After the arrest of the German Uwe Lenhoff in Feb 2019, the public Veltyco Group PLC, which he founded via a Reverse Takeover (RTO) in 2016, does not come to rest. For months there has apparently been a state of crisis. Understandable, right? In addition to this crisis situation, a Veltyco shareholder group and their advisors are now threatening the company, its officers and shareholders with a lawsuit in the millions. That’s also understandable given the facts, isn’t it? Here are a few details from the Veltyco criminal case.

The Liquidity Issue

Even before Lenhoff’s arrest and the corresponding uncovering of investment fraud performed with illegal broker platforms such as Option888,

The Melissa Blau Issue

We have heard that Melissa Blau, who stepped down as CEO of Veltyco in October 2018, discovered the malversations and therefore left the company after only 6 months. She is said to have been massively threatened by Lenhoff in the event that she passes on information.

Evidently, there was actually a lot to know about the criminal activities of the Veltyco group. Lenhoff was apparently adept at motivating partners like Payvision to participate in these criminal activities. Melissa Blau, on the other hand, obviously did not want this.

The Bakker Issue

FinTelegram, documents have been leaked showing that Veltyco shareholders and former business partners intend to take legal action against the company, its shareholders and its agents. Specifically, Lenhoff and his partner Dirk Jan (DJ) Bakker are accused of informing investors and business partners about the true background of Veltyco. According to reports, Lenhoff, who is currently in prison, is to assign the blame or responsibility for the fraud system surrounding the illegal broker schemes such as Option888,

Major Veltyco shareholders have reported to FinTelegram that DJ Bakker brokered Veltyco shares and collected commission for doing so. At the request of FinTelegram, individual investors invested and lost money in Veltyco and the Bulgarian Winslet Enterprises EOOD which has been the actual operating entity in the Veltyco Network. The Veltyco wouldn’t even have had its own bank account, Lenhoff said. According to FinTelegram’s available and verified information, DJ Bakker is said to have personally secured individual investors. Now it would not comply with the commitments in this respect, according to the investors concerned.

The Montenegro Issue

Since 2016 Lenhoff has cooperated closely with the Israeli Gal Barak. The two have made joint companies to leverage synergies in investment fraud with their illegal broker schemes. For example, they founded Global Payment Solutions Podgorica DOO and wanted to use it to launder the funds of the cheated small investors. According to the information available to us, however, the local partners have resisted these illegal practices and terminated the partnership.

Lenhoff and Veltyco board member Marcel Noordeloos founded the Velmont MNE in Montenegro and allegedly wanted to expand the illegal business in Montenegro. This has been confirmed by the people involved.

While Lenhoff is in prison in Austria, Gal Barak was able to buy his way out of extradition to Austria for the time being through high bribery payments in Bulgaria. We have already reported on the bribery of the Bulgarian authorities.

Veltyco was Lenhoff and Bakker

We have written statements that DJ Bakker motivated people to buy Veltyco shares and paid people up to 2% commission when they actually invested into Veltyco shares. This should support the price of the Veltyco share but the shareholders blame Bakker for market manipulation. As a major shareholder and partner of Uwe Lenhoff, Bakker has always been an insider and should, therefore, have known at all times about the fraud schemes surrounding Veltyco. Actually, this is what Lenhoff purports – Bakker was part of the scheme.

As a matter of fact, Veltyco was as much a Bakker baby as Lenhoff’s. If you read the London Stock Exchange admission paper carefully, you will notice that DJ Bakker worked with Lenhoff via his companies before Veltyco and was the largest Veltyco shareholder after they did the Reverse Takeover (RTO) with their

The existing shareholders of Sheltyco together with DGS C.V., Mark Rosman, Dirk Jan Bakker, Karsten Uwe Lenhoff and certain entities associated with them are deemed to be acting in concert in respect of the Acquisition for the purposes of the City Code All of them are

(Source: Veltyco admission document, June 2016)

What about Amsterdam real estate millions?

According to the documents available to us, Lenhoff invested the retail investors’ money not only in Ferraris, Bentleys and expensive watches but also in real estate. Massively in real-estate in Amsterdam, to be more precise.

FinTelegram has got documents indicating that Lenhoff together with its partner DJ Bakker allegedly owns 4,400 apartments in Amsterdam. Lenhoff apparently confirmed this to the authorities. He would hold these 4,400 apartments in Amsterdam through a trust construction. Lenhoff and his partner should thus have assets of several hundred million euros at their disposal. Even in the event that the acquisition of these apartments was made with a high level of third-party capital, assets were accumulated here. This is good news for all injured investors of Option888 & Co as well as for the shareholders of Veltyco.

Updates requested

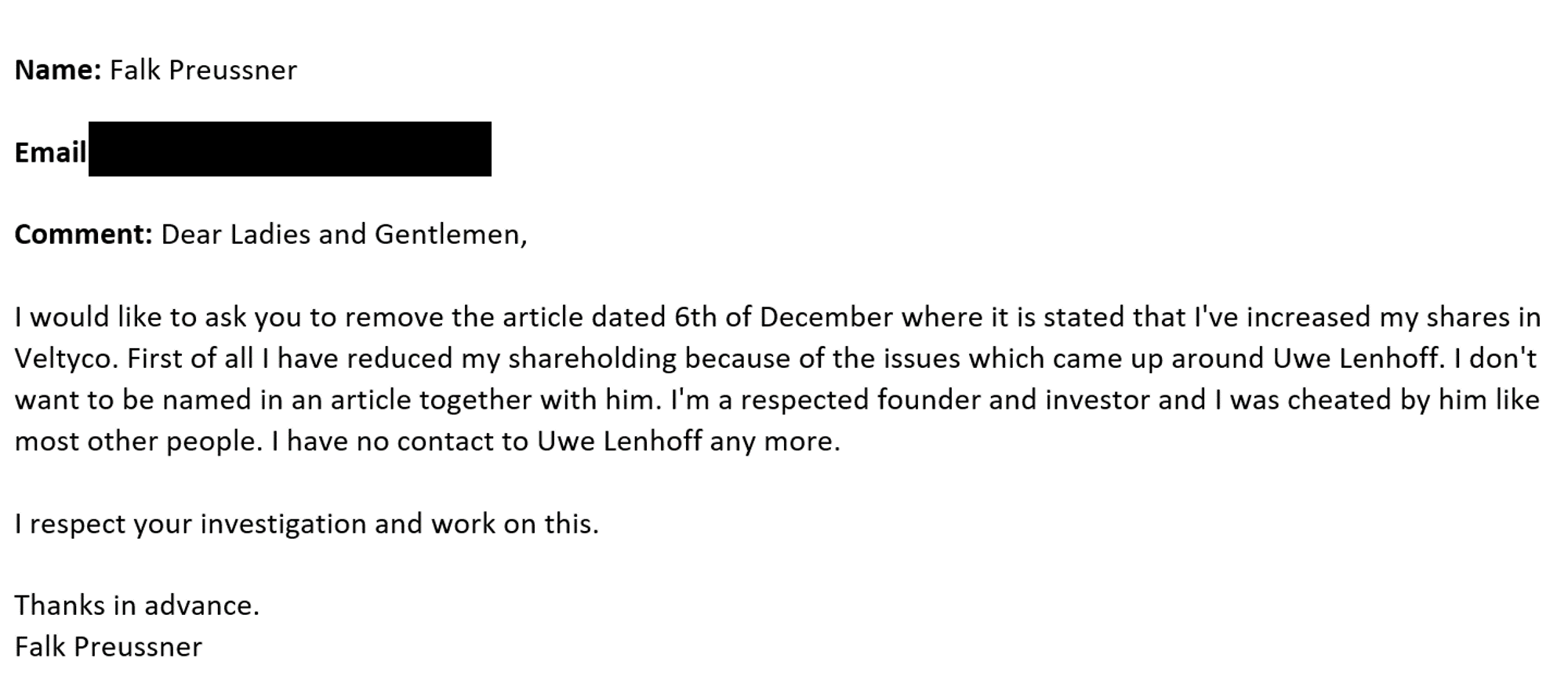

The investigation around Veltyco has just begun. According to the information available to us, investors are looking for more than a hundred million invested in the Veltyco Group around Lenhoff and Bakker. In parallel, the authorities in Germany, Austria,

We have sent a corresponding request to the legal representative of DJ Bakker and asked for clarification and/or statement. So far without success. A scheduled meeting with Bakker was

We are also in contact with the shareholders, investors and their advisors involved. They have assured us that they will keep us informed. It is in our interest to recover the funds for the cheated investors of Lenhoff and Barak. That’s why we started the EFRI campaign for Veltyco and Barak.