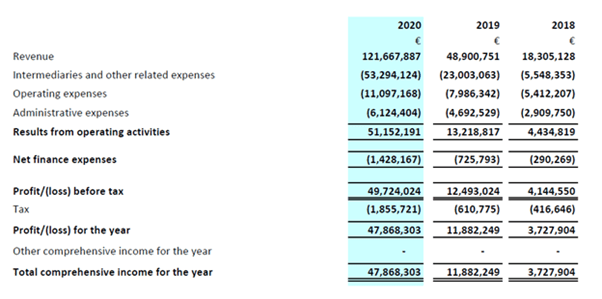

While the revenue of CySEC-regulated BDSwiss grew by 149% to €121.7 Mio in 2020, its profit before tax quadrupled to almost €50 Mio, the company informed in a Shareholder Letter sent signed by Alexander-Wilhelm Oelfke and Jan Malkus. The total trading volume surpassed €1 trillion; client deposits exploded from €102 to €238.4 Mio. The impressive growth was driven by the Contract for Differences (CFD) brokerage, which accounted for more than 99% of the revenues. For 2021, BDSwiss forecasted a profit of more than €66 Mio from the CFD business alone. In Oct 2020, BDSwiss applied for a bank license in Germany and aimed at a full FCA license, the Shareholder Letter informed. Here is an update!

The new troubles

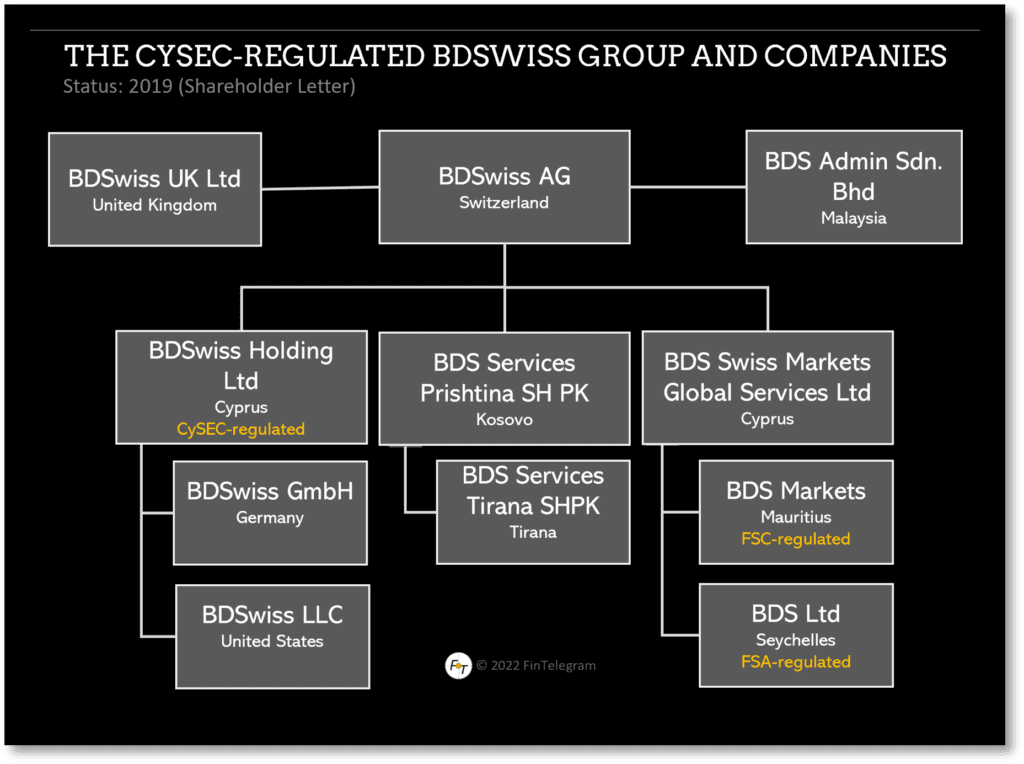

BDSwiss is a German venture established by Jan Malkus, who initially acted as CEO and is its current Chairman. Via their Swiss-based holding company, they control a network of companies to run BDSwiss. Including the CySEC-regulated entity and tho offshore broker in Mauritius and Seychelles.

As a reminder, BDSwiss is one of those CySEC-regulated brokers that work with their aggressive and partly illegal methods via offshore companies and fraudulent marketing methods. This is probably one of the main reasons for its explosive growth. The UK FCA banned BDSwiss from the UK market in August 2021 because of its illicit business practices. The German BaFin prohibited BDSwiss‘ offshore activities in March 2022. It, therefore, seems questionable whether the banking license in Germany and the full FCA license are achievable.

In our review on 29 April 2022, we found that now new client registrations were possible. On May 8, 2022, a new registration was no longer possible. In this respect, further record-breaking million-dollar profits for 2022 will most likely not take place at BDSwiss. But who knows, right?

The Golden Years

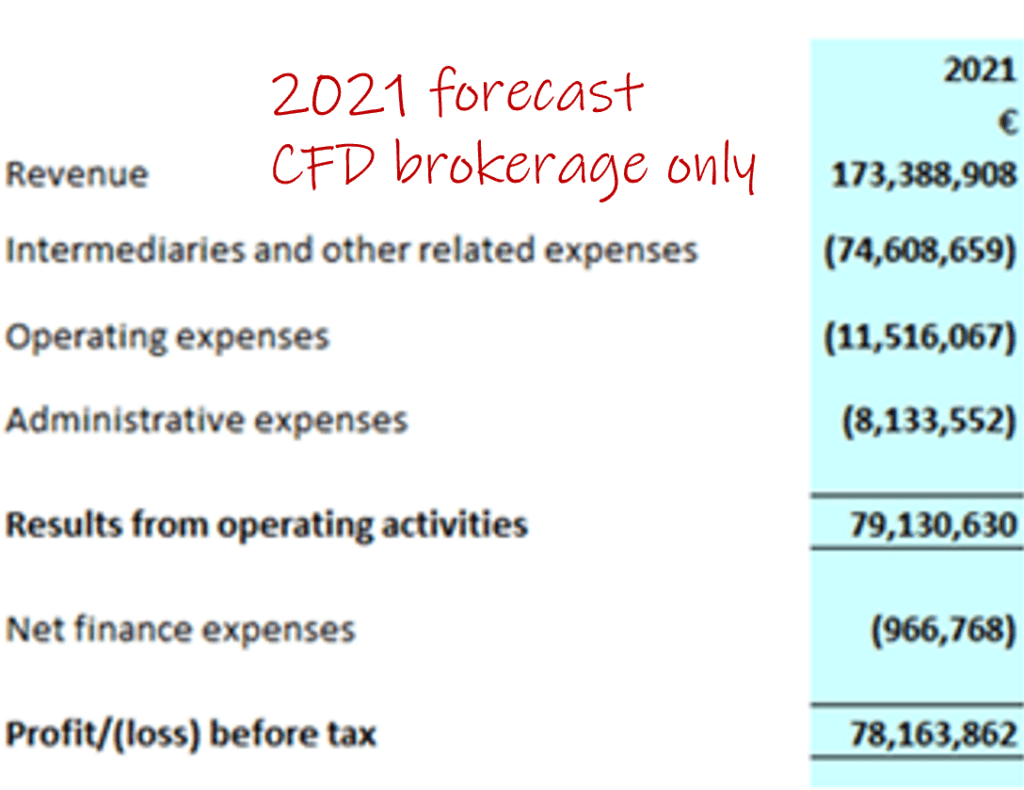

While 2022 is probably not going so great, the years between 2018 and 2021 were probably the Golden Years for BDSwiss. The CFD brokerage let the millions rain in and made the shareholders and managers rich (see forecast 2021 right). The BDSwiss client base grew across all geographic regions in 2020.

- revenue from European clients grew by 134% from 2019, representing 91% of the total revenue. This figure reflects clients retained from previous periods as well as the acquisition within the year.

- the East Asia and Pacific region grew by 219%, and

- the Middle East and North Africa by 181%.

This growth in non-European regions occurred even though the Introducing Broker (IB) acquisition channel was hindered due to the ongoing Covid-19 epidemic because the channel uses local physical networks and seminars for acquisition, the BDSwiss Shareholder Letter explains.

The German expansion

In October and November 2020, BDSwiss held meetings with representatives of the German BaFin, Bundesbank, and the European Central Bank (ECB) to present their business case and vision for the bank. On 30 October 2020, BDSwiss applied for a bank license to BaFin and the ECB. BDSwiss informed its shareholders that it had spent €1.1 Mio on legal and professional fees for this ambitious project. The total legal and professional fees rose substantially in 2020 by €2.5m to €4.2m.

One of the strategic projects for the German expansion was the GermanBlueChip Pool (www.germanbluechip.com) which was established through BDSwiss and its co-founder and former CEO Jan Malkus. The GermanBlueChip Pool (GBC) aims to become the single largest shareholder of globally leading German companies with a predefined strategic plan to unlock substantial value for its investors. The GBC is focused on listed German equities.

The affiliate & introducing broker boosters

Affiliate acquisition is the single most important success factor for the business for every broker. Throughout 2020, BDSwiss received more than 131,000 First-Time-Deposits (FTD) with a total volume of net deposits of more than €115 Mio via its affiliate network.

In 2020, BDSwiss paid €40.8 Mio in affiliate commissions, followed by IB commissions at €7.5m. In contrast, staff costs for Business Development, Conversion, and Retention departments accounted for only €3.0m.

Share information

If you have any information about BDSwiss, its operators, and facilitators, please let us know via our whistleblower system, Whistle42.

FYI, info I heard from an actual shareholder in the company, who was sold shares at crazy high prices some years ago facilitated by no one else than Mr. Jan Eric Malkus himself, NO shareholder has seen ANY of this money that BDSwiss made. Rather Jan Eric Malkus seems to be the one who has set up this new company, called German Blue Chip Pool https://www.janmalkus.com/en/portfolio#GermanBlueChipPool-info and from what I heard BDSwiss paid an 8 figure amount to buy shares of that company, which to date has not made any money or business itself really, interesting valuation for a company with no customers and no business. Alexander-Wilhelm Oelfke signed this deal from what I was told. Seems a nice way to siphon money out of BDSwiss into a different company under Malkus’ control?