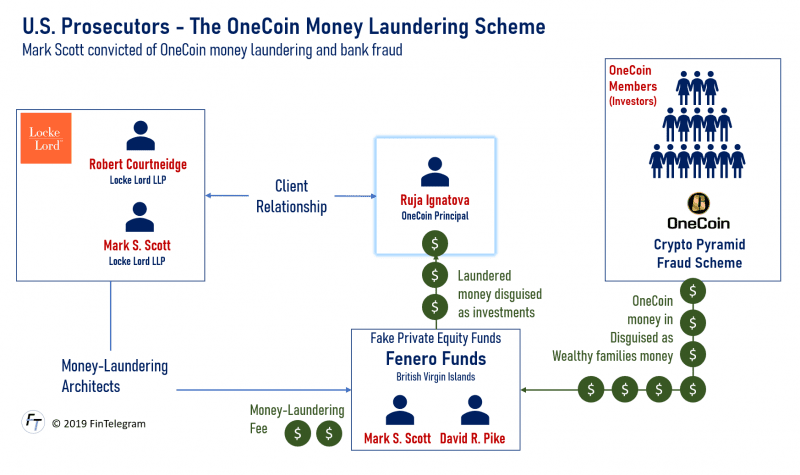

Mark S. Scott who was employed between June 2015 and September 2016 as an equity partner at the big US law firm Locke Lord LLP. According to the U.S. prosecutors, he was first introduced to OneCoin founder Ruja Ignatova in September 2015. Beginning in 2016, while working for Locke Lord, Scott formed a series of fake private equity investment funds in the British Virgin Islands known as the Fenero Funds. The following description of the money laundering and bank fraud scheme around OneCoin is based on the U.S. indictment and the findings in the trial against Mark S. Scott who was found guilty by the jury. He argued that his former partner with Locke Lord, Robert Courtneidge, would have also been involved in the OneCoin case.

Laundering the money with fake funds

Scott disguised incoming transfers of approximately $400 million into the Fenero Funds as investments from “wealthy European families.” Through the Fenero Funds, Scott opened accounts with various banks in various jurisdictions.

As a matter of fact, however, the money represented the proceeds of the OneCoin fraud scheme. Scott laundered the money through various Fenero Funds bank accounts in the Cayman Islands and the Republic of Ireland.

Scott subsequently transferred the funds back to the so-called Cyrptoqueen Ruja Ignatova and other OneCoin associated entities, this time disguising the transfers as outbound investments from the Fenero Funds.

Scott and his co-conspirators lied to banks and other financial institutions and caused them to make transfers of OneCoin proceeds and evade anti-money laundering procedures.

Money-laundering earns a luxury life

Money laundering has obviously paid off financially for Scott. He was able to leave Locke Lord and earn millions as a consultant and partner of OneCoin. But all good things come to an end and so they did for Scott when he was arrested near one of his seaside homes in Barnstable, Massachusetts, on September 5, 2018.

The U.S. prosecutors pointed out, that Scott boasted about earning “50 by 50.” Allegedly, he was paid more than $50 million for his money-laundering services. He used that money to purchase, among other things, a collection of luxury watches worth hundreds of thousands of dollars, a Ferrari and several Porsches, a 57-foot Sunseeker yacht, and three multimillion-dollar seaside homes in Cape Cod, Massachusetts.

Mark S. Scott, an equity partner at a prominent international law firm, used his specialized knowledge as an experienced corporate lawyer to set up fake investment funds, which he used to launder hundreds of millions of dollars of fraud proceeds. He lined his pockets with over $50 million of the money stolen from victims of the OneCoin scheme. Scott, who boasted of earning ‘50 by 50’ now faces 50 years in prison for his crimes.”

Manhattan U.S. Attorney Geoffrey S. Berman (Source: DOJ press release)

Scott was convicted of one count of conspiracy to commit money laundering, which carries a maximum potential sentence of 20 years in prison, and one count of conspiracy to commit bank fraud, which carries a maximum potential sentence of 30 years in prison. Sentencing before Judge Ramos is scheduled for February 21, 2020.

Scott will not be the last lawyer convicted of involvement in scams, money laundering and bank fraud. FinTelegram has evidence on other scams that could only be obtained through false KYC/AML confirmations and false legal opinions.