In November 2018, Blake Kantor (also known as “Bill Gordon“), the perpetrator behind a binary options and cryptocurrency scheme known as Blue Bit Banc (“BBB”), pleaded guilty to conspiracy to commit wire fraud. Kantor admitted to obstructing an investigation into his fraudulent scheme. While the U.S. Government seeks 70-87 months imprisonment sentence for Blake Kantor the CFTC seeks a default order against Blake Kantor and the other defendant.

Binary Options Court Season opened

The judicial processing of the binary options fraud is underway in the USA. The major court cases such as Lee Elbaz and Yukom are due to be decided in the coming months. The sentence hearings for Austin Smith, Yair Hadar, Lissa Mel, Liora Welles, and Shira Uzan are starting in August 2019. They already pleaded guilty to binary options fraud. The trial date for defendant Lee Elbaz has been set for July 16, 2019.

The court date for sentencing in the case of Blake Kantor and his BlueBitBanc (BBB) scheme is scheduled for mid-June 2019. Blake Kantor has already pleaded guilty to binary options fraud and most likely will be sentenced to several years in prison.

U.S. Government requests heavy sentencing for Blake Kantor

On Monday, May 13, 2019, the U.S. Government filed a Sentencing Memorandum with the New York Eastern District Court asking the Court to sentence the defendant to a substantial sentence of imprisonment within the Sentencing Guidelines range of between 70 and 87 months.

The Government notes that Blake Kantor operated a binary options and cryptocurrency fraud scheme for three years. He stole approximately $1.5 million from more than 700 U.S. investors. Before launching his scheme, Kantor has already been sentenced to 36 months’ imprisonment for his involvement in an ecstasy distribution organization.

The sentencing of Kantor has been recently rescheduled to June 17, 2019.

CFTC takes court action against BlueBitBanc scheme

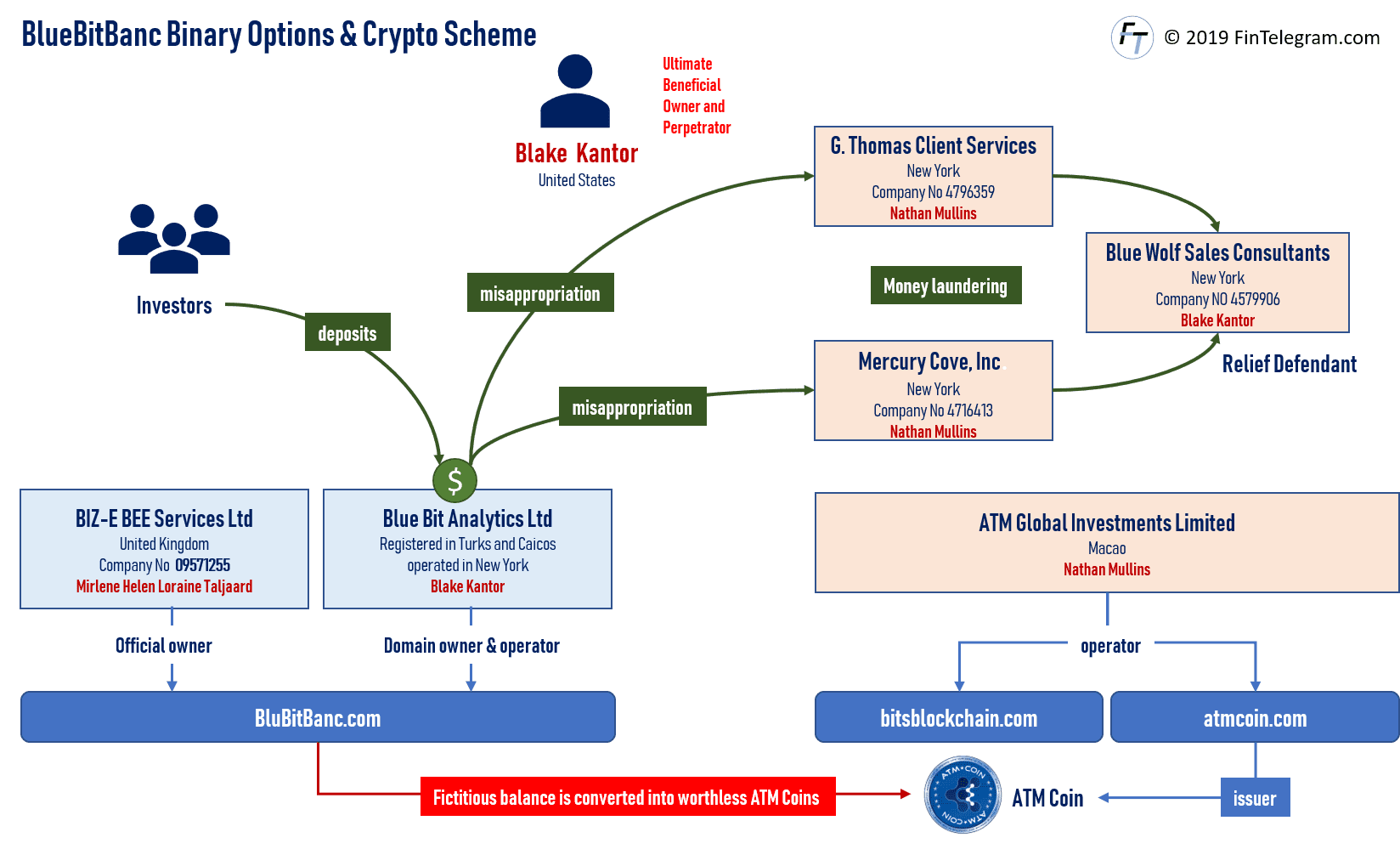

In April 2018, the U.S Commodity Futures Trading Commission (CFTC) filed a Complaint for Injunctive Relief, Civil Monetary Penalties and other Equitable Relief charging Blake Harrison Kantor and Nathan Mullins and their entities Blue Bit Analytics Ltd, Mercury Cove, Inc., and G. Thomas Client Services with operating a fraudulent scheme involving binary options and a virtual currency known as ATM Coin.

The BBB perpetrators fraudulently solicited the Blue Bit Enterprise’s customers to enter into these illegal, off-exchange binary options transactions. They did this through phone calls and emails to prospective customers and through their website, www.bluebitbanc.com.

Furthermore, the CFTC’s Complaint charges Kantor, Blue Bit Analytics, and G. Thomas Client Services with accepting customer funds and illegally acting as Futures Commission Merchants without being registered with the CFTC.

On May 31, 2019, the CFTC filed a Request for Certificate of Default seeking the entry of a default against defendants Blake Kantor aka Bill Gordon, Nathan Mullins, BlueBitBanc, Blue Bit Analytic Ltd, G. Thomas Client Services and Mercury Cove, Inc., as well as against relief defendant Blue Wolf Sales Consultants. The defendants have failed to file an answer or otherwise respond to the CFTC Complaint.

The CFTC Complaint alleges that since at least April 2014 and continuing to the present, the defendants have solicited potential customers through emails, phone calls, and a website to purchase illegal off-exchange binary options via companies such as BBB. The defendants finally sought to cover up their misappropriation by inviting customers to transfer their binary options account balances into a virtual currency known as ATM Coin.

The Scheme – purported trading and software manipulation

Kantor or individuals acting in the BBB scheme made purported binary options trades for the customers. Alternatively, customers were instructed how to enter orders through the BBB online order-entry platform on its website www.bluebitbanc.com. The perpetrators then manipulated or fabricated purported trades in their customers’ accounts to insure that they could be manipulated to the customers’ disadvantage. In some instances, trading losses continued until the customer’s online account was nearly depleted.

According to the U.S. prosecutors, Kantor and his BBB worked with trading software that fraudulently altered data associated with binary options investments so that the probability of investors earning a profit favored BBB and disadvantaged investors. This manipulation ultimately resulted in significant financial losses to the victims.

From 2015 through early 2017, at least twenty individuals worked for Blue Bit at various times in the Analytics sales office.

Misappropriation and money laundering

Customers typically were told to send their funds by wire or credit card to Blue Bit Analytics at its Nevis bank account. From there, most of the client funds were transferred to the bank accounts of the New York companies G Thomas Client Services and Mercury

G. Thomas Client Services and Mercury

To launder his illicit profits, Kantor arranged bank accounts using aliases and identifying information of other people making it more difficult to trace the funds that Kantor fraudulently took from investors. Kantor also converted BBB investments into ATM Coin, a worthless cryptocurrency that he misleadingly told investors was worth substantial sums of money.

The crypto exit

In or around October 2017, as part of an exit strategy, the Kantor and his co-conspirators began to migrate their fraudulent business model away from binary options into a new fraudulent scheme in an effort to conceal the BBB fraud.

Kantor offered his clients to convert their account balances into a new cryptocurrency called ATM Coin (ATMC) which was issued by a venture called Bitsblockchain. According to the ATM Coin whitepaper, Bitsblockchain (www.bitsblockchain.com) and the ATM Coin (www.atmcoin.com) operated by ATM Global Investments Limited in Macao. Over the few months that the BBB clients have had holdings of ATMC, they have seen a growing value of ATMC in their Bitsblockchain dashboard. As a matter of fact, however, ATM Coin was a worthless cryptocurrency that Kantor misleadingly told investors was worth substantial sums of money.

When clients tried to withdraw their ATMCs to monetize their profits representative of Bitsblockchain told them that their account was blocked and “in a process of investigation.”

Interestingly, the websites of Bitsblockchain and ATM Coin are still online.

In fact, many binary options schemes 2017 have switched to the crypto domain. Currently, many CFD providers have cryptocurrencies in their trading portfolio and also use Bitcoins & Co as an opportunity to raise customer funds.

Binary Options (CFTC definition)

Binary options are options that either pay nothing or a pre-determined payout depending upon the investor’s prediction as to whether the price of the referenced asset (such as the price of gold or silver) will rise above or below a specified amount on a specified date and time. The payout depends entirely on the outcome of this type of yes/no proposition. For example, the yes/no proposition might be whether the price of silver will be higher than $33.40 per ounce at 11:17 a.m. on a particular day.

Unlike other types of options, a binary option does not give the holder the right to purchase or sell the underlying asset. When the binary option expires, the option holder is entitled to a pre-determined amount of money if the customer has made a correct prediction. If the customer has made an incorrect prediction, he or she gets nothing and loses the premium paid.