We have already brought several reports about the mysterious Russian shadow banking scheme, Perfect Money. No one knows who the beneficial owners are and their relationship with the political establishment in Russia. Due to the sanctions imposed by the Western allies against the Russian financial system, Perfect Money is likely to benefit. We know that many scammers and illicit businesses use Perfect Money. We have tested the PM Credit Exchange and found that mainly scammers take loans there and do not repay without any sanctions. Stay away.

Pseudonymous with Trust Score

Perfect Money (PM) works in a pseudonymous mode and does not oblige its clients to get verified. The scheme applies an open Trust Score (TS) system in which the registered customers, called agents, are rated. Agents can verify themselves with PM, but they do not have to. One of the PM features is a peer-to-peer Credit Exchange, where

- borrowers can request loans and

- lender can accept loan requests or

- make requests to lend.

More than 87.000 loan requests are currently listed on the PM Credit Exchange. The loan requests range from microloans with a few dollars to several thousand dollars and promise high returns. The microloans make up the majority of the loan requests advertised. Loan brokerage is generally a regulated financial business that requires the approval of the relevant regulators. The Russian shadow banking scheme Perfect Money does not have such a license.

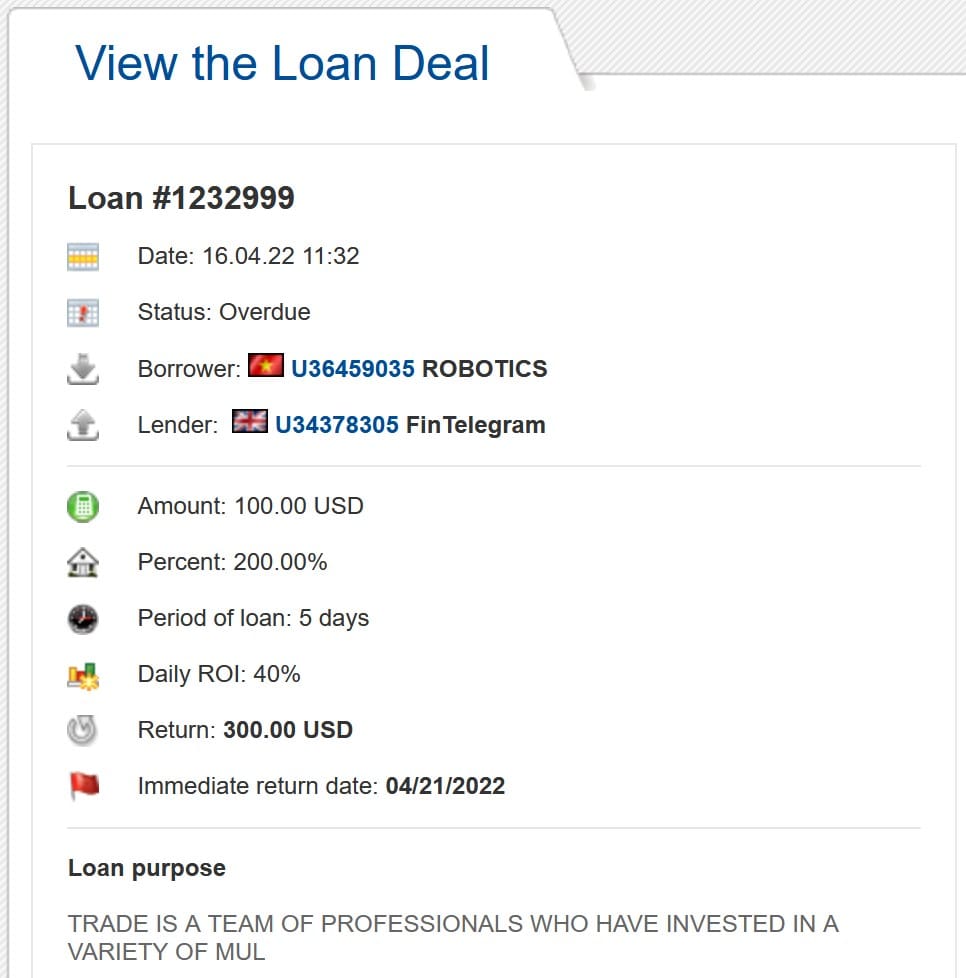

We have accepted several microloans and provided the respective funds to verified agents with a positive Trust Score. PM has the agents’ personal information through the verification (KYC) process. We have communicated with our borrowers through the PM chat system. In our chat conversations, the borrowers confirmed the in-time repayment to us several times. However, the fact is that the agents were not available on the repayment day. Of course, the repayment was not made.

Conclusion

The vast majority of loan requests in the PM Credit Exchange come from agents who do not intend to repay the loans. Sure, PM automatically tries to make a “compulsory repayment” from the borrower’s PM account, but it is useless if no funds are available. PM does not take further action to protect lenders or get their money back. Moreover, PM does not provide the borrower’s data to enable the lender to take steps to get their money back.

We strongly advise against using the PM Credit Exchange. Scammers contaminate this peer-2-peer lending scheme. PM has no measures in place to detect scammers or protect lenders.