FinTelegram has already reported many times on the unorthodox approach of Maltese authorities against money laundering and illegal investment practices. The collapsed Pilatus Bank is maybe a perfect example of the failure of Maltese regulators. The online magazine Shift reports that the investigating European law enforcement agencies are coming under pressure. In a pending arbitrage case, the World Bank’s ICSID recommended suspending criminal investigations against its owner Ali Sadr, who also seeks compensation for damages.

The Pilatus Case

Ali Sadr Hashemi Nejad, also known as Ali Sadr, is an American businessman. He established Pilatus Bank in Maltese in 2013. The Maltese investigative reporter and anti-corruption activist Daphne Caruana Galizia accused the bank of laundering funds from allegedly corrupt schemes on behalf of offshore companies and individuals. An 18-month investigation by Maltese authorities determined the claims were untrue. Caruana Galizia was murdered with a car bomb on 16 October 2017.

Ali Sadr was charged in the U.S. in March 2018 with violating U.S. sanctions on Iran. He was found guilty, but the court verdict was overturned in July 2020, and the charges were dropped.

On November 4, 2018, the European Central Bank (ECB) revoked the bank’s banking license. Pilatus later accused the ECB and the MFSA of closing the bank based on falsely alleged crimes committed before the bank existed.

At the time of Ali Sadr’s indictment, the MFSA and Malta’s political leadership faced international accusations that they “looked the other way.” At the same time, Malta would have been under pressure from the FATF for money laundering issues. Under international pressure, the MFSA would have wanted to make an example of Pilate and took reckless and wanton action, Pilatus and Ali Sadr claimed.

Earlier this year, an EU court rejected an attempt by Pilatus to get its license back, the Times of Malta reported.

The ICSID Counterattack

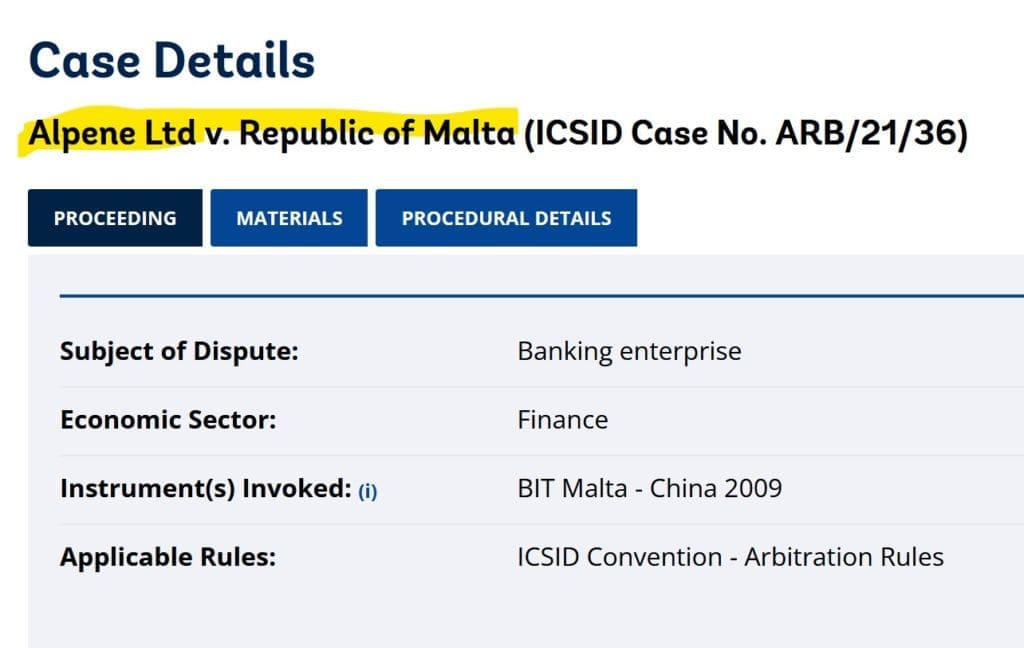

In July 2021, Ali Sadr allegedly filed an urgent request at the World Bank’s International Centre for Settlement of Investment Disputes (ICSID) to terminate the Maltese law enforcement investigations. Moreover, he is claiming damages and loss of earnings but has also requested that any legal action planned against him in Malta be suspended. The request was filed via the Hong Kong entity Alpene Ltd, controlled by Ali Sadr.

Alpene claims that Malta’s action against the closed Pilatus by revoking its license and the resulting liquidation of the bank amounts to an expropriation by Malta. It is claiming damages in the amount of several million US dollars.

Last Wednesday, ICSID recommended that all related criminal proceedings by Malta be suspended until ICSID rules on Alpene‘s case against Malta. Recommendations by the ICSID are considered binding in the international community.

According to the Times of Malta, government sources would say that Sadr would be “clutching at straws.”

Share Information

If you have any information about Pilatus or Ali Sadr, please share it with us through our whistleblower system, Whistle42.