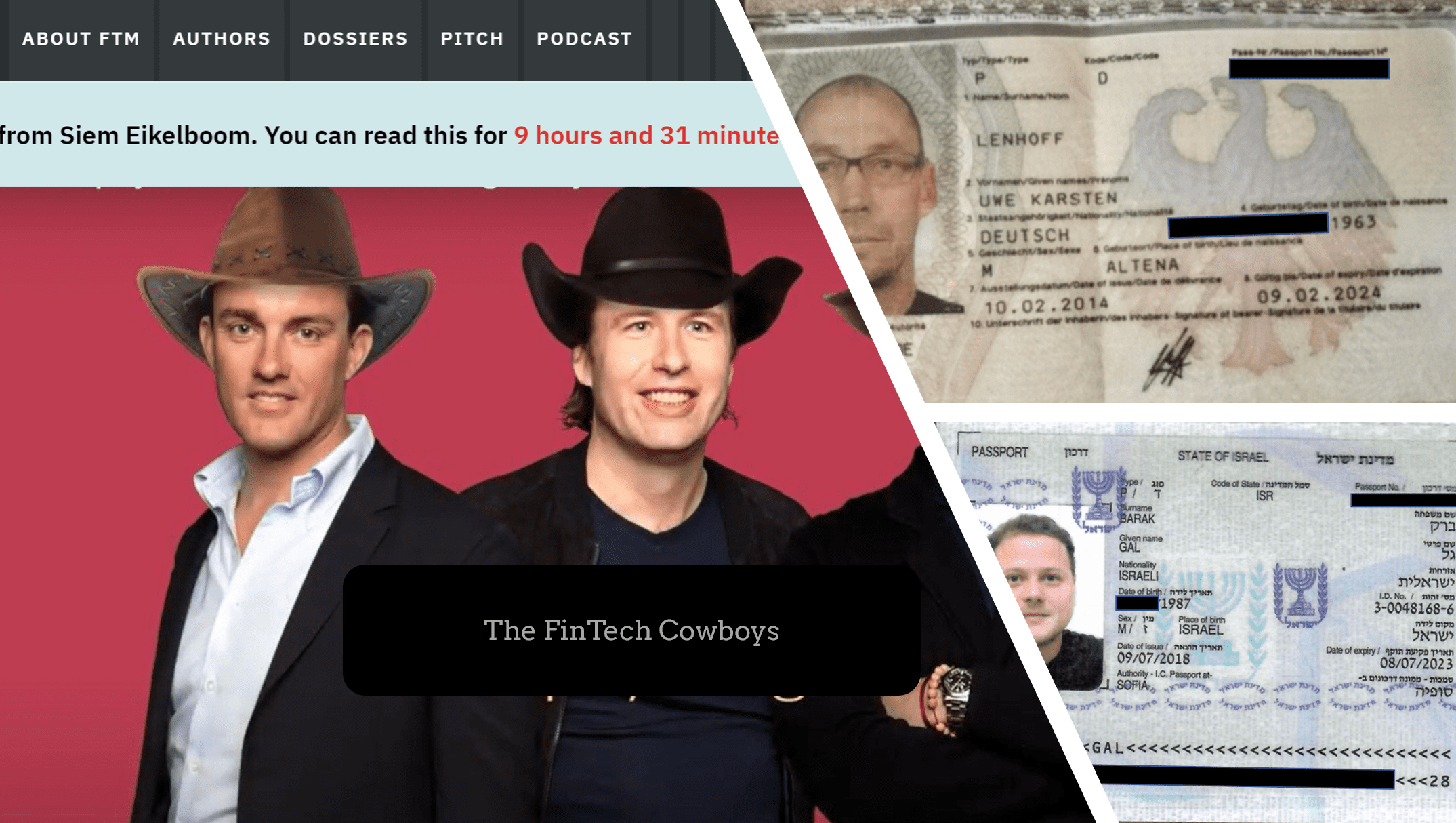

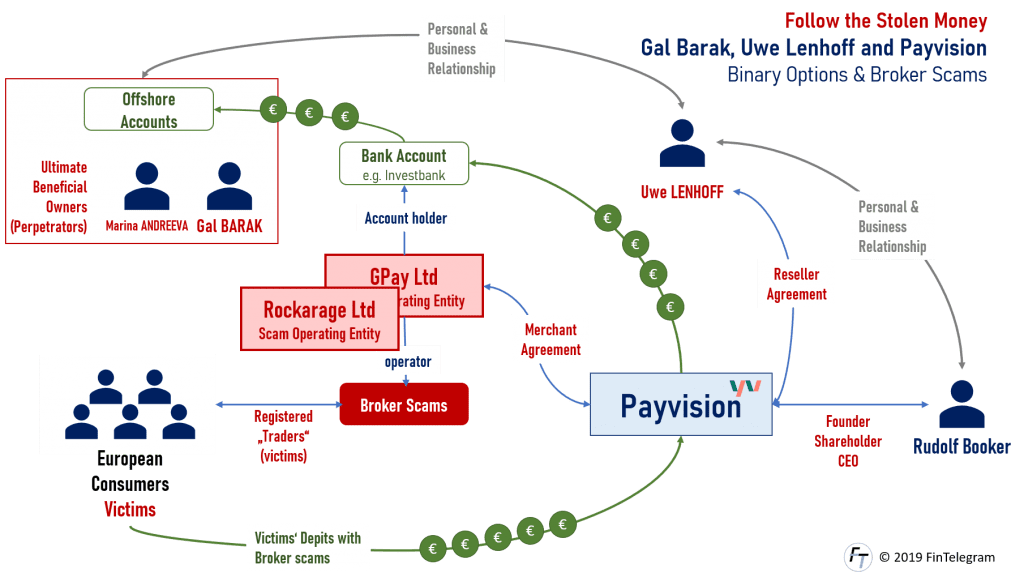

It is no secret that we at FinTelegram see payment processors as the key in the fight against cybercrime and scams. Without the collaboration of payment processors, scam operations and online fraud schemes would be very difficult if not impossible. Currently, EFRI, co-founded by FinTelegram, is fighting with the Dutch FinTech Payvision for restitution payments to the victims of scams of Uwe Lenhoff and Gal Barak who has been found guilty of investment fraud and money-laundering in the Vienna Cybercrime Trials (“#VCT“).

The allegations

Payvision and its founders are alleged to have knowingly and willfully accepted scam operators and their legal entities as clients (merchants) and processed and laundered the illegal (stolen) funds for them. The founding team around Rudolf Booker is said to have personally enriched themselves because the huge amount of illicit payment transactions from scams and cybercrime ventures inflated their company’s balance sheets and valuations.

Plenty hard evidence

The allegations raised by the European Funds Recovery Initiative (“EFRI”) is supported by an abundance of evidence. This also includes listening logs of conversations between Rudolf Booker and the alleged principal of a cybercrime organization, Uwe Lenhoff. Booker has been increasingly concerned about FinTelegram’s reporting since spring 2018. Booker was fully aware of the illegal nature of the related business.

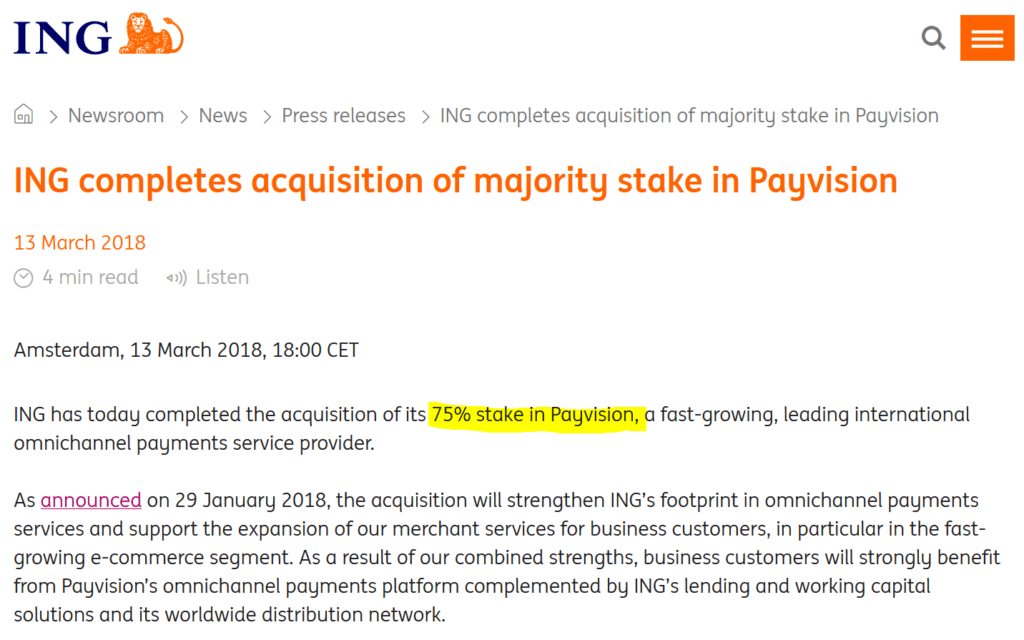

Both the investigations of FinTelegram and EFRI as well as the findings of the law enforcement teams in the #VCT have shown that Payvision, under the then management of the founding team around Rudolf Booker, knowingly and willfully facilitated binary options and broker scams with its payment services between 2014 and 2019. In doing so, Payvision management inflated its transaction volume, increased the FinTech’s valuation to several hundred million, and finally sold it to ING Bank in March 2018.

Payvision has even submitted Suspicious Activity Reports (SARs) on transactions of scam clients like Gal Barak or Uwe Lenhoff to the relevant regulatory authority. At the same time, despite the obvious suspicion and warnings from regulators in various jurisdictions, Payvision continued to process payments for their scams. If necessary, Booker intervened personally and quickly accepted a new shell entity as a merchant.

Excellent relationship with scammers

Rudolf Booker had a rather close relationship with the alleged German cybercriminal Uwe Lenhoff. Both spent skiing vacation in Austria, for example. The vacation was organized by Lenhoff. Lenhoff was also a sort of affiliate of Payvision and acquired Gal Barak, among others.

Restitution payments please!

On behalf of its members, EFRI now asks for restitution payments from Payvision. Although Booker and the founding team left in April 2020 and Payvision is under 100% control of ING-Bank, this does not change the fact that Even under the news CEO Andre Valkenburg Payvision is liable for its past mistakes, regulatory and legal violations, and the resulting fraud of the facilitated scams. Payvision is apparently developing into a reference case for the liability of scam facilitating payment processors in the course of the Vienna Cybercrime Trials.

End of October 2020 EFRI has sent another letter to Payvision with additional data. In this case, the victims will have the stamina to fight through their legitimate claims.