet costs had at least $1.3 million sent to the company’s account at FBME from an account at Wirecard.

The full extent of the relationship between Wirecard, FBME, and Eaze is yet to be uncovered. One source of Forensic News said that the allegations against Wirecard mirror those of FBME “to a T.” Akhavan, as seen in the emails above, appears to be a key link between the three entities.