FinTelegram has received information that the authorities in Poland and other EU member states are investigating the payment service provider (PSP) MoneyNetInt Ltd. Whistleblowers and scam victims have repeatedly reported to FinTelegram that payments to binary options and broker scams have been processed through MoneyNetInt’s Polish bank accounts. MoneyNetInt is a UK registered company operating under a license from the UK Financial Conduct Authority (FCA). EU passport regulations, therefore, allow the company to provide its financial services within most EU countries. CEO of the company is Israeli Ishay Moshe Trif.

Key data

- Registration: MoneyNetInt Ltd with company no 05246578 in the UK

- License: UK Financial Conduct Authority license number 900190

- Chief Executive Officer: Yishay Moshe Trif (LinkedIn profile)

- Beneficial Owners: Yishay Moshe Trif, Gil Asher Trif, Raphael Yehudah Golan

- Website: www.moneynetint.com

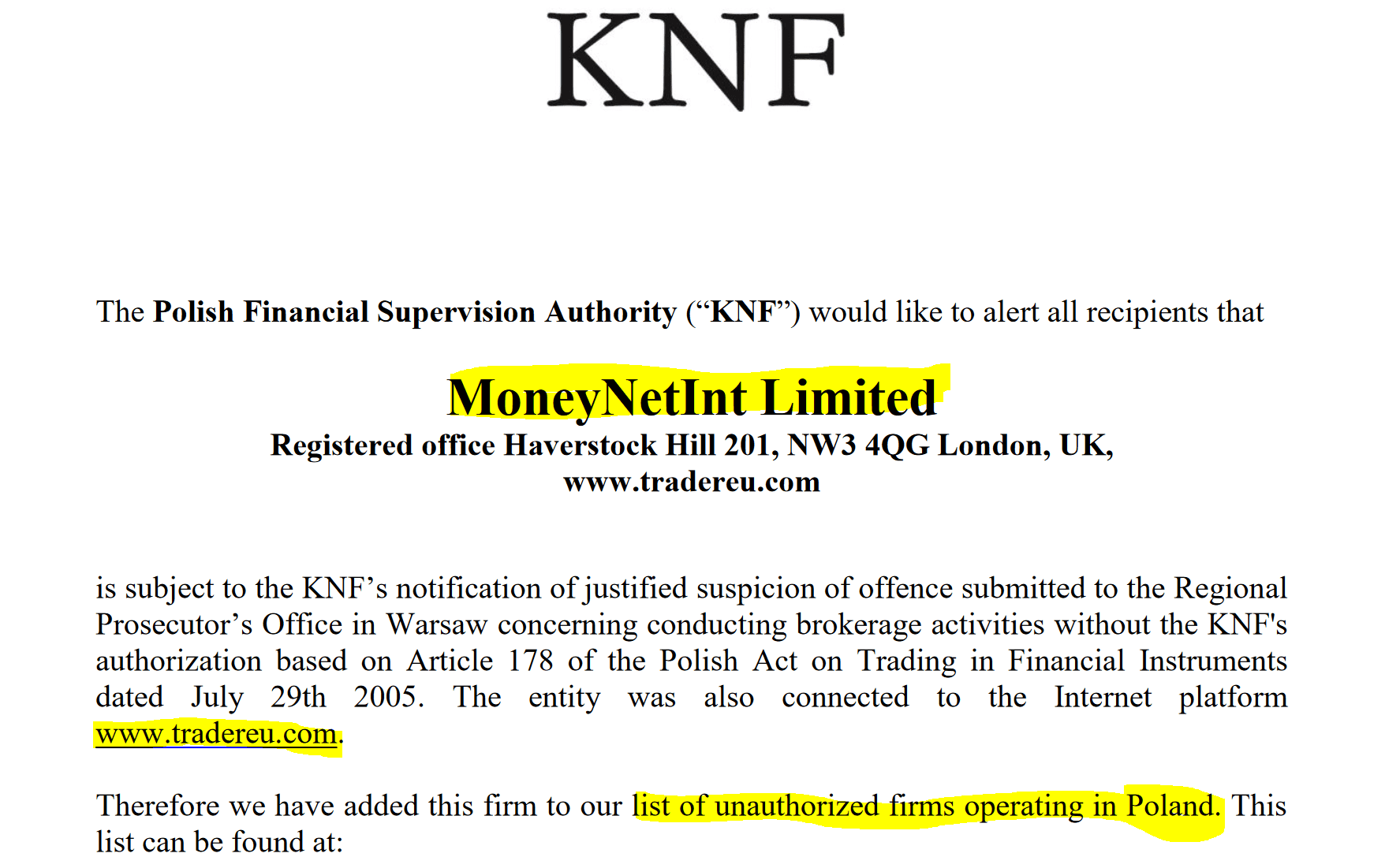

Investor warnings from financial watchdogs

The financial market supervisory authorities of Poland and other jurisdictions have already warned MoneyNetInt and investors in the past about violations of securities and capital markets law in connection with broker scams. For example, the Polish Financial Market Authority KNF has issued a public investor warning against MoneyNetInt because of the broker scam Tradereu.com. KNF filed a criminal complaint with the Regional Prosecutor’s Office in Warsaw in this context.

In December 2017, the Belgian FSMA disclosed that MoneyNetInt was involved in the Swiss Royal Bank (SRB) scam as a PSP. Payments from customer victims were processed through this and other scams through MoneyNetInt’s Polish accounts.

Already in July 2016, Simona Weinglass reported in the Times of Israel in her article Follow the money – how one defrauded binary options investor got his cash back about the involvement of MoneyNetInt in binary options scams and bank accounts in Poland. MoneyNetInt‘s participation in binary options scams has been public knowledge since early 2016 at the latest.

Gal Barak and OptionStarsGlobal

MoneyNetInt was also involved as PSP in some of the scams of Israeli Gal Barak and his E&G Bulgaria. For example, payments from OptionStars and OptionStarsGlobal victims were processed via MoneyNetInt. The Polish bank accounts of MoneyNetInt were also identified in this context by FinTelegram and EFRI.

Gal Barak‘s

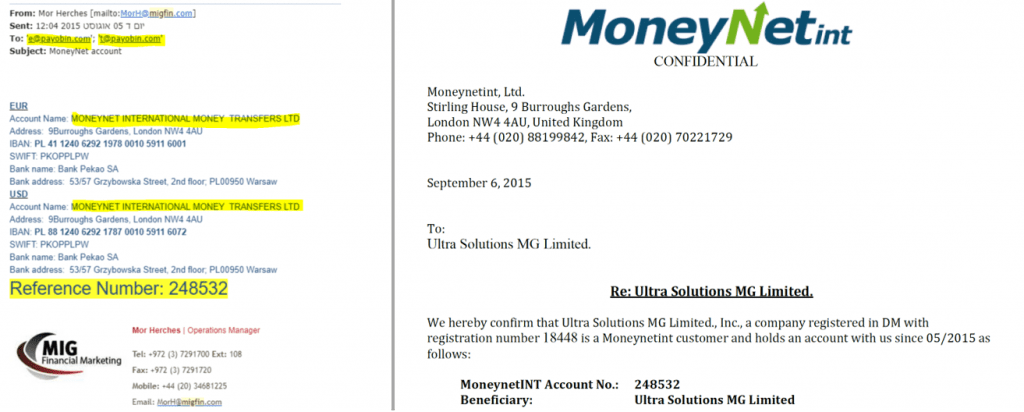

ICoption, MigFin, and Payobin

MoneyNetInt was, besides Payobin of Eyal Nachum and Tamir Zoltovski, one of the partners of the Israeli binary options schemes ICoption, TitanTrade, or TradeSolid. Just to name a few.

Apparently, MoneyNetInt (MNI) and Payobin have been well aware of the illicit background of the binary options scams, as seen from the email correspondence from Feb 24 and Feb 25, 2016, below.

In it, MoneyNetInt officially informs the scam operators that a victim of ICoption threatens MoneyNetInt through his lawyer and wants his money back. MoneyNetInt, in turn, informs ICoption and urges him to solve the problem immediately. Otherwise, one would make a complaint with Interpol. The email was sent on Feb 24, 2016.

On Feb 25, 2016, the MigFin people, in turn, informed Eyal Nachum of Payobin and draw his attention to the imminent danger. This (and many other) communication between the scam operators like MigFin and the PSPs proves that everyone was part of the network behind the scams and knew about it. There are no excuses for “good faith.” All this obviously happened knowingly and willfully.

EFRI and payment service providers

The European Fund Recovery Initiative (EFRI), co-founded by FinTelegram, has been able to establish evidence about the massive involvement of MoneyNetInt in numerous victim reports of various scams. Along with UPayCard and Moneta International UAB, MoneyNetInt Ltd was/is certainly the largest regulated PSP in this global scam broker scene.

Authorities in various countries have been intensively combating PSPs in the field of binary option and broker scams for months. It is an indisputable fact that these scams would not be possible without the support of these PSPs. Tens of thousands of retail investors would not have lost their money to these scams. These PSPs support illegal and fraudulent broker schemes and make a lot of money with them. The money stolen by the small investors is laundered and distributed via the participating PSPs and their bank accounts.

According to the motto “Follow the money“, the authorities can also pursue the stolen funds via the payment service providers involved and find the beneficial owners behind the scams. However, this requires the cooperation of the PSPs involved.

Investigations, the presumption of innocence, and facts

The investigations of the Polish authorities should provide new insights in this respect and stop the activities of PSPs in the area of broker and investment scams. FinTelegram would like to expressly state that until proven otherwise, the presumption of innocence applies to MoneyNetInt.

However, there is no doubt that MoneyNetInt has supported dozens of investment, brokerage, and binary options scams with its payment services. This PSP has been the partner of vast binary options schemes.