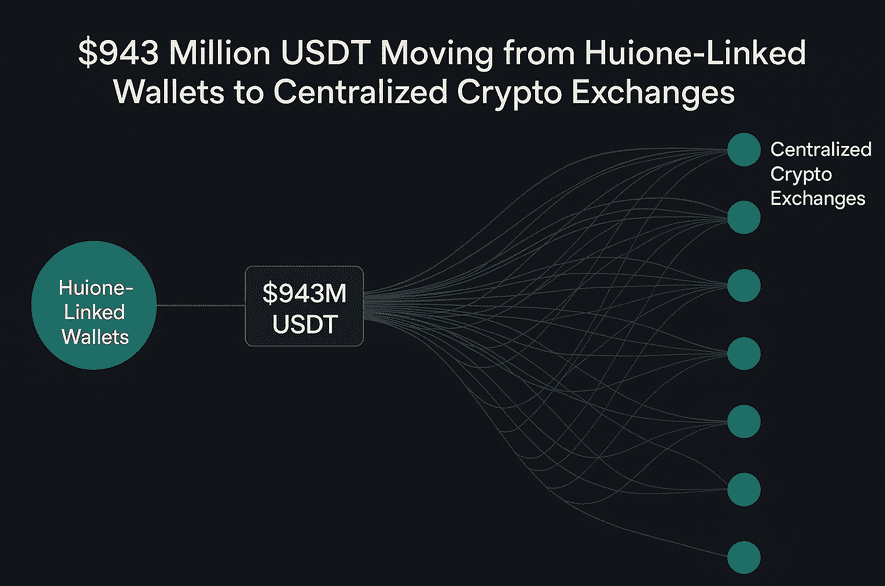

Despite FinCEN’s designation of Huione Group as a primary money laundering concern, wallets linked to the network have shifted nearly $1 billion USDT to major centralized exchanges. This case exposes the resilience of illicit crypto flows and the urgent need for global regulatory coordination.

5 KEY POINTS

- $943 Million USDT linked to Huione flowed into centralized exchanges between May 1 and June 17, 2025, after FinCEN’s action.

- FinCEN Sanctions: U.S. financial institutions are now barred from servicing Huione, aiming to sever its access to the U.S. financial system.

- Complex Laundering Tactics: Funds routed via layered transactions, OTC desks, and nested intermediaries to obscure origins.

- Global Footprint: Huione’s operations span Cambodia, Hong Kong, and Poland, complicating enforcement and oversight1.

- AML Weaknesses: Investigations reveal ineffective or absent AML/KYC controls across Huione’s subsidiaries, heightening systemic risk.

SHORT NARRATIVE

After being labeled a primary money laundering concern by the U.S. Financial Crimes Enforcement Network (FinCEN), the Huione Group’s crypto wallets continued to move vast sums of Tether (USDT) to major exchanges. Blockchain analytics show that, in just six weeks, nearly $1 billion in USDT was funneled through complex, indirect channels—demonstrating the group’s ability to evade direct regulatory scrutiny and maintain liquidity despite sanctions.

EXTENDED ANALYSIS

FinCEN’s Section 311 action against Huione Group, under the USA PATRIOT Act, represents one of the most severe measures in the U.S. anti-money laundering arsenal. It prohibits U.S. institutions from maintaining correspondent accounts for Huione, effectively isolating it from the U.S. financial system. Yet, the continued flow of $943 million USDT into centralized exchanges highlights critical enforcement gaps:

- Jurisdictional Arbitrage: Huione exploits regulatory differences across Cambodia, Hong Kong, Poland, and other regions, using subsidiaries and layered entities to obscure financial flows.

- Crypto Ecosystem Vulnerabilities: The group leverages the pseudo-anonymity of blockchain, OTC desks, and nested service providers to bypass direct exchange scrutiny.

- Operational Resilience: Despite sanctions, Huione’s network adapts rapidly, rebranding and shifting operations to maintain access to global liquidity pools.

- AML/KYC Deficiencies: Public disclosures and regulatory findings confirm a lack of effective AML/KYC controls within Huione’s ecosystem, increasing exposure to illicit finance.

- Regulatory Implications: The case underscores the limitations of unilateral sanctions and the urgent need for cross-border cooperation, enhanced blockchain analytics, and robust compliance frameworks.

ACTIONABLE INSIGHT

Compliance teams should immediately review exposure to Huione-linked addresses and entities, enhance blockchain surveillance for indirect flows, and coordinate with global partners to close regulatory gaps. Proactive engagement with analytics providers and law enforcement is critical.

CALL FOR INFORMATION

Have you observed suspicious flows, OTC desk activity, or exchange exposure linked to Huione or its affiliates? Share intelligence securely with FinCrime Observer—your insights can help disrupt global laundering networks.