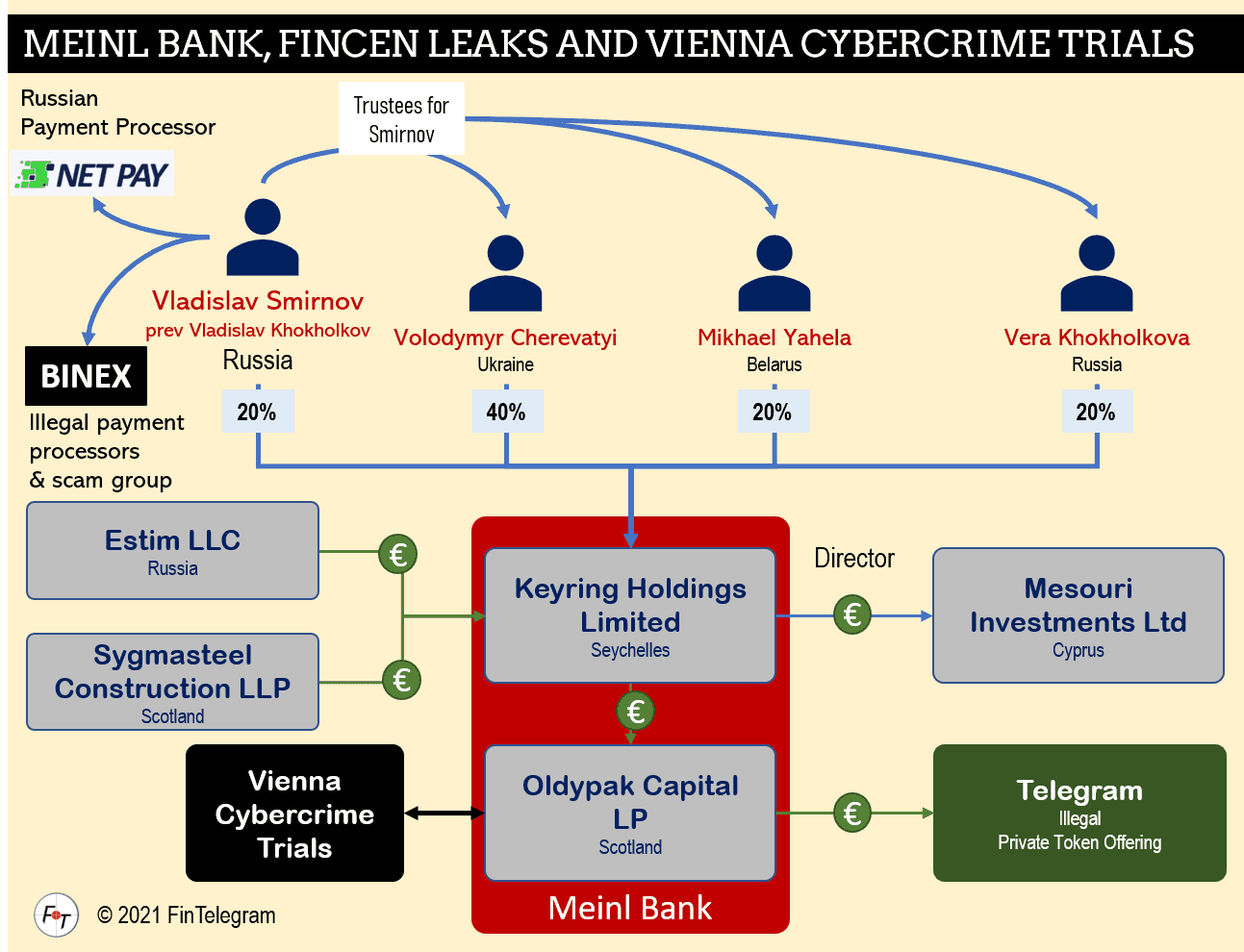

Austria’s Meinl Bank was notorious for its role in the international money laundering scene. In September 2020, FinTelegram reported that a significant portion of the Suspicious Activity Reports (SARS) revealed by the FinCEN Leaks involved Austrian Meinl Bank and its subsidiary Meinl Bank Antigua. In addition, the OCCRP report titled The Vienna Bank Job revealed that the bank laundered hundreds of millions from Ukraine. Furthermore, cybercrime activists such as Russian Vladislav Smirnov also used Meinl Bank for his business. Meinl Bank has since closed; its former CEO, Peter Weinzierl, was arrested yesterday in the UK.

The U.S. Case

The U.S. Department of Justice announced on May 25, 2021, that Peter Weinzierl was arrested in the UK at the request of the US. He and his former Meinl Bank colleague Alexander Waldstein are accused of being part of a global money-laundering scheme that laundered hundreds of millions of dollars through the U.S. financial system involving the notorious Brazilian construction conglomerate Odebrecht. While Weinzierl was arrested, Waldstein remains at large.

U.S. Prosecutors claim that the defendants and their co-conspirators used fraudulent transactions and fake agreements to move more than $170 million from bank accounts in New York held in the name of Odebrecht, through the Meinl Bank, to offshore shell company bank accounts secretly controlled by Odebrecht. The latter used the slush funds to pay bribes.

This is the U.S. case but in fact the story around money laundering and Meinl Bank is much bigger and politically explosive.

Disgraced Austrian judiciary

An indictment planned by the public prosecutor’s office against Julius Meinl and Peter Weinzierl for embezzlement was shelved by the Ministry of Justice in 2018.

The allegations of systematic money laundering by Meinl Bank were well known to the Austrian judiciary. In fact, law enforcement launched respective investigations several years ago. However, in 2020, the Austrian judiciary closed the money laundering investigations against Meinl Bank and its persons despite overwhelming evidence. Insiders speak of political intervention in this context. Given the allegations and the enforcement actions of the U.S. authorities, the Austrian judiciary looks rather disgraced.

The scammers’ bank

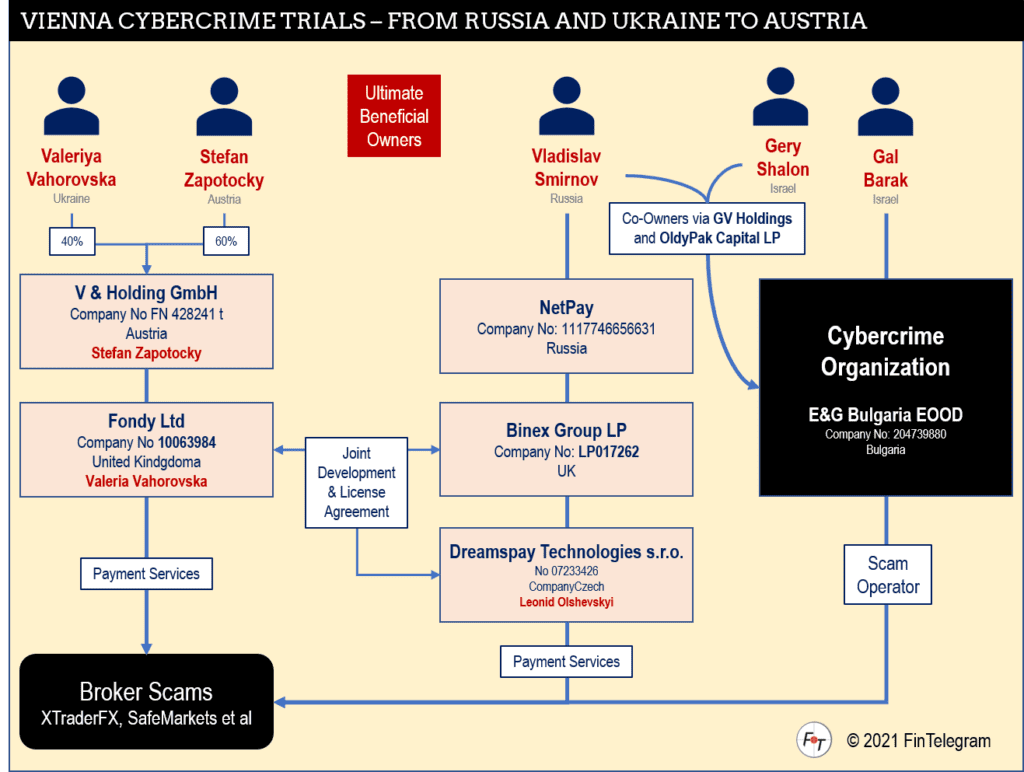

In the Vienna Cybercrime Trials, the Russian Vladislav Smirnov (previously known as Vladislav Khokholokov) and his Israeli partner Gery Shalon are listed as defendants. Their former partner Gal Barak has already been sentenced to several years in prison for investment fraud and money laundering. Barak’s wife, Marina Barak, is currently on trial. More indictments are to follow, one hears. It is not yet known whether Vladislav Smirnov and Gery Shalon are among them.

Smirnov operates the payment processor NetPay (www.net2pay.ru) in Russia and also used the Austrian Meinl Bank for his transactions. In 2018, Smirnov used Meinl Bank to invest in Telegram’s Initial Coin Offering (ICO). The SEC later declared this ICO illegal, and Telegram had to return the funds to investors. One of these investors was the Russian Smirnov. We have heard that Smirnov lost a lot of money in the course of Meinl Bank’s bankruptcy. Money that was frozen there by the authorities (read our report here).

Smirnov is also the beneficial owner of Binex Group, which operated various illegal payment processors in the UK, Montenegro, the Czech Republic, and Binex broker scam.