The Veltyco case becomes the subject of investigations of the UK Financial Conduct Authority (FCA). One of the larger shareholders of the listed Veltyco Group PLC has filed a £500 million fraud complaint with FCA on July 29, 2019. The fraud complaint is available to FinTelegram. The name of the shareholder, a UK citizen,

FinTelegram has received written statements from this shareholder. In it, the shareholder claims that the main shareholders of Veltyco are also involved in the fraud schemes involving the founder Uwe Lenhoff and his fellow board member Marcel Noordeloos.

I want Veltyco management in prison. One of the main shareholders was paying people 2% to buy shares in Veltyco in the market place in order to

Veltyco shareholder filing £500 fraud complaint with FCAstrenghten the price which enabled Uwe to sell shares.

According to the information available to us, the shareholder is an insider who is personally acquainted with the management of Veltyco and its major shareholders. One of the persons accused by this shareholder, a major shareholder of Veltyco and former partner of Lenhoff, denied any allegation. He would have been cheated by Lenhoff himself and lost more than €4.5 million. The fact is that all the main shareholders of Veltyco questioned by FinTelegram now recognize Lenhoff’s fraud, but identify Lenhoff as the sole culprit.

Another major shareholder holding more than 10% of Veltyco shares has shown willingness to join the criminal complaint and to take action against the Veltyco management.

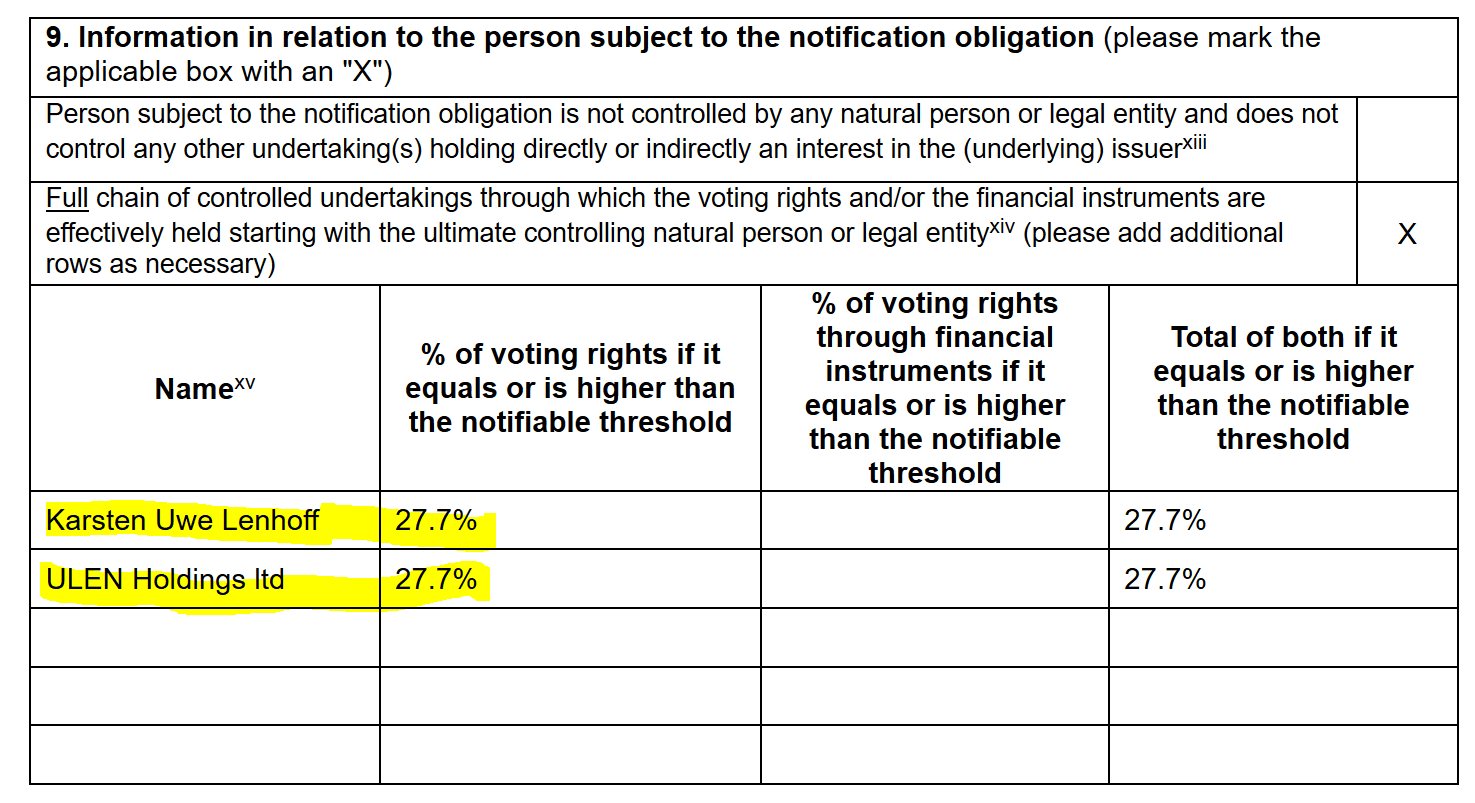

In the meantime, the Veltyco shares of the arrested founder Uwe Lenhoff have been transferred from Lensing Management Ltd (British Virgin Islands) to Ulen Holdings Ltd. the reason for that is most probably that Lensing Mangement Ltd is the subject of criminal investigations.